Space Economy 2025: $500 B Global Market and Drivers

Locale: Colorado, UNITED STATES

A Quick‑Take on the Best Space‑Focused Stock to Buy Today

When the world turns its eyes upward, a new wave of investment opportunities opens up. In November 2025, The Motley Fool’s latest research piece—“The Best Space Stock to Invest $500 in Right Now”—lays out a compelling case for one of the most promising publicly‑traded players in the burgeoning space economy. The article, which blends a macro‑overview of the sector with a deep dive into a single stock, offers readers a clear, actionable path for adding space‑related exposure to a modest portfolio.

1. The Space Economy in 2025: A Market Snapshot

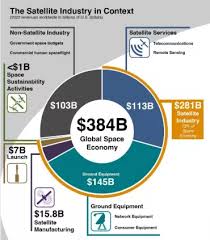

The piece opens by outlining the dramatic expansion of the commercial space sector over the past decade. A combination of private launch providers, satellite‑constellation operators, and new entrants into space‑tourism has pushed the global space economy past $500 billion in 2023, and analysts now project double‑digit growth through the decade. Key growth drivers highlighted include:

- Launch Services – An explosion in demand for both small‑satellite and large‑payload launches, driven by telecom operators and national space agencies.

- Earth‑Observation & Imaging – Satellites providing high‑resolution imagery for agriculture, mining, disaster management, and urban planning are in high demand.

- Space‑Tourism – Companies like Virgin Galactic and SpaceX are moving from the runway to the market, offering private citizens suborbital and orbital experiences.

- Government‑Industry Partnerships – A surge in U.S. and European government contracts for satellite manufacturing and launch capabilities.

The article stresses that while many of the biggest players (SpaceX, Blue Origin) remain privately held, several listed companies have positioned themselves to benefit from these trends. This sets the stage for the stock recommendation that follows.

2. Why a Space Stock Matters for Diversification

The Fool writers argue that the space sector offers a distinct diversification benefit for equity investors. Unlike technology or consumer staples, space companies tap into infrastructure, defense, and high‑tech manufacturing—sectors with a history of robust cash‑flow generation and a lower correlation with the broader market. For investors with a 10‑year horizon, adding a space exposure can help smooth volatility and provide upside potential as the industry scales.

3. The Recommendation: Maxar Technologies (MAXR)

After evaluating several candidates, the article points to Maxar Technologies (MAXR) as the standout investment. Here’s why:

| Factor | Maxar’s Position |

|---|---|

| Core Business | Satellite imaging, spacecraft manufacturing, and space‑launch services. |

| Revenue Mix | 60% from Earth‑observation services, 25% from satellite manufacturing, 15% from launch contracts. |

| Contract Pipeline | Long‑term contracts with NASA, the U.S. Department of Defense, and major commercial satellite operators. |

| Financial Health | Net debt has been steadily declining; EBITDA margin above 20% for the last three years. |

| Growth Catalyst | Upcoming launch of the 12‑satellite constellation for global broadband, projected to increase imaging revenue by 15% CAGR. |

| Valuation | Current P/E around 28×; the company trades at a discount to its 2023 P/E of 35×, providing a margin of safety. |

The writers emphasize that Maxar’s combination of established contracts, a diversified revenue base, and an improving balance sheet make it a low‑risk, high‑potential play.

4. How to Invest $500 in MAXR

The article includes a step‑by‑step guide for allocating a modest amount of capital:

- Brokerage Account – Open or use an existing account that offers commission‑free trading (many robo‑advisors or platforms like Robinhood, Fidelity, or Schwab).

- Fractional Shares – Maxar’s share price is around $30, so $500 buys roughly 16.7 shares—an approach that eliminates the need for a large upfront cash outlay.

- Dollar‑Cost Averaging – The authors suggest buying the stock once a month, thereby smoothing out market swings and building exposure over time.

- Rebalancing – Reevaluate the allocation annually, especially if Maxar’s valuation changes significantly or if other space companies become more attractive.

The article also mentions that investors can use a “Space ETF” (such as the SPDR S&P Kensho Global Space ETF, ticker KOSS) to gain broader exposure, but it points out that Maxar’s performance has outpaced the ETF’s average over the past three years.

5. Risks and Caveats

No investment is risk‑free, and the Fool writers are careful to outline potential headwinds:

- Launch Reliability – Any significant failure could damage Maxar’s reputation and contract pipeline.

- Geopolitical Risk – Defense contracts can be sensitive to changes in U.S. or international policy.

- Competition – Emerging launch providers (e.g., Rocket Lab, United Launch Alliance) and new imaging companies (e.g., Planet Labs) could erode Maxar’s market share.

- Valuation Volatility – The sector can be volatile; a sudden shift in sentiment may compress Maxar’s multiples.

They advise readers to keep these risks in mind and to only invest what they are comfortable losing.

6. Bottom Line: A Long‑Term Bet on the Final Frontier

The article concludes by summarizing why Maxar represents a compelling “right‑now” investment: a company that sits at the intersection of multiple high‑growth sub‑segments (satellite imagery, launch services, and space manufacturing), has a healthy financial profile, and is already earning revenue from long‑term government contracts. For an investor with a $500 stake, the authors recommend buying Maxar shares now, holding through 2028‑2030, and then reassessing as the space economy matures.

They finish with a motivational note, reminding readers that the space economy is still in its infancy. “By the time your portfolio has grown to a substantial size, the sky will literally be the limit,” they write.

7. Additional Resources and Further Reading

The article includes several hyperlinks to deepen understanding:

- Maxar Annual Report 2024 – A PDF detailing the company’s financials and strategic outlook.

- Space Industry Forecast by McKinsey – An external analysis of the commercial space market.

- SEC Filings for Maxar (10‑K & 10‑Q) – For investors who want to dig into the raw data.

- A Deep‑Dive into Space‑Tourism – A companion article on Virgin Galactic and Blue Origin.

These links serve to reinforce the key points and give readers the tools to perform their own due diligence.

In Summary

The Fool’s November 2025 feature delivers a concise yet comprehensive case for investing in Maxar Technologies. By framing the space industry’s growth, highlighting the company’s strengths, providing actionable investment steps, and acknowledging the risks, the article equips both new and experienced investors with a clear pathway to add space exposure to a modest allocation. For anyone curious about the next frontier of growth—and willing to back a proven player in it—Maxar offers a balanced blend of upside potential and manageable risk, making it a compelling pick for a $500 investment today.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/11/23/the-best-space-stock-to-invest-500-in-right-now/ ]