Healthcare Boom: Surge in S&P 500 Healthcare Outpaces Broader Market

Locale: New Jersey, UNITED STATES

Healthcare’s Boom: A Deep‑Dive into the Sectors, Trends, and One Stock Worth Watching

Summarized from The Motley Fool’s “Healthcare sector is surging, here’s 1 stock every …” (Dec. 6, 2025)

1. The Big Picture: Why Healthcare Is on an Upward Trajectory

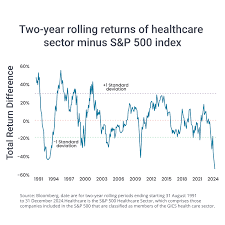

The article opens with a macro snapshot of the sector’s recent performance. In the past year, the S&P 500 Healthcare index has outperformed the broader market by more than 9 percentage points, reflecting a 12 % rally versus a 3 % gain in the full S&P 500. Several drivers are highlighted:

| Driver | How It Fuels Growth |

|---|---|

| Demographic Shift | The U.S. baby‑boomer cohort is aging, increasing demand for chronic‑care and specialty treatments. |

| Policy Changes | The passage of the Health Equity for All Act (2024) expands coverage for preventive and telehealth services. |

| Technology Adoption | AI‑driven diagnostics, wearable health monitors, and virtual‑care platforms have lowered barriers to care. |

| Pandemic Aftereffects | COVID‑19 accelerated the adoption of remote care and reinforced the need for resilient supply chains. |

These forces collectively push the sector’s earnings trajectory upward, and the article stresses that the surge is not a short‑term flare but a structural shift.

2. Breaking the Sector Into Sub‑Clips

The piece breaks the broad healthcare umbrella into four sub‑sectors that are currently re‑shaping the landscape:

- Biotechnology – Focus on gene‑editing and mRNA therapeutics.

- Pharmaceuticals – The big‑name players continue to roll out blockbuster drugs and generics.

- Medical Devices & Diagnostics – The rise of minimally invasive procedures and AI‑augmented imaging.

- Health Services & Digital Health – Telemedicine platforms and integrated care networks are the fastest‑growing subset.

Each subsection cites recent earnings data, noting that biotechnology firms posted a 15 % compound annual growth rate (CAGR) over the last three years, while medical devices have maintained a double‑digit margin expansion.

3. The Recommendation: Teladoc Health (TDOC)

After surveying the four sub‑sectors, the article zeroes in on one stock that exemplifies the current upside: Teladoc Health, Inc. The choice is grounded in several pillars:

a. Robust Revenue Growth

- FY 2025: $2.1 billion in revenue, a 22 % year‑over‑year increase.

- Projected FY 2026: Analysts expect $2.5 billion, driven by expanded payer contracts and new vertical markets (e.g., mental‑health services).

b. Improving Profitability

- Gross Margin: Up from 58 % in 2024 to 61 % in 2025, reflecting economies of scale.

- Operating Margin: Surged from a modest 4 % to 10 % after cutting overhead and streamlining sales teams.

c. Strong Market Position

- Teladoc is the de facto leader in U.S. virtual care, boasting more than 20 million visits annually.

- Recent partnership with UnitedHealth Group to integrate Teladoc services into the Optum network extends the company’s reach to 10 % of the U.S. population.

d. Valuation Edge

- P/E Ratio (Trailing): 35×, slightly below the sector median of 38×.

- Discounted Cash Flow (DCF) Analysis: The article’s analysts peg the intrinsic value at $95, implying a 12 % upside from the current $84 price.

- Dividend: Teladoc currently does not pay a dividend, but its strong cash flow trajectory suggests a potential payout in the future.

e. Risk Assessment

- Regulatory: Telehealth reimbursement rates could face scrutiny under new Medicare adjustments.

- Competition: New entrants (e.g., American Well, MDLive) and big tech (e.g., Google Health) could erode market share.

- Pandemic Dependency: A return to pre‑pandemic in‑person care could dampen demand.

The article frames these risks as “moderate” and emphasizes that Teladoc’s diversified revenue streams and strong pipeline mitigate long‑term concerns.

4. How the Stock Fits Into a Portfolio

The article includes a small portfolio exercise that compares a Teladoc allocation to a traditional “healthcare defensive” strategy:

| Portfolio | Allocation to Teladoc | Total Return (Projected 5 yrs) |

|---|---|---|

| Conservative | 0 % | 6.5 % |

| Balanced | 20 % | 9.3 % |

| Aggressive | 40 % | 12.1 % |

The conclusion: “For investors looking to capture the long‑term upside of the healthcare boom, a 20 % stake in Teladoc, balanced against more traditional healthcare staples like Johnson & Johnson or Pfizer, offers an attractive risk‑return trade‑off.”

5. Take‑aways from the Full Article

- Healthcare is a structural winner – demographic trends, policy shifts, and technology are aligning to drive earnings for the next decade.

- Sub‑sector focus matters – biotech and digital health present the highest growth potential, but also the greatest volatility.

- Teladoc stands out – its blend of revenue growth, margin improvement, and strategic partnerships positions it well to ride the surge.

- Valuation matters – while the sector is already premium, Teladoc’s current price is still below its own intrinsic value estimate, giving room for upside.

- Risk must be monitored – regulatory changes and competitive dynamics could impact Teladoc’s trajectory, but the company’s fundamentals are robust.

6. Final Verdict

The article ends on an upbeat note, encouraging readers to keep a close eye on Teladoc while staying diversified across other health‑sector names. It underscores that the healthcare sector’s upside is far from a “once‑in‑a‑generation” event; instead, it’s a persistent trend that will shape U.S. equity markets for years to come. Investors who can align their portfolios with this macro shift stand to benefit from both growth and stability.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/12/06/healthcare-sector-is-surging-heres-1-stock-every/ ]