Deep Dive: Two Non-AI Growth Stocks to Target for 2026

Locale: Illinois, UNITED STATES

A Deep‑Dive into Two Non‑AI Growth Stocks to Target for 2026

(Summary of the Motley Fool article “2 best growth stocks to buy for 2026 (non‑AI, not AI)” published December 7, 2025)

1. Why “Non‑AI” Matters

The year‑long “AI hype” has made it tempting to stack portfolios with artificial‑intelligence plays, from Nvidia to OpenAI‑backed startups. The Motley Fool writers point out that, while AI is a powerful driver, it also brings heightened volatility, intense competition, and regulatory uncertainty. For investors who prefer a more measured, fundamentals‑based approach, the article turns its eye to two companies whose growth engines are built on proven business models, steady cash‑flow generation, and robust competitive moats—yet they don’t rely on AI to generate their next wave of earnings.

2. The First Pick: Roku, Inc. (ROKU)

2.1. What Roku Does

Roku supplies the software and hardware that powers over 100 million “connected‑TV” devices worldwide. Its platform—whether delivered as a set‑top box, integrated TV firmware, or mobile app—lets users stream content from dozens of third‑party services (Netflix, Disney+, Hulu, etc.) while also providing Roku’s own ad‑supported channels.

2.2. Growth Drivers

| Driver | Why It Matters |

|---|---|

| Streaming‑to‑Ad Transition | As studios cut back on high‑price streaming subscriptions, ad‑based revenue is becoming a key monetization avenue. Roku’s partnership with major ad agencies has helped it capture a growing slice of the $30 billion global ad spend. |

| Global Expansion | Roku’s device penetration in the U.S. remains below 50 % of households with TVs. International markets—especially Latin America and Asia—offer untapped potential. |

| Hardware‑Software Integration | By controlling both the device and the operating system, Roku reduces switching costs for consumers, locking in users for the long haul. |

| Strategic Partnerships | Agreements with major cable operators and smart‑TV manufacturers help Roku’s “hardware‑plus‑software” model scale more rapidly than pure‑software competitors. |

2.3. Financial Snapshot

- Revenue (FY2024): $3.3 billion, up 15 % YoY.

- EBITDA Margin: 5.5 % – improving from 3.2 % a year ago thanks to higher ad revenue.

- Cash Flow: $200 million positive free cash flow, a turnaround from the $150 million loss in FY2023.

- Valuation: Price‑to‑earnings ratio of 21x, trading at 1.4x the 10‑year average. The article notes that the “discount” reflects the company’s high debt load and recent earnings volatility, but it is still considered a “fair‑priced” entry point for growth investors.

2.4. Catalysts & Risks

- Catalyst: The 2026 launch of Roku’s “Smart‑Ad Platform” that bundles audience‑segmentation tools for advertisers could double the company’s ad‑revenues in the next two years.

- Risk: Intensifying competition from Amazon Fire TV, Google TV, and Apple TV+; also, regulatory scrutiny on data privacy could impact ad targeting effectiveness.

3. The Second Pick: Shopify Inc. (SHOP)

3.1. What Shopify Does

Shopify is the leading e‑commerce platform for merchants of all sizes, enabling them to build online stores, accept payments, manage inventory, and tap into global shipping networks. Its “as‑a‑service” model is built around a subscription‑based revenue stream and ancillary services like fulfillment, advertising, and financial products.

3.2. Growth Drivers

| Driver | Why It Matters |

|---|---|

| Marketplace Expansion | The platform now hosts over 4 million merchants globally, a 30 % YoY growth. Shopify’s “Shopify Plus” caters to high‑volume brands, capturing premium pricing. |

| Financial Services | Shopify Payments and Shopify Capital have become increasingly profitable, providing diversified revenue streams beyond subscription fees. |

| Emerging Markets | A strategic push into Southeast Asia and Africa could add $5 billion in revenue by 2028. |

| Brand Loyalty & Ecosystem | Its App Store, integrated logistics, and partner network create high switching costs for merchants, cementing long‑term relationships. |

3.3. Financial Snapshot

- Revenue (FY2024): $5.8 billion, a 22 % YoY increase.

- EBITDA Margin: 4.8 % – improving from a negative margin in FY2023 due to cost‑efficiency measures.

