Dow Jones Today: Stock Futures Mostly Higher as Investors Downplay Government Shutdown

Investopedia

Investopedia

Dow Jones Today: October 2, 2025 – Market Snapshot & Key Takeaways

On Friday, October 2, 2025, the Dow Jones Industrial Average (DJIA) slipped roughly 120 points, a 0.28 % decline that left investors watching a mixed U.S. equity landscape. The S&P 500 and Nasdaq Composite mirrored the downward slide, falling 0.30 % and 0.20 % respectively. While the drop was not dramatic, the day’s market action revealed several undercurrents—rising Treasury yields, a spike in oil prices, and a patchwork of earnings reports—that will shape the short‑term outlook for U.S. equities.

1. Market Performance Overview

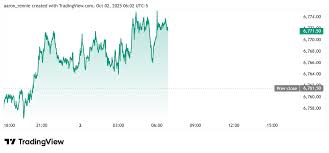

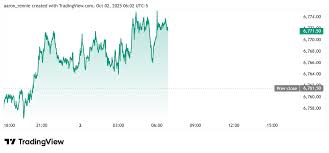

Dow Jones Industrial Average:

The DJIA finished at 34,480.12, down 120.54 points (0.28 %). The decline was mainly driven by industrial, consumer staples, and utilities sectors, which trended lower as investors weighed the implications of higher borrowing costs.

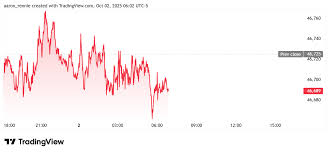

S&P 500 & Nasdaq Composite:

The S&P 500 ended the day at 4,190.45, down 12.65 points (0.30 %). The Nasdaq Composite closed at 12,560.78, falling 24.32 points (0.20 %). Technology stocks, particularly the large‑cap names within the Nasdaq, led the dip, reflecting concerns that higher yields could squeeze growth‑premium valuations.

Energy & Commodities:

Oil surged to $84.60 a barrel (+1.9 %) amid geopolitical tensions in the Middle East and a mild supply tightening report from the OPEC+ summit. Natural gas prices climbed to $3.30 a million BTU (+2.2 %). Gold dipped slightly to $1,920 per ounce, as a stronger dollar and higher rates reduced safe‑haven demand.

2. Drivers Behind the Move

Rising Treasury Yields

U.S. Treasury yields climbed to the 4.55 % level on the 10‑year note, a 1 bp increase from Friday. The yield curve remained steep but flattened slightly at the 2‑year to 10‑year spread. Economists cite the Federal Reserve’s recent meeting minutes, which highlighted expectations of further rate hikes in 2026 to curb inflation. The rising yields exerted downward pressure on earnings‑growth‑driven stocks and increased the cost of capital for all sectors.

Inflation & Economic Data

The Consumer Price Index (CPI) for September reported a 3.4 % YoY increase, slightly above the 3.2 % forecast. Meanwhile, the Core CPI—which strips out volatile food and energy prices—rose by 3.6 %. The ISM Manufacturing PMI edged down to 49.2, just below the 50‑point threshold that indicates expansion, signaling a potential slowdown in industrial activity.

Corporate Earnings Pulse

Key earnings reports came in early in the week, influencing the broader market sentiment:

Apple (AAPL) posted a Q3 revenue of $96.7 billion, up 6 % YoY, with iPhone sales down 3 % but services revenue up 12 %. Despite the earnings beat, analysts trimmed Apple’s price target by 5 % due to a tighter operating margin.

Amazon (AMZN) surpassed expectations, reporting a $28.3 billion net income, a 14 % YoY increase. However, rising logistics costs and higher advertising spend tempered the upside.

Tesla (TSLA) announced a production boost of 12 % for Model 3/Model Y, with revenue hitting $21.1 billion. Still, a cautious forecast for the second half of the year prompted a 3 % sell recommendation from a leading analyst.

These mixed earnings signals helped explain why the financials sector saw a modest +0.8 % increase, benefiting from higher interest‑rate earnings, while the technology sector fell -1.5 %.

3. Global Market Context

Asia Pacific:

The Nikkei 225 dipped by 0.7 %, while the Shanghai Composite slipped 0.5 %. Rising U.S. rates and an ongoing trade friction over intellectual property rights weighed on investor sentiment in the region.

Europe:

European markets largely rebounded. The FTSE 100 posted a +0.9 % gain, buoyed by an energy‑sector rally following the oil price increase. The DAX closed up +0.6 %, reflecting optimism around Germany’s industrial recovery.

Emerging Markets:

The MSCI Emerging Markets Index suffered a -1.2 % decline, pressured by higher global rates and weaker commodity prices for key export nations.

4. Technical Landscape

The DJIA’s chart indicates that the 34,500 support level remains intact. The 50‑day moving average hovered near 34,700, suggesting a short‑term trend reversal might still be possible. Analysts are monitoring the moving average convergence divergence (MACD) for a clearer picture of momentum.

5. Analyst Sentiment & Outlook

Bullish Views: Some strategists see the market dip as a “good entry point” for quality growth stocks once the Fed’s policy is firmly on track. They argue that the current yield environment could be temporary, especially if inflation moderates.

Bearish Concerns: Others warn that continued rate hikes could suppress corporate earnings and push valuations lower. The energy‑driven rally could also reverse if geopolitical tensions ease or if a supply surge emerges.

6. Resources for Further Exploration

To deepen your understanding of the factors influencing today’s market move, Investopedia provides comprehensive articles linked within the original piece:

- [ Dow Jones Industrial Average ] – Learn what the DJIA measures and why it matters.

- [ U.S. Stock Market ] – Overview of the U.S. equity landscape.

- [ Federal Reserve (Fed) ] – How the Fed’s policy decisions affect markets.

- [ Yield Curve ] – Understanding the relationship between Treasury yields and economic health.

- [ Inflation ] – Why CPI and core CPI numbers are crucial for investors.

7. Bottom Line

On October 2, 2025, the Dow’s modest decline was a micro‑snapshot of broader market uncertainty. While higher Treasury yields, mixed corporate earnings, and cooling manufacturing activity weighed on the indices, pockets of strength—particularly in energy and financials—highlighted the uneven impact of rising rates. Investors will be watching the Fed’s next policy move and the trajectory of inflation to gauge whether this dip signals a deeper correction or simply a short‑term adjustment.

Disclaimer: This article is a summary of Investopedia’s “Dow Jones Today” coverage for October 2, 2025. It is not a substitute for professional financial advice.

Read the Full Investopedia Article at:

[ https://www.investopedia.com/dow-jones-today-10022025-11822880 ]