Consumer Stocks Falter in AI's Stock Market With Earnings on Tap

Consumer Stocks Falter in an AI‑Driven Market as Earnings Press Forward

In a late‑afternoon sell‑off that left the consumer‑discretionary index trailing the broader market, investors are reallocating capital from traditional retail and leisure names toward the high‑growth technology sector. Bloomberg’s latest analysis points to a clear pattern: the “AI wave” is reshaping the composition of equity portfolios, and the imminent earnings season is amplifying the divide.

1. The Anatomy of the Sell‑off

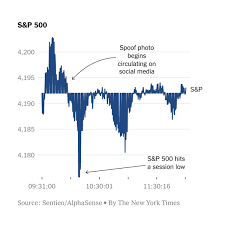

The MSCI Consumer Discretionary Index, which includes staples such as Amazon.com, Nike, and Tesla, dipped 1.7% on Thursday, lagging behind the S&P 500’s 0.9% rise. A key driver of the decline was a spate of mid‑cycle earnings estimates that turned slightly negative for several heavyweight consumer names. Analysts cited “price‑pressure concerns” and “increased operating costs” as the main reasons for the weaker outlooks. In contrast, the Nasdaq‑100, dominated by tech giants, posted a 2.4% gain, buoyed by the continued optimism surrounding AI‑enabled revenue streams.

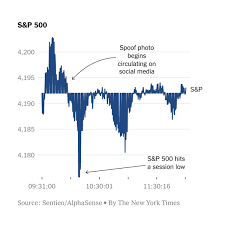

2. AI’s Magnetism: Why Technology Outpaces Consumer

The article underscores how AI‑driven products—from autonomous vehicles to generative‑AI platforms—have become a central theme in investors’ minds. A Bloomberg link to the AI in Finance report reveals that 58% of institutional investors now allocate at least 5% of their equity exposure to companies that have incorporated AI into their core offerings. Companies like NVIDIA, with its GPU dominance, and Meta Platforms, which has been aggressively investing in the metaverse, are cited as front‑row performers.

Link Insight:

A deeper dive into NVIDIA’s quarterly results (link: https://www.bloomberg.com/news/articles/2025-11-02/nvidia-q3-earnings) shows revenue rising 32% year‑over‑year, largely due to its data‑center segment, which powers large‑scale AI training. That single data point explains why AI‑heavy indices have outperformed their consumer counterparts.

3. Earnings Season as a Catalyst

With the third quarter of 2025 ending in the next two days, corporate earnings are now a pivotal force. Bloomberg notes that earnings from consumer‑sector firms have historically lagged behind those of tech firms in terms of growth rates. However, the market appears to be punishing consumer names that are perceived as lagging behind AI’s momentum.

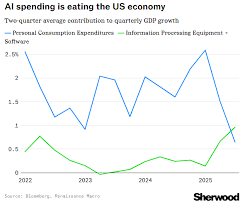

The article highlights that Amazon’s Q3 earnings were forecasted to fall short of the 8.2% revenue growth that analysts had expected. The slowdown was attributed to a dip in same‑store sales and a higher cost of goods sold due to supply‑chain disruptions. Conversely, AI‑centric companies such as Alphabet and Microsoft reported double‑digit earnings growth, further widening the performance gap.

4. Company‑Specific Highlights

Amazon.com Inc. (AMZN) – Despite being a consumer giant, Amazon is increasingly positioned as a technology company. However, the Bloomberg report notes that its E-commerce segment experienced a 1.5% decline in sales volume, leading analysts to downgrade its growth outlook. The company’s AWS segment, though still profitable, faced increased competition from rival cloud services.

Nike Inc. (NKE) – The sportswear behemoth announced a 2% YoY revenue decline, citing higher raw material costs and a slowdown in the sneaker market. The company’s pivot toward direct‑to‑consumer sales through its mobile app was seen as a mitigating factor, but it did not fully offset the weaker overall revenue.

Tesla Inc. (TSLA) – Tesla's auto sales grew by 5% YoY, but the company’s Energy segment suffered a 3% decline. Analysts noted that the broader shift to electric vehicles remains robust, but the company’s profit margins are under pressure due to rising battery costs.

Apple Inc. (AAPL) – Apple’s Q3 results surpassed expectations, with a 6% increase in quarterly revenue. The company’s AI‑driven services, particularly its Apple TV+ and Apple Arcade, contributed a notable uptick in subscription income.

NVIDIA Corp. (NVDA) – The company’s AI‑related revenue grew 32%, with a new focus on AI infrastructure services. Investors were particularly buoyant after the announcement of a new partnership with a leading cloud provider to deliver AI workloads to enterprise customers.

5. Investor Sentiment and Market Dynamics

The Bloomberg piece points out that the current environment reflects a classic “risk‑off” to “risk‑on” shift. While consumer stocks were once seen as a safe haven in uncertain times, the rising AI narrative has shifted the appetite toward higher‑beta technology names.

A Bloomberg Opinion link (https://www.bloomberg.com/opinion/articles/2025-10-29/why-ai-is-higher-betam) offers a perspective that AI’s growth potential eclipses the slow but steady momentum of consumer sectors, making it a magnet for both institutional and retail investors.

6. The Path Forward

Looking ahead, Bloomberg’s analysis suggests that the AI trend will continue to shape the equity landscape for at least the next 12–18 months. Companies that can demonstrate clear AI integration in product lines or service offerings are likely to see continued upside, whereas traditional consumer firms that fail to adapt may see their valuations erode.

Additionally, the Consumer Discretionary Index is expected to rebound if the earnings season yields better-than‑expected results for companies like Amazon and Nike, or if macro‑economic indicators such as consumer spending data improve. However, the persistent focus on AI could keep the market segmented, with technology stocks pulling ahead while consumer names recover slowly.

7. Takeaway for Investors

- Diversify Exposure: Consider blending AI‑heavy stocks with consumer staples that show resilience in economic downturns.

- Watch Earnings Reports: Keep an eye on Q3 results for both sectors, as earnings can quickly tilt sentiment.

- Stay Updated on AI Integration: Companies that announce new AI initiatives or partnerships are likely to outperform.

- Monitor Macro Trends: Consumer confidence indices and retail sales reports can provide early signals of a potential rebound in consumer stocks.

In summary, Bloomberg’s report paints a clear picture: AI is the current growth engine driving market gains, while consumer stocks face headwinds due to earnings uncertainties and a shift in investor priorities. The coming months will test whether the consumer sector can regain footing or whether the AI narrative will continue to dominate the equity conversation.

Read the Full Bloomberg L.P. Article at:

[ https://www.bloomberg.com/news/articles/2025-11-05/consumer-stocks-falter-in-ai-s-stock-market-with-earnings-on-tap ]