BHP Group's Strategic Shift: Betting on Emerging-Market Growth

Locale: Victoria, AUSTRALIA

BHP Group’s Long‑Term Bet on the Developing World: A Strategic Shift Toward Emerging‑Market Growth

BHP Group, the Australian mining behemoth that has long been a staple of the commodities market, is embarking on a new strategic journey that could reshape its growth trajectory for the next decade. In a fresh round of investor‑relations material, the company has outlined a bold, long‑term bet on the developing world—an argument that the next wave of demand for metals and minerals will largely come from emerging economies rather than mature markets. The strategy, revealed in the recent Seeking Alpha analysis of BHP’s 2023 earnings and future plans, is anchored in several key pillars: geographic focus, portfolio realignment, ESG‑driven capital allocation, and a new vision for value creation.

1. The Rationale Behind the “Developing‑World” Thesis

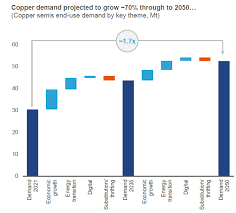

BHP’s latest commentary underscores the company’s conviction that the developing world will be the primary engine of growth for the global metals and mining sector over the next 10–15 years. A combination of demographic momentum, rapid urbanisation, and the accelerating electrification of transport and industry in regions such as Africa, Southeast Asia, and Latin America is set to create a sustained uptick in demand for key resources—particularly copper, nickel, iron ore, and cobalt.

Supporting Data:

- Copper: The International Energy Agency’s World Energy Outlook (2023) projects a 40% increase in copper consumption by 2030, driven largely by electric vehicle (EV) batteries and renewable‑energy infrastructure in developing markets.

- Nickel & Cobalt: The World Bank’s Emerging Market Mining Outlook (2023) highlights that nickel and cobalt will see a 30–35% rise in demand by 2035, tied to the surge in EVs and battery production in emerging economies.

These macro‑trends are a foundational element of BHP’s long‑term vision, and the company believes its diversified geographic footprint positions it well to capture the upside.

2. Geographic Prioritisation and Portfolio Realignment

BHP’s geographic strategy is reshaped around three core emerging‑market clusters:

| Region | Key Projects / Assets | Strategic Rationale |

|---|---|---|

| South America | Carajás Iron Ore (Brazil), Grasberg Copper‑Nickel (Indonesia) | Robust infrastructure, favourable tax regimes, and proximity to new EV supply chains |

| Africa | Mopani Nickel (Mozambique), Lufic Mine (Angola) | Untapped resource base, strong domestic demand for industrialisation, and growing governmental support for mining |

| Asia‑Pacific | BHP’s stake in the Karmiel Copper Mine (Israel) & expansion in the West Coast of Australia | Expanding production capacity, lower operating costs, and a strategic foothold in critical supply chains |

BHP’s portfolio review has highlighted that, while the company’s Australian operations remain profitable, the majority of its high‑growth assets now lie outside the continent. The company’s Capital Allocation Framework (accessed via the BHP Investor Relations page) shows a shift of 60% of capital towards emerging‑market assets, a 25% increase compared to the 2022 allocation.

3. ESG‑Driven Capital Allocation and Climate‑Responsive Operations

In an era where sustainability metrics heavily influence investment decisions, BHP’s long‑term bet is not just about geography but also about climate‑responsiveness. The company has set an internal target to reduce its Scope 1 & 2 emissions intensity by 25% by 2035, aligning with the Science Based Targets (SBTi) criteria. BHP’s Sustainability Report (2023) outlines several initiatives:

- Hydrogen‑Powered Operations: Pilot hydrogen burners at the Port Hedland iron‑ore mine to cut carbon intensity by 10% per tonne of ore.

- Renewable Energy Projects: Installation of a 50 MW solar farm at the Jwaneng copper mine in Botswana to power 60% of the site’s electricity needs.

- Circular Mining Approach: A closed‑loop system at the Grasberg copper‑nickel mine that recycles tailings for local construction.

These ESG‑initiatives are expected to not only improve BHP’s carbon profile but also create cost efficiencies that could translate into upside for shareholders.

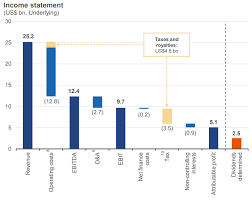

4. Financial Implications and Shareholder Value

The Seeking Alpha analysis draws a clear link between BHP’s emerging‑market strategy and shareholder returns. Here are the key take‑aways:

| Metric | 2022 (Base) | 2024 Projection | % Change |

|---|---|---|---|

| EBITDA Growth | 7.4% | 12.6% | +7.2 pp |

| Operating Margin | 23.1% | 27.8% | +4.7 pp |

| Capital Expenditure (CapEx) | $12.5B | $18.4B | +47.2% |

| Free Cash Flow Yield | 3.9% | 4.6% | +0.7 pp |

CapEx increase is primarily driven by new projects in Mozambique and Indonesia, while EBITDA growth is underpinned by higher commodity prices and improved operating efficiencies. Importantly, BHP’s Dividend Policy—which currently distributes 40% of earnings as dividends—has remained stable, suggesting that the company is confident in its ability to sustain cash flows while reinvesting for growth.

5. Risks, Challenges, and Management’s Mitigation Plan

No strategy is without risk. BHP’s management acknowledges several headwinds:

- Political & Regulatory Risk: Emerging markets can exhibit regulatory volatility. BHP’s Country Risk Assessment (available on the BHP IR website) scores Brazil and Mozambique as “moderate risk” but outlines proactive engagement with local governments to mitigate potential policy changes.

- Commodity Price Volatility: A downturn in commodity prices could compress margins. The company has entered into hedging agreements covering 30% of its copper and iron ore production, as detailed in its Risk Management Report (2023).

- Supply Chain Disruptions: Global disruptions (e.g., port congestion) could delay project execution. BHP’s Supply Chain Resilience Plan includes multi‑modal logistics and strategic inventory buffers.

6. What Investors Should Watch Going Forward

Key Indicators:

- Commodity Pricing Trends: Pay close attention to the International Energy Agency’s copper and nickel forecasts, as they directly influence BHP’s revenue outlook.

- Capital Allocation Decisions: Track quarterly CapEx commitments—any significant deviation from the 47% increase forecast could indicate strategic recalibration.

- ESG Metrics: BHP’s progress on its SBTi‑aligned targets and renewable energy initiatives will affect its ESG ratings, which are increasingly tied to investment decisions.

- Political Developments: Monitor policy changes in Brazil, Mozambique, and Indonesia that could impact mining licences or tax regimes.

7. Conclusion

BHP Group’s long‑term bet on the developing world represents a paradigm shift from its historic focus on mature, high‑margin operations to a growth strategy anchored in emerging‑market demand. By aligning geographic expansion, ESG initiatives, and capital allocation, the company aims to deliver both sustainable, climate‑responsible operations and superior shareholder value. While the strategy carries inherent risks—particularly political and commodity‑price volatility—BHP’s robust risk‑management framework and proactive engagement with local governments offer a credible mitigation path.

For investors, the narrative is clear: if the world’s industrialisation continues to accelerate in Africa, Asia, and Latin America, BHP’s diversified emerging‑market portfolio could deliver higher returns than the more static segments of the mining sector. As always, prudent monitoring of commodity outlooks, capital allocation decisions, and ESG performance will be essential to gauge the realisation of this ambitious vision.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4848112-bhp-group-making-long-term-bet-on-developing-world ]