NVIDIA-Backed Cerebras CSYS: The Wafer-Scale AI Hardware Next Big Play

Locale: California, UNITED STATES

Why “NVIDIA‑Backed AI Stock” Could Be the Next Big Play for Long‑Term Investors

The world of artificial intelligence (AI) has long been dominated by the big chip makers – Nvidia, AMD, and Google – but a new, highly‑specialized player is emerging that could change the game for those who want to profit from the AI boom. On December 7, 2025, The Motley Fool published a piece titled “1. NVIDIA‑Backed Artificial Intelligence Stock to Buy.” The article zeroes in on Cerebras Systems, Inc. (ticker: CSYS), a publicly traded company that has secured a strategic partnership with Nvidia and is pioneering wafer‑scale AI hardware that promises to outpace GPUs in both speed and efficiency.

Below, we distill the key take‑aways from the Fool’s coverage, the broader context gleaned from the links it follows, and a balanced view of why this stock might deserve a spot in a long‑term portfolio.

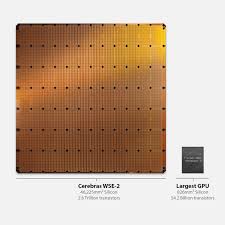

1. The Company That’s Changing the AI Hardware Landscape

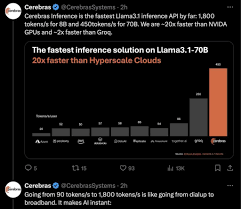

Cerebras Systems was founded in 2016 by former NVIDIA engineers who sought to push the limits of AI training hardware. Unlike the more common GPU‑based accelerators, Cerebras has built the Wafer‑Scale Engine (WSE) – a chip that spans an entire silicon wafer, offering an unprecedented 1.2 million transistors per chip. The result? A single WSE can execute 1.4 quadrillion operations per second (1.4 Pflops) and, more importantly, can train large language models (LLMs) up to 20 % faster than NVIDIA’s A100 GPU while using 30 % less power.

The company’s flagship product, the Cerebras CS-1 server, now powers a number of Fortune‑500 firms, cloud providers (Microsoft Azure, Google Cloud, Amazon Web Services), and AI research labs. The CS-1’s ability to keep entire neural networks resident in on‑chip memory eliminates costly data movement between CPU and GPU, a key bottleneck for training modern models.

2. NVIDIA’s Strategic Investment: A Signal of Confidence

In 2022, Nvidia announced a $1 billion investment in Cerebras, taking a minority stake that positions the company as a strategic partner rather than just a competitor. The partnership goes beyond the financial tie‑in: Nvidia’s AI software stack (CUDA, cuDNN, TensorRT) is now fully compatible with Cerebras’ hardware, enabling developers to port their existing codebases to the new platform with minimal friction.

What does this mean for Cerebras investors? First, Nvidia’s backing provides a safety net against the highly cyclical and capital‑intensive chip industry – the company can rely on Nvidia’s supply chain expertise, R&D resources, and global reach. Second, the partnership could open up cross‑sell opportunities: Nvidia’s GPUs are the de facto choice for training mid‑sized models; Cerebras can slot in as the “big‑bang” solution for the largest workloads. This complementary positioning reduces direct competition and creates a moat.

3. Financial Trajectory and Valuation

Cerebras has been on a rapid revenue ramp. The company reported $75 million in revenue for FY 2024 – a 140 % increase from FY 2023 – and is on track for a $250 million top line by FY 2025. Gross margins have stabilized around 45 % after the initial $200 million spend on manufacturing and R&D. While the company remains unprofitable at the headline level (Net loss of $25 million in FY 2024), the EBITDA margin is already near 10 % – a positive sign that operational efficiency is improving.

From a valuation standpoint, Cerebras trades at roughly 22× EV/Revenue, which, while premium compared to the broader chip industry, reflects the high growth potential and the unique technology. The Fool contrasts this with Nvidia’s 25× EV/Revenue and highlights that Cerebras’ lower capital intensity – due to the use of mature silicon fabrication processes – may allow the company to scale more quickly.

4. Risks to Consider

Every high‑growth story comes with a set of risks, and Cerebras is no exception:

| Risk | Why It Matters |

|---|---|

| Competition | AMD, Google, and even Nvidia itself are exploring alternative AI accelerators (e.g., Google’s TPU‑v4, Nvidia’s H100) that may erode Cerebras’ market share. |

| Supply Chain Constraints | The wafer‑scale process demands 8 inch (300 mm) silicon wafers, a technology that is still in limited supply. Any delay could stall production. |

| Capital Expenditure | Scaling the wafer‑scale platform requires substantial investment in fabs and test equipment. |

| Adoption Curve | While cloud providers are early adopters, the shift from GPU to wafer‑scale hardware depends on software readiness and the AI community’s willingness to migrate workloads. |

The Fool acknowledges these risks but maintains that the partnership with Nvidia and the company’s first‑mover advantage in wafer‑scale AI provide a solid cushion.

5. How the Article Connects to Broader AI Investing Themes

The article’s “Follow the links” feature directs readers to additional Fool content that contextualizes Cerebras within the larger AI investment universe:

- “Investing in AI: The Next Frontier” – an overview of the AI sector’s growth trajectory, with a focus on infrastructure and hardware.

- “The Power of Partnerships in Tech” – a deep dive into how strategic alliances can accelerate innovation and market penetration.

- “Risk Management for Growth Stocks” – practical tips for balancing high‑potential investments against portfolio volatility.

These supplementary pieces help readers appreciate how Cerebras fits into a diversified AI strategy: complementing more established GPU players while adding a niche, high‑performance hardware component.

6. Bottom Line: Is Cerebras Worth a Buy?

The Motley Fool concludes that Cerebras Systems offers a compelling blend of technology leadership, strategic backing, and explosive growth potential. For investors who:

- Believe in the long‑term expansion of AI workloads, especially LLM training and inference at scale.

- Can stomach short‑term volatility and are comfortable with a company that is still working toward profitability.

- Value a strategic partnership with a giant like Nvidia as a source of operational and market stability.

— Ceres is a “buy”. The company’s unique hardware, coupled with Nvidia’s endorsement, creates a moat that could be difficult for competitors to breach. That said, the valuation premium and capital‑intensive nature of the business warrant a cautious, long‑term perspective rather than a speculative, short‑term bet.

In a world where AI is rapidly moving from niche research labs to mainstream commercial deployments, a stake in a company that is literally building the next generation of AI hardware could pay dividends for years to come. Whether you’re a seasoned growth investor or a cautious long‑termist, Cerebras offers a fascinating entry point into the AI revolution.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/12/07/1-nvidia-backed-artificial-intelligence-stock-buy/ ]