Madison Investments Q3 2025 Market And Economic Review - Equity Markets

Madison Investments Q3 2025 Market and Economic Review: Equity Markets – A Comprehensive Summary

Madison Investments’ Q3 2025 market and economic review offers a deep dive into the forces shaping the equity markets through the final quarter of the year. Drawing on macro‑economic data, central‑bank policy decisions, corporate earnings trends, and sector‑specific dynamics, the report charts a path forward for investors navigating a landscape of elevated rates, lingering inflationary pressures, and evolving risk sentiment.

1. Economic Backdrop

Inflation and the Federal Reserve

Inflation in the United States remained stubbornly above the Fed’s 2 % target throughout the quarter. The Consumer Price Index (CPI) continued to climb, driven by persistent energy costs and supply‑chain bottlenecks. The Federal Reserve’s policy statement released on 13 March 2025 confirmed that the policy rate would stay at 5.5 % for the foreseeable future. The Fed reiterated that rate cuts would likely be postponed until 2026, citing the need to ensure that inflation has fully normalized. This stance has kept borrowing costs high, tightening corporate capital budgets and putting pressure on high‑growth sectors.

Interest Rates and Yield Curves

U.S. Treasury yields were firmly in the 4.5‑5.5 % range for the 10‑year tenor, reflecting market expectations of continued tight monetary policy. The yield curve, though still upward‑sloping, has flattened slightly compared to the start of the year, indicating heightened market uncertainty about the pace of the Fed’s tightening cycle. The 2‑10 yield spread narrowed to around 0.7 %, a key technical indicator that often precedes recessions.

Currency Movements

The U.S. dollar strengthened against major peers, with the USD Index hovering around 106 points. A strong dollar dampens export earnings for U.S. manufacturers and adds pressure to multinational earnings when they are translated back into dollars. This dynamic has had a noticeable impact on the performance of companies with significant foreign exposure.

Commodity Prices

Oil remained a key driver of market volatility, with Brent crude hovering around $90–$95 a barrel. Crude’s price resilience has supported energy‑sector stocks but contributed to broader inflationary headwinds. Gold, meanwhile, held its ground at roughly $1,850 per ounce, reflecting investor appetite for a safe‑haven amid uncertain growth prospects.

2. Equity Market Performance

Broad Indexes

The S&P 500 finished Q3 2025 on a modest 1.6 % gain, a sharp contrast to the 5.4 % rally seen during the first half of the year. The Dow Jones Industrial Average posted a 2.3 % rise, while the Nasdaq 100 slipped by 0.9 %. Volatility, measured by the VIX, spiked to a 12‑month high of 22.5 during the final week of September, underscoring heightened risk sentiment.

Sector Analysis

- Technology: Tech stocks remained under pressure, with the NASDAQ Composite lagging behind its pre‑pandemic trajectory. Software and cloud providers saw modest earnings, but rising borrowing costs curbed expansion plans.

- Financials: Banks benefited from a steepening yield curve, with net interest margins widening. The Financial Select Sector SPDR Fund (XLF) gained 3.8 % through the quarter.

- Energy: Despite higher commodity prices, energy stocks underperformed due to the continued impact of the dollar’s strength on exports and rising interest rates dampening investment.

- Consumer Discretionary: This sector lagged behind its peers, as consumers adjusted spending habits in response to higher financing costs.

- Healthcare: The Healthcare Select Sector SPDR Fund (XLV) held steady, buoyed by the sector’s defensive nature and a mix of steady earnings.

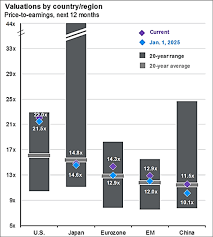

Dividends and Valuations

Dividend‑paying stocks gained modest traction, with the S&P 500 Dividend Aristocrats Index rising 4.2 %. The overall valuation environment remained stretched, with the Cyclically Adjusted Price/Earnings (CAPE) ratio hovering near 22, a level that historically correlates with moderate long‑term growth.

3. Corporate Earnings Pulse

Quarterly Results Overview

Companies reported mixed earnings, with a trend toward smaller-than‑expected earnings growth. The average earnings per share (EPS) beat consensus by a modest 1.8 %, but revenue growth slowed across many large-cap names. Analysts flagged supply‑chain constraints and elevated commodity costs as the primary drivers behind the slowdown.

Key Highlights

- Tech: A major cloud services provider reported a 3 % YoY revenue growth, but diluted EPS fell 12 % due to increased R&D spend.

- Financials: A leading bank posted a 9 % increase in net interest income, offset by a 4 % rise in loan losses.

- Energy: An integrated oil‑and‑gas firm recorded a 7 % rise in adjusted EBITDA, driven by higher crude prices but tempered by higher operating costs.

- Consumer Discretionary: A flagship retail brand posted a 2 % decline in same‑store sales, reflecting consumer price sensitivity.

Guidance

Corporate guidance was cautious. A majority of companies trimmed their fiscal‑year revenue targets by 1–2 %, citing the “tight” macro environment. Earnings guidance, however, remained relatively consistent, suggesting that companies expect a period of stable but subdued growth.

4. Strategic Outlook

Investment Themes for 2026

Madison Investments identifies several themes for the coming year:

1. Financials: With the yield curve expected to steepen further, financial institutions stand to benefit from higher net interest margins.

2. Consumer Staples: These companies tend to weather inflationary periods better, given their pricing power.

3. Utilities: A potential shift toward renewable energy and regulatory incentives could provide a catalyst for growth.

4. Dividend‑Yielding Equities: Defensive stocks with stable cash flows become attractive as risk appetite wanes.

Risk Factors

- Rate Hikes: The possibility of additional Fed tightening in 2026 could intensify market volatility.

- Geopolitical Tensions: Escalations in Eastern Europe or the Middle East could affect commodity supplies and global supply chains.

- Policy Shifts: Unexpected policy changes, such as a Fed pivot or fiscal stimulus, could alter the macro landscape dramatically.

Portfolio Construction Tips

Madison recommends a diversified approach that emphasizes liquidity, defensive positioning, and a tilt toward sectors that historically perform well in a high‑rate, inflationary environment. Investors should also consider incorporating fixed‑income instruments with durations matched to their risk tolerance, as Treasury yields remain a core driver of equity valuations.

5. Conclusion

The Q3 2025 market and economic review from Madison Investments paints a nuanced picture of equity markets navigating a higher‑rate, inflationary world. While equity gains were modest and volatility remained elevated, certain sectors—particularly financials and utilities—offered resilience. Corporate earnings echoed the broader macro constraints, yet guidance remained largely unchanged, reflecting a cautious but stable outlook. For investors, the upcoming year promises a blend of opportunities and challenges, and a disciplined, macro‑aware strategy will be key to navigating the complex terrain ahead.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4841041-madison-investments-q3-2025-market-and-economic-review-equity-markets ]