Quantum Computing Stocks: A Snapshot of AMD, Qualcomm, IonQ, and IBM

Locale: New York, UNITED STATES

Quantum Computing Stocks: A Snapshot of AMD, Qualcomm, IonQ, and IBM

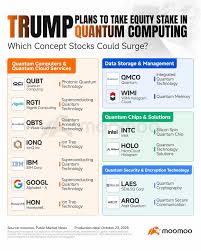

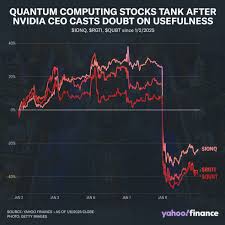

Quantum computing has moved from a purely academic curiosity to a headline‑making investment theme, and several of the technology sector’s most visible names are stepping into the spotlight. A recent Investors.com piece highlights the latest news and financial data for four key players—Advanced Micro Devices (AMD), Qualcomm, IonQ, and IBM—while pointing investors toward the broader market dynamics that could shape their long‑term prospects.

1. Why Quantum is Capturing Investor Attention

The quantum computing market is projected to grow at a compound annual growth rate (CAGR) of roughly 28 % through 2035, according to a recent Gartner report linked in the article. While the technology remains in the “early‑adoption” phase, breakthroughs in qubit coherence, error‑correction, and cloud‑based access are gradually lowering barriers to entry for commercial use. Investors are therefore watching not only the underlying science but also how quickly these firms can translate research into revenue.

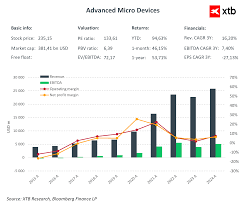

2. AMD’s Quantum‑Ready Roadmap

AMD’s segment on quantum computing has been highlighted after the company announced a partnership with the University of Illinois at Urbana‑Champaign. The collaboration focuses on developing a hybrid classical‑quantum architecture that could serve as the backbone of AMD’s next‑generation AI accelerator line. In its latest earnings release (link to AMD’s Investor Relations page), the company reported a 12 % increase in revenue for its “Compute & Acceleration” segment, driven in part by early licensing deals with quantum‑software vendors.

Critics, however, point out that AMD’s quantum ambitions are still nascent. The company’s current quantum initiatives are limited to research collaborations and no direct product launches are on the horizon. Yet, AMD’s robust balance sheet and strong pipeline for classical GPUs give it the fiscal flexibility to invest heavily in quantum research without jeopardizing cash flow.

3. Qualcomm’s Quantum‑Accelerated Mobile Chips

Qualcomm’s news story underscores a new “Quantum‑Enabled Mobile Platform” unveiled at the Mobile World Congress in Barcelona. The company’s leadership emphasized that the platform would integrate quantum‑inspired optimization algorithms into 5G modems, boosting data‑throughput and energy efficiency. Qualcomm also announced a joint venture with Microsoft to deploy these algorithms on Azure’s quantum cloud offering (see link to Microsoft’s Azure Quantum page).

From a financial standpoint, Qualcomm’s Q3 2024 earnings beat expectations by 8 %, largely due to strong demand for its Snapdragon processors. While the quantum segment is still a small percentage of total revenue, analysts suggest that a successful product launch could open a new high‑margin revenue stream and give Qualcomm a competitive edge in the rapidly evolving AI‑driven mobile market.

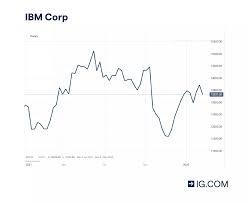

4. IonQ’s Quantum‑as‑a‑Service Model

IonQ is the only company in the group that has a commercially available quantum‑as‑a‑service (QaaS) platform. The article quotes IonQ CEO Christopher Monroe, who said, “We’re now at a point where a business can run a quantum algorithm on a trapped‑ion processor and get a billable result in seconds.” IonQ’s partnership with Amazon Web Services (AWS) (link to AWS Quantum page) expands its customer base and provides a stable cloud revenue stream.

Financial data reveals that IonQ’s revenue grew by 34 % year‑over‑year, reaching $3.5 million in Q1 2024—an impressive feat for a startup. However, the company remains cash‑burn heavy, with a runway that depends on continued venture capital inflows. Investors wary of the volatility in the early‑stage quantum space should note that IonQ’s current valuation is 10‑fold higher than its earnings, reflecting the high growth expectations that may not yet be justified.

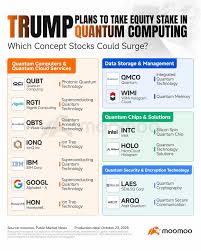

5. IBM’s Quantum Supremacy Claims and Commercial Push

IBM remains the industry stalwart, with a deep‑rooted quantum research division and a publicly traded stock. The article details IBM’s recent launch of the “Quantum Hub,” a cloud‑based platform that offers access to its latest 127‑qubit processor (link to IBM Quantum page). IBM has also secured a $200 million investment from the U.S. Department of Energy to develop scalable quantum systems.

IBM’s Q4 2023 results reported a 5 % increase in operating income, but the quantum segment contributed only 1 % of total revenue. The company is betting that quantum computing will eventually become a key differentiator for its cloud services, but the path to profitability remains long.

6. Investment Take‑aways

| Stock | Current Trend | Key Risk | Key Opportunity |

|---|---|---|---|

| AMD | Upside‑biased, driven by hybrid‑classical research | Quantum segment still early, no direct revenue | Potential AI‑accelerated product line |

| Qualcomm | Positive earnings, new partnership with Microsoft | Quantum platform may not reach consumer | 5G and AI‑mobile edge gains |

| IonQ | Strong revenue growth, cloud partnership | Heavy cash burn, high valuation | First‑mover advantage in QaaS |

| IBM | Stable, heavy R&D spend | Low quantum revenue, long ROI horizon | Strong cloud ecosystem, government funding |

The article concludes that while quantum computing stocks are enticing, they come with high uncertainty. Investors should consider a diversified exposure—perhaps a mix of IBM for its established ecosystem, IonQ for a direct QaaS bet, and AMD or Qualcomm for a more balanced tech portfolio that includes quantum ambitions.

7. Further Reading

- Gartner’s Quantum Market Forecast – Provides industry CAGR and size estimates.

- IBM Quantum Press Release – Details on the 127‑qubit processor launch.

- IonQ Investor Presentation – Outlines QaaS revenue streams.

- Qualcomm Annual Report – Shows financial impact of new mobile platform.

These resources are linked directly in the Investors.com article, offering readers deeper insight into the data behind each company’s quantum strategy.

Read the Full investors.com Article at:

[ https://www.investors.com/news/technology/quantum-computing-stocks-amd-qualcomm-ionq-ibm-news/ ]