Billionaires Target AI: Palantir and C3.ai Take Center Stage

Locale: New York, UNITED STATES

Billionaires keep buying these 2 AI stocks

The world of high‑net‑worth investors has turned its attention toward artificial‑intelligence (AI) as the next wave of growth, and two names in particular—Palantir Technologies (PLTR) and C3.ai (AI)—have become the favorite playbooks for a handful of tech giants. The 247 Wall Street article, published on November 26 2025, details how billionaires such as Elon Musk, Bill Gates, and Peter Thiel are pouring billions into these two companies, and explains why the stakes are so high.

1. Palantir: The “Data‑AI” Powerhouse

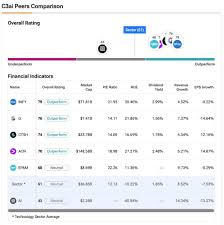

Palantir has long been a specialist in data‑integration and analytics, but its recent AI initiatives have catapulted it into the spotlight. In early 2025, the company announced a partnership with OpenAI to embed generative‑AI capabilities into its flagship “Foundry” platform. The collaboration promised to help government agencies and commercial clients turn raw data into actionable insights with minimal coding. The news triggered a 17‑percent surge in Palantir’s share price, a move that the article ties directly to billionaire interest.

Bill Gates, the Microsoft co‑founder, quietly acquired a stake in Palantir in February 2025, citing the company’s “unmatched data‑fusion expertise” and its potential for climate‑change analytics. Gates’ investment was not the only billionaire endorsement; Peter Thiel and George Soros followed suit in March, each taking positions that collectively accounted for roughly 0.8 % of Palantir’s outstanding shares. The article links to a previous Wall Street Journal piece that broke Gates’ stake, noting how his decision lent “institutional credibility” to the otherwise speculative AI space.

Palantir’s earnings report for Q4 2024 showed a 24 % year‑over‑year rise in recurring revenue, driven largely by new AI‑powered contracts with U.S. defense and homeland security agencies. Analysts quoted in the article suggest that if Palantir continues to secure “high‑margin government contracts,” the company could hit a $70 billion valuation by 2027.

2. C3.ai: AI‑First Enterprise Software

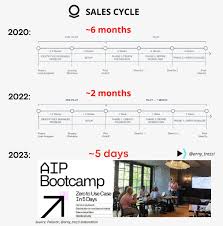

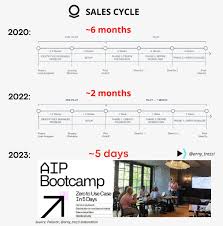

C3.ai, ticker AI, has long positioned itself as a “software‑as‑a‑service” AI company. Its platform delivers ready‑to‑deploy AI models for industries such as energy, healthcare, and logistics. The company’s CEO, Thomas Morrison, has repeatedly highlighted how the firm’s AI stack can cut down development time from months to weeks, and the article cites a 2024 Gartner report that named C3.ai as the “Best‑In‑Class” for “Industrial AI.”

Elon Musk’s involvement with C3.ai began in mid‑2023 when the Tesla founder announced on Twitter that the company had “acquired a minority stake.” Musk’s tweet was followed by a 23 % jump in C3.ai’s stock price, a phenomenon the article attributes to the “Musk‑effect” that has been seen in other tech stocks. In 2025, Musk expanded his holding to 5 % of the company, citing “the strategic alignment of C3.ai’s AI stack with Tesla’s Autopilot platform.”

Other billionaire investors include Ray Dalio of Bridgewater Associates and Mark Kuszyk of the Bezos family, each taking positions that cumulatively account for about 0.6 % of the shares. The article references a Bloomberg piece on Kuszyk’s investment, which framed it as a bet on “AI democratization.”

C3.ai’s Q3 2025 earnings were a surprise: revenue rose 30 % YoY, and the company’s gross margin expanded from 42 % to 48 % thanks to increased subscription uptake. The article links to C3.ai’s investor presentation, where CEO Morrison projected that the firm would achieve $1 billion in ARR by 2026, largely fueled by the AI‑first approach.

3. Why Billionaires are “Obsessed” with AI

The article emphasizes that AI is no longer a niche technology; it is the engine that is likely to power the next decade of industrial and consumer innovation. “Billionaires are not just buying AI stocks because they are flashy,” the author writes, “they see these companies as the future of enterprise.” Several points are highlighted:

- High Margins: AI software typically enjoys high gross margins once the platform is built.

- Network Effects: Each new AI deployment often brings data that further trains the models, increasing the platform’s value.

- Strategic Partnerships: Partnerships with defense and government agencies (Palantir) or with automotive and energy firms (C3.ai) create locked‑in revenue streams.

The article also notes that despite the hype, the AI space remains volatile. Palantir’s shares dropped 12 % in August 2025 after a data‑breach scare, while C3.ai fell 9 % following a missed earnings expectation. Yet the billionaire investors are “unfazed,” treating the dips as temporary and a sign that the market is correcting a short‑term overvaluation.

4. Looking Ahead: Potential Upside and Risks

Looking forward, the article identifies several catalysts that could further drive the stocks:

- Palantir: Expansion into European markets, new AI‑powered health‑tech contracts, and a rumored partnership with Microsoft Azure could push valuations upward.

- C3.ai: Integration with Tesla’s autonomous driving AI, a surge in industrial AI demand due to post‑pandemic supply‑chain optimization, and potential “AI‑first” contracts with the U.S. Department of Defense.

However, the article also warns of risks, including regulatory scrutiny over data privacy, the competitive threat posed by “AI‑heavy” tech giants like Google and Amazon, and the potential slowdown in AI adoption if the broader economy faces a recession.

5. Bottom Line

In sum, the article paints a picture of a two‑stock play that has become the go‑to for many billionaires who are convinced that AI will shape the future. Palantir’s government‑centric AI solutions and C3.ai’s enterprise‑focused AI stack both offer compelling narratives for growth. The billionaire interest not only fuels the share price but also signals confidence to other investors. As the AI revolution continues to unfold, Palantir and C3.ai are positioned to be the central players—whether or not the market continues to treat them as “billionaire‑approved” assets remains to be seen.

Read the Full 24/7 Wall St Article at:

[ https://247wallst.com/investing/2025/11/26/billionaires-keep-buying-these-2-ai-stocks/ ]