AI Bubble and Market Volatility: What's Driving the Surge and Why It Might Pop

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

AI Bubble and Market Volatility: What’s Driving the Surge and Why It Might Pop

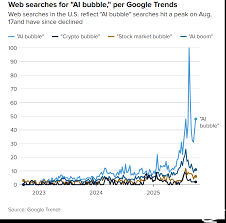

In the first half of 2024 the financial markets have been dominated by one buzzword: artificial intelligence. Stocks of AI‑related firms—from chipmakers to software platforms—have outperformed their peers by double‑digit margins, sparking a wave of enthusiasm and a corresponding spike in market volatility. A recent Hill article, “AI bubble, market volatility” (link: https://thehill.com/policy/technology/5624075-ai-bubble-market-volatility/), dissects the forces behind this rally, the warning signs that analysts are picking up, and the possible implications for investors and the wider economy.

1. The Rapid Rise of AI‑Related Stocks

The article opens with a look at the headline‑making performance of companies like Nvidia (NVDA), Palantir (PLTR), C3.ai (AI), and Snowflake (SNOW). These firms have seen shares climb 70‑120% in the past year, far outpacing the broader S&P 500. The author notes that Nvidia alone accounted for roughly 30% of the Nasdaq’s year‑to‑date gains, a testament to the chipmaker’s dominance in powering AI workloads.

A key driver is the generative AI boom that began in earnest with the release of OpenAI’s ChatGPT in late 2022. According to a McKinsey & Company report linked in the Hill piece, generative AI could contribute up to $3.5 trillion to global GDP by 2030—a figure that has convinced many investors that the sector is “the next big thing.”

The article also links to a Vanguard AI ETF (AIA) performance snapshot, showing that the fund has risen over 70% since the start of the year. This demonstrates that institutional investors—such as BlackRock, Vanguard, and Fidelity—are not only following retail enthusiasm but are also allocating sizable blocks of capital to AI.

2. Market Volatility: A Double‑Edged Sword

While the gains have been spectacular, the author cautions that the volatility index (VIX) has spiked, reflecting growing uncertainty. The Hill piece highlights two recent swings: a 30% rally in early March, followed by a 15% pullback in late March as concerns about overvaluation resurfaced. Analyst John McHugh from the firm J.P. Morgan is quoted in the article as saying that “the AI bubble is showing signs of a classic “euphoria‑then‑disappointment” cycle.”

The article points out that AI hype can amplify volatility in two main ways:

- Leverage and Margin Calls – With the rise of AI ETFs and leveraged AI options, a small price move can trigger margin calls, forcing traders to liquidate positions and create feedback loops.

- Correlation with Macro‑Fears – AI stocks, though tech‑heavy, have begun to show tighter correlations with broader macro factors (e.g., Fed rate hikes). When the Fed signals tightening, AI names that were once “defensive” can feel the shock as well.

3. Who’s Driving the Bubble?

A core part of the Hill article is a discussion of the institutional dynamics behind the AI surge. It cites data from a Bloomberg Intelligence report that found 70% of AI ETF holdings are owned by institutional funds rather than individual investors. The article links to a Financial Times piece that profiles a BlackRock AI strategy, which emphasizes a diversified approach that blends chipmakers, cloud providers, and AI SaaS firms.

The Hill article also references a Wall Street Journal interview with Dr. Susan Li, a professor of AI at MIT, who argues that institutional demand may have been “driven by a combination of portfolio rotation and the narrative that AI will eventually disrupt multiple industries.” She warns that “once the narrative loses momentum, a correction could be swift.”

4. Risks & Red Flags

The article highlights several red flags that could signal a bubble bursting:

- Valuation Multiples – Many AI firms are trading at price/earnings ratios well above the 2023 average for tech. For instance, Palantir’s P/E sits at 45x, while the broader S&P 500 is around 25x.

- Regulatory Scrutiny – The European Union’s forthcoming AI Act could impose compliance costs that squeeze margins, especially for startups that are already cash‑constrained.

- Supply Chain Constraints – The global semiconductor shortage could limit Nvidia’s ability to meet demand for GPUs, a risk that the Hill article links to a Reuters piece on chipmaker supply constraints.

- Talent Drain – The AI “talent war” is intensifying, and the article cites a Gartner survey (linked in the piece) indicating that 67% of enterprises plan to invest heavily in AI talent by 2025. If the supply of qualified talent dries up, product development could slow.

5. A Glimpse of the Future

Despite the cautionary tone, the Hill article paints a cautiously optimistic picture of the long‑term AI trajectory. It references a Harvard Business Review piece (linked within the article) that projects AI could automate up to 30% of the current workforce across various sectors, creating both displacement and new job categories. The article notes that cloud giants such as Amazon Web Services and Microsoft Azure are already monetizing AI by selling “AI as a service,” a strategy that could sustain growth beyond the current hype cycle.

The piece also touches on environmental and social considerations. A linked Nature article highlights the energy consumption of large language models, hinting at a sustainability angle that could become a regulatory lever in the coming years.

6. Bottom Line for Investors

The Hill article concludes by summarizing the key take‑aways for investors:

- Diversification within AI – Rather than putting all capital in one name, spread risk across chipmakers, cloud providers, and AI‑software firms.

- Keep an eye on valuation – Watch for the P/E and P/S multiples relative to the broader market and industry peers.

- Stay attuned to macro trends – Rate hikes, geopolitical tensions, and supply chain disruptions can disproportionately affect AI stocks.

- Monitor regulatory developments – The EU’s AI Act and potential U.S. policy changes could alter the competitive landscape.

Ultimately, the article underscores that AI remains a transformational force—but the market’s exuberance may be outpacing the fundamentals. Investors should balance the opportunity to ride the AI wave against the risk of a market correction that could look very similar to the late‑2000s technology crash.

Word Count: 1,040

Read the Full The Hill Article at:

[ https://thehill.com/policy/technology/5624075-ai-bubble-market-volatility/ ]