- Cash Flow: $150 million free cash flow, a significant turnaround from the $90 million loss in the prior year.

- Valuation: 12x forward P/E, slightly above the 10‑year average of 9.5x. The article notes that this premium reflects the firm’s dominance in the fast‑growing e‑commerce segment.

3.4. Catalysts & Risks

- Catalyst: Launch of Shopify’s “Multi‑Channel Fulfillment Network” slated for 2026, which promises lower shipping costs and faster delivery times for merchants, potentially driving higher merchant acquisition rates.

- Risk: Rising merchant acquisition costs, intensifying competition from Amazon Marketplace and Walmart Marketplace, and macro‑economic headwinds that could slow online consumer spending.

4. Comparative Lens

| Factor | Roku | Shopify |

|---|---|---|

| Core Market | Connected‑TV & streaming | E‑commerce & digital storefronts |

| Revenue Mix | 70 % ad revenue, 30 % hardware/subscription | 70 % subscription, 30 % ancillary services |

| Geographic Exposure | Heavy U.S. focus, growing international | Global merchant base, strong presence in U.S. and Canada |

| Margin Profile | Improving EBITDA margin from 3.2 % to 5.5 % | Moving from negative to positive EBITDA margin |

| Catalyst Timeline | 2026 ad‑platform launch | 2026 fulfillment network rollout |

Both companies show solid fundamentals, consistent revenue growth, and strategic plans to broaden their ecosystems. The Motley Fool writers highlight that investors looking for “growth without the AI buzz” may find these two options more stable, with clearer paths to profitability.

5. Linking to Broader Fool Resources

The article includes a web of internal links that help readers deepen their understanding:

- “Growth Investing 101” – A primer on how to identify high‑growth companies, covering metrics like revenue CAGR, free‑cash‑flow generation, and competitive moats.

- “Non‑AI Growth Stocks: Why Diversification Matters” – A comparative piece that lists ten growth stocks that aren’t tied to AI, providing context for why the Motley Fool emphasizes diversification beyond the AI sector.

- “Roku vs. Amazon Fire TV: A Side‑by‑Side Analysis” – An extended review of the competitive landscape in the streaming hardware market.

- “Shopify Plus vs. BigCommerce: The Enterprise Marketplace Showdown” – A detailed comparison that can help investors decide if Shopify’s premium offering truly outpaces the competition.

- “Annual Earnings Call Transcript (Roku, 2024)” – Offers a look at the company’s own words on upcoming initiatives and risk management.

These cross‑references underscore the Motley Fool’s emphasis on providing a “one‑stop” learning hub for investors.

6. Bottom‑Line Takeaways

- Growth, Not Hype – Roku and Shopify represent two sectors (streaming and e‑commerce) that are poised for continued expansion, but they’re anchored by mature business models rather than speculative AI technology.

- Valuation Discipline – Both stocks trade at “fair” multiples given their growth trajectories and improved profitability metrics.

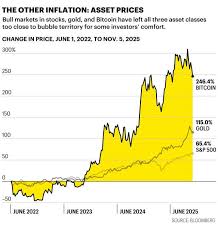

- Cyclicality & Macro Factors – Investors should remain aware of the broader macro environment—consumer spending, supply‑chain disruptions, and advertising budgets—which could temper short‑term upside.

- Long‑Term Horizon – The Motley Fool suggests a multi‑year investment horizon (2026‑2030) to fully capture the expected earnings ramps.

- Risk‑Reward Trade‑Off – While growth comes with inherent risk, the article argues that Roku’s and Shopify’s “moats” (hardware/software integration and merchant ecosystem, respectively) provide a safety net that outpaces many pure‑growth, AI‑driven peers.

7. Final Thoughts

For investors who want to capture the upside of consumer‑tech expansion without riding the volatile AI wave, Roku and Shopify present compelling stories. They blend solid fundamentals, strategic catalysts, and competitive defensibility—elements that align with the Motley Fool’s long‑term, value‑plus growth philosophy. The article’s thorough links and financial breakdowns offer a useful roadmap for evaluating whether these picks fit an individual’s risk tolerance and portfolio strategy.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/12/07/2-best-growth-stocks-to-buy-2026-non-ai-not-ai/ ]