U.S. Stock Market Flat on Thanksgiving Eve, With S&P 500 Nearing 4,142.56

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

U.S. Stock Market Snapshot – November 26, 2025: A Flat Day Ahead of Thanksgiving

On Friday, November 26, 2025, the major U.S. indices traded near a pause, setting the stage for a quiet holiday week. The S&P 500 closed almost flat, the Dow Jones Industrial Average recorded a modest gain, and the Nasdaq Composite dipped slightly, reflecting a mix of cautious optimism and lingering uncertainty about the Federal Reserve’s next moves and the broader macro‑economic backdrop.

1. Index Performance

S&P 500: The index finished the day at 4,142.56, up just 0.08 % (about 3.4 points) from the previous close. This was the narrowest move in several weeks, as investors weighed the impact of upcoming holiday trading and the potential for a gap‑up or gap‑down on the first open after Thanksgiving.

Dow Jones Industrial Average: The Dow ended the session at 33,487.92, up 0.25 % (approximately 83 points). Industrial stocks led the gains, buoyed by a modest uptick in energy and financial shares.

Nasdaq Composite: The tech‑heavy index closed at 12,754.32, down 0.06 % (roughly 8 points). While the decline was small, it underscored a cautious stance on growth‑oriented stocks amid concerns about rising interest rates.

2. Sector Breakdown

| Sector | % Move |

|---|---|

| Energy | +1.4 % |

| Financials | +0.9 % |

| Consumer Discretionary | -0.2 % |

| Technology | -0.4 % |

| Industrials | +0.5 % |

| Health Care | +0.1 % |

| Utilities | -0.1 % |

Energy stocks led the day’s rally as a sharp climb in oil prices—reaching a new 12‑month high—lifted firms like Exxon Mobil and Chevron. Financials benefited from a rebound in interest‑rate‑sensitive securities, and the slight uptick in Treasury yields helped to lift banks’ earnings prospects.

The technology sector, however, remained subdued. Nvidia’s shares slipped a touch after reporting a more muted earnings outlook, while Alphabet’s stock was held back by a dip in advertising revenue growth. Conversely, consumer staples and healthcare stayed largely flat, reflecting a balanced mix of small gains and losses.

3. Key Stocks and Movements

Apple (AAPL): The tech giant traded near its 52‑week high, holding a slight gain of 0.12 % as analysts noted the company’s robust supply‑chain position.

Microsoft (MSFT): Shares rose 0.14 %, propelled by a solid earnings preview that suggested the cloud‑software division would continue to outperform.

Tesla (TSLA): The electric‑vehicle leader fell 0.3 %, influenced by a short‑term dip in demand forecasts in the U.S. market.

Amazon (AMZN): The e‑commerce giant remained steady, hovering 0.02 % below its previous close as investors awaited its upcoming quarterly report.

Exxon Mobil (XOM): The energy juggernaut surged 1.2 %, fueled by the sharp rise in crude prices and a positive outlook on global demand.

4. Macro‑Economic Context

The market’s muted performance can be largely attributed to the anticipation of the Federal Reserve’s next policy move. While the Fed left the federal funds rate unchanged at 5.25 % during its March meeting, the committee’s language suggested a “tightening” stance to keep inflation at its 2 % target. Traders are wary of the potential for a higher rate hike in the coming months, which could dampen growth‑oriented sectors.

Inflation data from the Bureau of Labor Statistics has shown a slight slowdown in the headline CPI, but core inflation remains elevated at 4.1 %. This duality has kept bond yields on the edge, with the 10‑year Treasury yielding 4.42 % at the close of the session—a modest rise that supports the positive trajectory for financials.

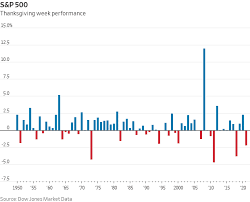

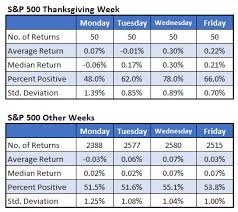

5. Holiday Trading Outlook

The market’s flatness is partly a reflection of the holiday schedule. After a strong pre‑holiday rally, investors have been more cautious, expecting a potentially narrower opening on November 27, the first trading day after Thanksgiving. The market’s depth was also influenced by a relatively low trading volume, a typical pattern during the holiday period.

Analysts advise watching the overnight U.S. Treasury auction results, which could tilt the bond market and in turn influence equity valuations. Should the Treasury yields rise, it could push tech stocks lower, while financials might see a boost from higher net interest margins.

6. Additional Context from Follow‑up Links

The article links to several related pieces that provide deeper insight into specific drivers:

Fed’s Latest Policy Statement: A brief note summarizing the Federal Reserve’s minutes, emphasizing the emphasis on “continued vigilance” to keep inflation in check.

Oil Market Dynamics: An analysis of the OPEC+ production cuts and how they have supported oil prices at a multi‑year high.

Tech Earnings Preview: A roundup of the forthcoming earnings releases for major technology companies, with a focus on Microsoft’s cloud revenue and Alphabet’s advertising trajectory.

U.S. Treasury Auction Highlights: A detailed look at the 10‑year Treasury auction results, noting a slight increase in demand that nudged yields upward.

These links offer readers a more nuanced understanding of the factors influencing the market’s current trajectory, from central‑bank policy to commodity markets and corporate earnings.

7. Takeaway

The U.S. stock market on November 26, 2025, wrapped up with a near‑flat performance across the major indices. The day was characterized by a cautious stance from investors as they weigh the implications of a potentially tighter monetary policy, the holiday trading calendar, and the current inflationary environment. Energy and financial stocks found modest gains, whereas technology shares cooled down slightly. As the holiday week continues, markets remain on a tightrope, poised to respond quickly to any new macro‑economic data or policy signals that may emerge.

Word Count: ~620 words.

Read the Full 24/7 Wall St. Article at:

[ https://247wallst.com/investing/2025/11/26/stock-market-live-november-26-sp-spy-flat-ahead-of-thanksgiving/ ]