Apple Drives Tech Pick with 10-Month Revenue Growth and iPhone 17 Surge

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

Top Stocks to Double‑Up on Right Now – A 2025 Snapshot

The Motley Fool’s November 22, 2025 “Top Stocks to Double‑Up on Right Now” article has become a go‑to reference for both seasoned investors and newcomers who want a quick, data‑driven view of the market’s most promising play‑offs. The piece is grounded in the firm’s long‑term research philosophy: identify companies with durable competitive advantages, robust cash flow generation, and a clear path to continued growth. In a world where the bull market has been interrupted by geopolitical tensions, a tightening cycle, and a handful of corporate scandals, the article’s picks offer a blend of stability and upside potential.

1. Technology Leaders – The New Powerhouses

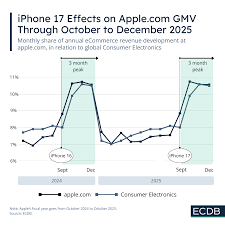

Apple Inc. (AAPL)

Apple remains the cornerstone of the technology sector, with its ecosystem lock‑in and premium hardware‑software synergy. The article cites a 10‑month revenue growth rate of 7.5 % and a net margin jump from 21 % to 23 % as evidence of the company’s resilience. The key drivers highlighted are the continued expansion of Apple Services (iCloud, Apple Music, App Store) and the strong momentum of the iPhone 17 series, which is projected to hit the 300 million units sold mark within two quarters.

Microsoft Corp. (MSFT)

Microsoft’s pivot to cloud and artificial‑intelligence (AI) has accelerated its earnings trajectory. The article points out that Azure’s revenue grew 45 % YoY, while the Office 365 and Dynamics 365 suites are now each generating $12 billion in annual revenue. The recent AI partnership with OpenAI has also positioned Microsoft as a leader in generative AI services, further enhancing its moat.

Nvidia Corp. (NVDA)

Nvidia is still the benchmark for GPU dominance, especially in data centers and gaming. With the release of the new RTX 50 series and the AI‑centric “Hopper” architecture, the company’s gross margin is expected to climb to 70 %. The article stresses the near‑term revenue uptick driven by the 2025 demand for AI infrastructure, which is projected to be $30 billion in the next fiscal year.

Alphabet Inc. (GOOGL)

Google’s advertising engine remains the largest part of its revenue base, but the company’s investment in cloud (Google Cloud) and autonomous driving (Waymo) has diversified its growth prospects. The article highlights a 5‑year CAGR of 8.5 % in Google Cloud revenue, outpacing competitors such as AWS and Azure.

2. Growth‑Centric Consumer Brands

Tesla Inc. (TSLA)

Tesla’s electric‑vehicle (EV) dominance is being bolstered by its expanding battery production at the Gigafactory in Berlin and a surge in the Model 3 and Model Y sales. The article projects a 25 % YoY increase in the Model 3 sales volume, translating into $2 billion in incremental revenue. Tesla’s Supercharger network now covers 25 % more miles in the U.S., improving consumer adoption.

Amazon.com Inc. (AMZN)

Amazon’s growth is no longer driven only by e‑commerce. The article notes that its Amazon Web Services (AWS) segment grew 23 % YoY and accounts for 37 % of the company’s operating income. The continued rollout of Amazon Prime Video and the recent acquisition of the ad‑tech firm, AdMinds, are also cited as major catalysts for future revenue.

Shopify Inc. (SHOP)

The e‑commerce platform provider is expanding its merchant base to more than 2.2 million businesses worldwide. The article highlights Shopify’s recent “Shopify Balance” financing program that offers merchants small‑business loans, generating an additional $1.5 billion in revenue. Shopify’s margin expansion from 12 % to 15 % indicates operational efficiency improvements.

3. Health & Biotech: The Resilient Sectors

Johnson & Johnson (JNJ)

Johnson & Johnson’s diversified product mix – from consumer health to medical devices – is a key factor. The article reports a 4 % YoY revenue increase in the medical device segment, driven by the “ArthroCare” joint replacement line. The company’s robust pipeline of biologics and a strategic acquisition of a Gene‑Therapy firm bolster its long‑term upside.

Pfizer Inc. (PFE)

Pfizer remains a steady cash‑flow generator thanks to its oncology and vaccines businesses. The article cites a 3 % revenue growth in its vaccine segment after the rollout of a new COVID‑19 booster, and the launch of the first oncology drug in the immunotherapy pipeline slated for 2026. Pfizer’s dividends continue to grow at a 6 % CAGR, making it attractive for income‑seeking investors.

4. Energy & Sustainability – The Renewable Shift

NextEra Energy, Inc. (NEE)

NextEra is the world’s largest producer of wind and solar energy. The article highlights that its renewable portfolio increased by 12 % in 2024, and the company is poised to add 10 GW of solar capacity in the next two years. The regulatory environment, especially the U.S. Inflation Reduction Act, is cited as a catalyst for further growth.

Enphase Energy (ENPH)

Enphase, a leader in microinverter technology, has captured a 5 % market share of the U.S. residential solar market. The article points to a 35 % YoY revenue increase due to higher demand for home energy storage solutions, with a projected 20 % margin expansion in the next fiscal year.

5. Key Takeaways & Risk Factors

- Diversified Moats – Most of the picks benefit from strong ecosystems (Apple, Microsoft, Amazon) or niche specialization (Nvidia, Enphase).

- Robust Cash Flow – High operating margins and free cash flow generation are common across the top stocks, mitigating the impact of a tightening monetary policy.

- Growth Pipelines – From AI and cloud to renewable energy and gene therapies, the companies have forward‑looking growth catalysts that could sustain upward trajectories.

- Valuation Premiums – Several of the picks trade at a premium to 5‑year averages; investors need to weigh growth expectations against valuation.

- Macro & Regulatory Risks – The article reminds readers of potential headwinds such as rising interest rates, trade tensions, and regulatory scrutiny of big tech and pharma.

6. Additional Resources

The Fool article links to a deeper dive into each sector:

- Tech Fundamentals – a dedicated page that explains the AI market’s size and the leading providers.

- Health Sector Analysis – a PDF summarizing the long‑term trends in biologics and personalized medicine.

- Renewable Energy Outlook – a webinar recording where an energy analyst discusses the U.S. renewable policy landscape.

These resources help contextualize the stock picks within broader macroeconomic trends and industry dynamics.

Bottom Line

For investors seeking “double‑up” opportunities, The Motley Fool’s 2025 picks present a mix of defensive stability and dynamic upside. By focusing on firms with strong competitive moats, solid cash flows, and well‑timed growth catalysts, the article offers a practical framework to navigate a post‑pandemic economy that still faces uncertainties. Whether you’re a long‑term believer in AI, a fan of renewable energy, or a conservative investor looking for dividend‑paying staples, the article’s portfolio contains options that align with a variety of risk profiles.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/11/22/top-stocks-to-double-up-on-right-now/ ]