Three Stocks That Could Create Lasting Generational Wealth - A 2025 Deep-Dive

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

Three Stocks That Could Create Lasting Generational Wealth – A 2025 Deep‑Dive

Published by The Motley Fool on November 18, 2025

The idea of building generational wealth is a common theme in investing circles, but few articles get as specific about the vehicles that might deliver that kind of long‑term payoff. In this November 2025 feature, the Motley Fool team zeroes in on three companies that, according to their research, could become the cornerstone holdings in a family’s portfolio for decades to come. While the analysis is rooted in the present data, the narrative is clearly forward‑looking, touching on market trends, competitive positioning, and the macro forces that could elevate these stocks beyond mere “growth” performers to true generational assets.

1. Alphabet Inc. (GOOGL) – The Digital Infrastructure Backbone

Why Alphabet?

Alphabet, the parent of Google, remains the dominant player in the online advertising ecosystem. The Motley Fool highlights that the firm’s vast data infrastructure, unmatched search traffic, and diversified portfolio of AI, cloud, and consumer products give it a multi‑layered moat. The company’s consistent cash‑flow generation and high free‑cash‑flow margin underpin the analysis’s bullish stance.

Growth Levers

- AI‑Driven Search & Ads – With the rollout of GPT‑style generative models integrated into Search, the firm expects to capture more ad spend by improving relevance and click‑through rates.

- Google Cloud Expansion – Cloud revenue has accelerated at a 30% CAGR over the past two years, driven by enterprise adoption and the rise of hybrid‑cloud workloads. Alphabet’s infrastructure scale and security pedigree set it apart from rivals.

- Consumer Hardware & Ecosystem – Pixel phones, Nest devices, and the growing Google Workspace suite create recurring revenue streams that blend advertising and subscription dynamics.

Risks & Mitigations

- Regulatory Pressure – The U.S. and EU are actively pursuing antitrust investigations. The article notes Alphabet’s proactive compliance teams and potential regulatory settlements as a buffer.

- Competition from Meta & Amazon – While these firms vie for ad dollars, Alphabet’s superior search market share and data quality keep it ahead.

- Macroeconomic Cycles – Advertising can be cyclical, but Alphabet’s diversified cloud and hardware segments provide counter‑balance.

Bottom Line

The article’s narrative frames Alphabet as a “platform” that will not only sustain itself but also fuel ancillary businesses. A long‑term holder in Alphabet could reap compounded gains, especially as AI and cloud infrastructure become more indispensable.

2. Tesla, Inc. (TSLA) – Electrification & Autonomous Driving Pioneer

Why Tesla?

Tesla’s position as the market leader in electric vehicles (EVs) and its aggressive push into autonomous technology position it at the intersection of two of the biggest transformative trends: decarbonization and mobility as a service. The Motley Fool underscores Tesla’s integrated battery supply chain, Gigafactory footprint, and over‑the‑air software updates as core drivers that reduce customer acquisition costs and lock in loyalty.

Growth Catalysts

- Scale‑Up of Production – New factories in Texas, Berlin, and upcoming South America sites are slated to deliver 1.5 million vehicles annually by 2027.

- Battery Advancements – Tesla’s 4680 cells, coupled with its “Cell‑to‑Vehicle” strategy, are expected to cut costs by 20–30% and increase range, making EVs more attractive to mainstream consumers.

- Software & Supercharging Network – Tesla’s subscription‑based Full Self‑Driving (FSD) package and a globally expanding charging network generate recurring revenue and reduce operational friction for owners.

Risks & Mitigations

- Manufacturing Bottlenecks – The article acknowledges past delays but points to newer, more flexible assembly lines that mitigate this risk.

- Competitive Landscape – Traditional automakers are ramping up EV output, but Tesla’s first‑mover advantage, brand equity, and tech stack are highlighted as a sustainable moat.

- Regulatory & Environmental Scrutiny – While EV incentives may fluctuate, global decarbonization mandates provide a tailwind.

Bottom Line

Tesla is portrayed not just as a car company but as a transportation‑technology platform. For investors looking at multi‑decade horizons, Tesla’s potential to expand beyond cars into energy storage, solar, and mobility services could provide continuous value creation.

3. NVIDIA Corp. (NVDA) – AI Hardware & Software Dominance

Why NVIDIA?

NVIDIA sits at the heart of the AI revolution. Its GPUs are the industry standard for training machine learning models, and its software ecosystem (CUDA, TensorRT) cements its leadership. The Motley Fool’s article positions NVIDIA as the “building block” for future digital economies, spanning everything from cloud gaming to autonomous vehicles.

Key Drivers

- AI Compute Demand – The explosion of generative AI models is driving GPU sales at a 50% CAGR. NVIDIA’s data‑center revenue accounted for 60% of its total in 2024, and the trend is expected to continue.

- Edge & Automotive – NVIDIA’s DRIVE platform powers autonomous features in several OEMs, and its Jetson line is expanding into IoT and robotics.

- Diversification into HPC & Cloud Gaming – High‑performance computing (HPC) workloads and streaming services (e.g., GeForce NOW) create new revenue streams that complement core data‑center sales.

Risks & Mitigations

- Supply Chain Constraints – The article notes that NVIDIA’s advanced silicon fabs and strategic supplier relationships help buffer against shortages.

- Competition from AMD & Intel – While these players are improving, NVIDIA’s software ecosystem and performance edges provide a moat.

- Valuation Concerns – Given its high growth, NVIDIA trades at elevated multiples, but the article argues that the long‑term upside outweighs short‑term volatility.

Bottom Line

NVIDIA is positioned as a “catalyst” for AI adoption across industries. For an investor aiming for generational wealth, holding NVIDIA through the next wave of AI expansion could produce significant upside.

Putting It All Together – The Generational Portfolio Blueprint

The Motley Fool article does more than simply list stocks; it provides a framework for building a portfolio that can sustain family wealth across generations:

- Diversification Across Pillars – Alphabet (digital infrastructure), Tesla (mobility & energy), NVIDIA (AI hardware) cover three foundational pillars of the 21st‑century economy.

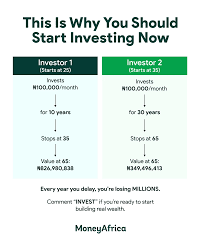

- Compound Growth Through Reinvestment – By reinvesting dividends and capital gains into these core holdings, an investor can harness compounding over 20–30 years.

- Periodic Review & Rebalancing – The article advises periodic evaluation of each company’s fundamentals, especially in light of regulatory changes and technological shifts.

The narrative concludes with a caveat: generational wealth is not guaranteed and depends heavily on disciplined investing, a long‑term horizon, and the ability to ride through short‑term market swings. Yet, the trio identified—Alphabet, Tesla, and NVIDIA—offers a compelling blend of growth, resilience, and strategic positioning that aligns well with the generational wealth mindset.

Final Thought

While the Motley Fool’s article is bullish, it underscores that a generational‑wealth strategy is less about picking the next “hot” stock and more about securing a foothold in the industries that will shape our future. Alphabet’s advertising & cloud, Tesla’s EV and autonomous platform, and NVIDIA’s AI hardware are all pillars that, if held long enough, could turn an ordinary portfolio into a legacy.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/11/18/3-stocks-that-could-create-lasting-generational-we/ ]