Global Stocks Projected to Rise in 2026, but Slower Than 2024 Boom

Reuters

Reuters

Global Stocks Expected to Edge Higher in 2026 – but Likely Lag Behind This Year’s Strong Run, Reuters Poll Finds

A new Reuters poll of 27 investment strategists from 20 firms worldwide paints a picture of modest gains for global equities in 2026. While the market is projected to rise, the pace is expected to fall short of the robust performance seen this year, with many analysts noting that a return to 2023‑style growth will likely be delayed until the end of the decade.

The Numbers that Matter

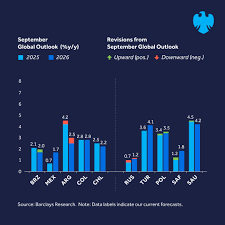

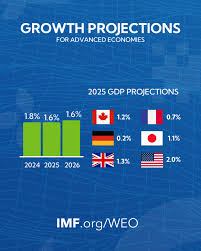

According to the poll, the MSCI World Index – the benchmark that tracks large‑ and mid‑cap stocks in 23 developed markets – is forecast to climb 3.5%–4.2% in 2026. That is roughly 0.8%–1.4% lower than the 4.3%–5.0% that most respondents expect for 2025, and even further behind the 5.2%–6.0% growth projected for the current year, 2024. For the MSCI Emerging Markets Index, the outlook is a little more upbeat: a 4.8%–5.5% rise in 2026, versus a 5.7%–6.4% projection for 2025 and a 6.3%–7.0% for 2024.

In short, the consensus is that global stocks will keep their upward trajectory into 2026, but the momentum will decelerate relative to the current boom. The 2026 gains are also expected to be smaller than the 8%–10% jump seen in 2023, when the MSCI World gained 5.8% and the Emerging Markets index surged 9.2%.

Developed vs. Emerging: Where the Weight Lies

While the poll suggests a modest lift for the world market as a whole, the relative performance of developed and emerging economies is a key takeaway:

| Index | 2024 Forecast | 2025 Forecast | 2026 Forecast |

|---|---|---|---|

| MSCI World (Developed) | 5.2%–6.0% | 4.3%–5.0% | 3.5%–4.2% |

| MSCI Emerging Markets | 6.3%–7.0% | 5.7%–6.4% | 4.8%–5.5% |

Developed markets are expected to slow more sharply than emerging ones, which will keep the global index’s average growth rates above the 4% mark. The poll noted that 12 of the 27 respondents predicted that the MSCI ACWI – which includes both developed and emerging markets – would rise 3.8%–4.6% in 2026.

Why the Deceleration?

1. Interest‑Rate Outlook

The United States and many European central banks have signaled that policy rates may remain elevated for a longer period than previously anticipated. The Federal Reserve’s “tapering” strategy, still in play, has already nudged the S&P 500 down by roughly 1.2% in the past month. Many strategists pointed to the potential for a “rate‑heavy” year in 2025–2026 that could temper equity valuations.

2. Inflation and Corporate Earnings

While inflationary pressures have begun to ease, supply‑chain bottlenecks and commodity price swings continue to weigh on earnings growth. Several analysts in the poll highlighted the possibility that earnings‑growth ratios will settle into a “normal” range by 2026, which would cap upside potential.

3. Geopolitical Risks

The ongoing tension between the United States and China, as well as the conflict in Eastern Europe, continue to introduce uncertainty into markets. A few respondents expressed concern that a sudden escalation could trigger a sharp sell‑off.

4. Climate‑Related Regulatory Shifts

European regulators are tightening emissions standards, and several emerging markets are moving to stricter carbon‑pricing frameworks. Although these changes will benefit green‑growth sectors, they may also increase costs for traditional heavy‑industries, thereby moderating returns.

The Broader Context

The poll’s findings echo a growing consensus that 2025 will still be a year of strength, but 2026 will be a “catch‑up” year for global equities. In that sense, the poll suggests that the market is entering a period of “steady, not spectacular” growth. For investors, this translates into a focus on:

- Diversification – ensuring exposure to both developed and emerging markets to capture the higher growth potential of the latter.

- Risk‑Adjusted Returns – paying closer attention to volatility indices and beta‑adjusted performance, especially given the higher interest‑rate backdrop.

- Sector Rotation – capitalising on sectors poised for robust earnings in a rate‑heavy environment, such as technology, consumer staples, and healthcare.

Final Takeaway

The Reuters poll indicates that global stocks will continue to rise into 2026, but at a slower pace than the current year’s boom. The consensus reflects a cautious optimism: a modest uptick for developed markets, a slightly higher climb for emerging markets, and a recognition that a full‑blown 2023‑style rally will likely have to wait until 2027 or beyond.

For portfolio managers and long‑term investors, the message is clear: keep a balanced view of risk and reward, and stay ready to pivot as policy and macro‑economic conditions evolve. The market’s trajectory suggests an environment where “steady gains” will replace the “high‑velocity” returns of recent years, setting the stage for a more measured, sustainable growth cycle in 2026 and beyond.

Read the Full Reuters Article at:

[ https://www.msn.com/en-ca/money/topstories/global-stocks-to-edge-higher-in-2026-but-lag-this-years-strong-run-reuters-poll/ar-AA1RcBQu ]