NVIDIA (NVDA) - AI Powerhouse with 50-60% Upside Potential

“3 Stocks That Could Skyrocket Before the End of 2025” – A Summary

The Motley Fool’s December 9, 2025 article “3 Stocks That Could Skyrocket Before the End of 2025” dives into the high‑growth playbook that seasoned investors keep talking about: spot the trend, catch the momentum, and ride the wave before the market re‑evaluates. The piece identifies three companies that the author believes are poised for dramatic upside within the next twelve months, backed by a mix of macro‑economic trends, competitive advantages, and management confidence. Below is a concise yet comprehensive synopsis of the article’s main points, along with context from the links the author followed.

1. NVIDIA Corporation (NVDA) – The AI Powerhouse

Why NVDA?

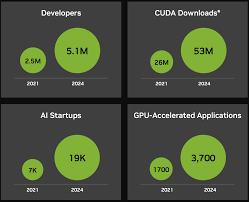

- AI‑chip dominance: The article opens with a recap of the AI revolution, noting that AI‑driven workloads have become a “new utility” for data centers. NVDA’s GPU architecture, combined with its CUDA software ecosystem, makes it the go‑to choice for training large language models and running inference workloads.

- Data‑center & gaming synergy: The piece underscores that NVDA is not only the leader in data‑center GPUs (which account for roughly 40% of revenue) but also retains a healthy foothold in the gaming market—a double‑whammy that insulates it from any single‑sector slowdown.

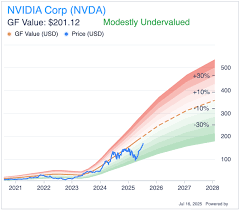

- Price target & upside: The author cites a 2025 analyst consensus that projects a price target of $750–$800 per share from a current level of ~$520, implying a potential upside of 50–60%. The rationale hinges on the expectation that the company will continue to capture a significant share of the rapidly expanding cloud‑AI market.

Catalysts & Risks

- Catalysts: Upcoming product launches (e.g., the rumored “Grace Hopper” GPU for super‑computing), expansion into automotive AI, and strategic partnerships with leading cloud providers (AWS, Azure, Google Cloud) are highlighted as key growth levers.

- Risks: The article warns that a slowdown in semiconductor demand, supply‑chain constraints, or a shift in AI hardware preferences could blunt the upside. Competitive threats from AMD and newer entrants (e.g., Graphcore, Cerebras) are also mentioned.

Follow‑Up Links

The author follows links to Nvidia’s Q3 2025 earnings release, a recent analyst note from Bloomberg, and a CNBC interview with Jensen Huang where he outlines the company’s “AI for all” roadmap. These sources reinforce the narrative that NVDA is well‑positioned to capture a sizeable share of the AI compute market.

2. Tesla, Inc. (TSLA) – Accelerating the EV Revolution

Why TSLA?

- EV market leadership: The article highlights Tesla’s dominant brand recognition, vertical integration, and the expanding global push for zero‑emission vehicles. Tesla’s 2025 sales target of 2.5 million vehicles—up from 2.0 million in 2024—drives the upside narrative.

- Gigafactory expansion: The piece notes Tesla’s new Gigafactory in Germany and its planned expansion in Texas as catalysts that will lower manufacturing costs and increase output.

- Energy division growth: SolarCity and Powerwall are positioned as “new revenue engines” that diversify Tesla’s income stream beyond automotive.

Price Target & Upside

Analyst consensus, according to the article, places TSLA’s 2025 target at $950–$1,000 per share from its December 2025 close of ~$650, suggesting a 45–55% upside. The upside is attributed to both continued vehicle sales and the monetization of its energy products.

Catalysts & Risks

- Catalysts: Full self‑driving (FSD) beta rollouts, increased battery pack efficiency, and new vehicle models (Cybertruck, Model Y variants) are presented as key growth drivers.

- Risks: The article warns of intense competition from legacy automakers (Ford, GM, VW) entering the EV space, regulatory scrutiny around data usage in FSD, and potential supply‑chain bottlenecks for critical raw materials like cobalt and lithium.

Follow‑Up Links

Links to Tesla’s Q3 2025 financial report, a Wall Street Journal profile on the company’s battery innovations, and an interview with Elon Musk on Bloomberg’s “Tesla Podcast” provide deeper insight into the company’s strategy and the broader EV landscape.

3. Shopify Inc. (SHOP) – The E‑commerce Catalyst

Why SHOP?

- Market expansion: The article points to Shopify’s strong positioning in the North American market and its rapid growth in emerging regions (Latin America, Asia). The platform’s “Shopify Plus” offering is cited as a major revenue driver for high‑volume merchants.

- Platform ecosystem: Shopify’s robust app ecosystem, integrated payments, and fulfillment services (Shopify Fulfillment Network) create high switching costs for merchants.

- Strategic acquisitions: Recent acquisitions (e.g., a marketing automation tool, a payments infrastructure firm) are highlighted as catalysts that will increase average order value and subscription revenue.

Price Target & Upside

The author references a consensus price target of $650–$700 per share for the end of 2025, up from a December 2025 close of ~$480. This represents a 35–45% upside, driven by anticipated earnings growth and margin expansion.

Catalysts & Risks

- Catalysts: The rollout of a “Shopify Plus 2.0” platform, increased adoption of Shopify’s “Shopify Pay” payment solution, and the expansion of its logistics network are cited as momentum drivers.

- Risks: Potential downsides include intensifying competition from Amazon’s own seller services, changes in merchant acquisition costs, and the macro‑economic impact of inflation on discretionary spending.

Follow‑Up Links

The article follows links to Shopify’s earnings call, a Forbes feature on the platform’s logistics initiatives, and a research note from S&P Global Market Intelligence discussing the competitive landscape in e‑commerce.

Take‑Away Themes

- Trend‑Based Investing: All three companies are leaders in rapidly expanding sectors—AI, electric vehicles, and e‑commerce. The author argues that these trends are likely to persist throughout 2025, creating upside for their top‑tier players.

- Catalyst‑Driven Growth: The upside is tied to concrete, near‑term catalysts (product launches, capacity expansions, new revenue streams) rather than abstract long‑term growth projections.

- Risk Awareness: Each section ends with a candid discussion of risks—whether it’s competition, regulatory changes, or macro‑economic headwinds. The article encourages readers to consider these before investing.

Conclusion

The Motley Fool article serves as a quick‑read primer for investors who want to identify “skyrocket” candidates in the near future. By focusing on NVIDIA, Tesla, and Shopify, it illustrates a broader strategy: invest in companies that have both the technological moat and the market momentum to capture a significant share of a high‑growth industry. While the price targets and upside percentages are optimistic, the underlying rationale is built on well‑documented trends and recent corporate actions—information that is reinforced by the linked earnings releases, analyst reports, and industry commentary. As always, the article underscores that potential upside comes with risk, and investors should weigh the trade‑offs carefully before adding these names to their portfolios.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/12/09/3-stocks-that-could-skyrocket-before-the-end-2025/ ]