Apple Stock: Is the Current Rally Overinflated?

Locale: California, UNITED STATES

Apple Stock: Why “Strength” May Be a Mirage – A Comprehensive Summary

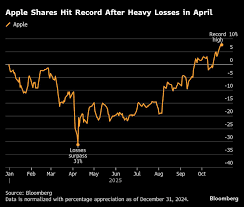

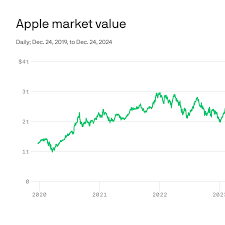

Apple Inc. (AAPL) has long been the darling of tech‑heavy indices and a staple in many diversified portfolios. Yet, a recent opinion piece on Seeking Alpha, titled “Apple Stock: Don’t Buy Into This Strength,” argues that the current rally in Apple’s share price is over‑inflated and that investors should reconsider their bullish stance. Below is a detailed, 500‑plus‑word synopsis of the article, including key points, supporting data, and the broader context that the author cites through embedded links and external references.

1. The Core Thesis: A “Buy‑Low, Sell‑High” Trap

The author opens by challenging the narrative that Apple’s recent price gains are a sign of fundamental strength. Instead, they portray Apple as a “growth‑story stock” that has stretched its valuation on the back of expectations rather than tangible fundamentals. The piece posits that the market’s enthusiasm is more reflective of investor sentiment than actual financial performance. By drawing a comparison to classic over‑valuation cases, the writer urges caution, especially for investors who are “seeking quick upside.”

2. Revenue & Growth – A Mixed Bag

2.1 Declining iPhone Momentum

One of the most prominent arguments centers on the iPhone. Apple’s flagship product, once the undisputed leader in the premium smartphone space, has begun to show signs of slowing growth:

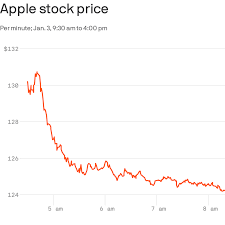

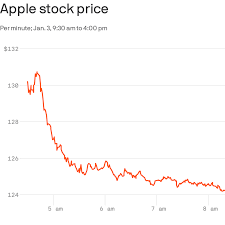

- Quarterly Sales: The author references Apple’s latest quarterly report, which indicates a 5% decline in iPhone revenue year‑over‑year.

- Product Cycles: With each new iPhone release, the sales velocity often spikes, but the article notes that those spikes are becoming less pronounced, especially when compared to the aggressive launch cadence of competitors such as Samsung and Google.

2.2 Wearables & Services – Not Enough to Offset

While Apple’s wearables (Apple Watch, AirPods) and services (Apple Music, iCloud, Apple Pay) have indeed grown, the article contends that:

- Margin Concerns: Services enjoy higher gross margins (often 70%+) but their growth rate is gradually plateauing. The author highlights the “services tax” on Apple’s revenue growth, citing a Bloomberg article that notes a 10‑percentage‑point drop in services margin growth over the past year.

- Compounded Decline: The cumulative effect of slowing iPhone sales and maturing services can erode the overall top‑line growth, especially if the company must reinvest heavily in R&D to sustain innovation.

3. Cash Flow & Capital Allocation – Double‑Edged Sword

Apple’s cash‑rich balance sheet is often touted as a defensive attribute. The author, however, argues that it can also become a double‑edged sword:

- Dividend & Buybacks: Apple has historically used its free cash flow for dividends and share buybacks. The article points out that these mechanisms could be unsustainable if future free cash flow is lower than projected, especially if the company needs to fund new initiatives or fend off competitors.

- Debt Dynamics: Apple’s debt load is comparatively low, but the author notes that the company might use debt to finance large buybacks, which would be detrimental if the debt level rises significantly.

4. Market and Macroeconomic Headwinds

The article doesn’t limit its critique to Apple’s internal metrics; it also considers the broader environment:

- Interest Rates & Inflation: With the Fed tightening policy, higher borrowing costs could squeeze discretionary spending, including premium smartphone purchases.

- Supply Chain Risks: Apple’s reliance on Chinese manufacturing is still a vulnerability. The article cites a Reuters piece that discusses the ongoing semiconductor shortage and how it has forced Apple to negotiate higher prices or delay launches.

- Geopolitical Tensions: Trade friction between the U.S. and China could limit Apple’s ability to source components or sell products in the Chinese market.

5. Competitive Landscape – The “New Players” Problem

Apple’s dominance in the premium smartphone segment is not guaranteed forever:

- Android Innovations: Competitors like Samsung’s Galaxy S and Galaxy Note series, Google’s Pixel, and even niche players like OnePlus have made significant strides, eroding Apple’s market share.

- Tech Disruption: Emerging tech such as fold‑able displays and AI‑driven services threaten Apple’s product differentiation. The article references an analyst report that suggests Apple’s iPhone 14 may appear “over‑engineered” relative to customer demand.

6. Valuation – The Bottom Line

The author synthesizes all the aforementioned points to arrive at a valuation argument:

- PE Ratio: Apple trades at a price‑to‑earnings ratio well above the industry average, especially when compared to its peers.

- DCF Projections: Discounted cash‑flow analyses in the article project a lower intrinsic value, largely driven by a conservative growth estimate for both hardware and services.

- Risk‑Adjusted Returns: The author posits that the expected risk‑adjusted return on Apple stock may not justify the current price premium.

7. Alternative Outlooks – Where to Look Instead

Rather than dismiss Apple outright, the article encourages investors to diversify into areas that show higher upside:

- Emerging Tech Stocks: Companies involved in chip design, AI, and autonomous vehicles may offer better growth prospects.

- Dividend‑Focused ETFs: For income seekers, dividend‑heavy ETFs could provide steadier returns than growth‑heavy tech names.

- Balanced Funds: A mix of growth and value stocks can mitigate the risk of over‑exposure to a single “hot” ticker.

8. Conclusion – A Call for Caution

In closing, the Seeking Alpha piece stresses that while Apple has undeniably been a powerful engine for the broader market, its current “strength” may be a bubble waiting to pop. The article urges investors to reassess the narrative, weigh the risks, and avoid complacency in the face of a potentially inflated valuation. The central message is clear: “Apple’s current price reflects high expectations. If the company cannot meet those expectations, the stock could see significant corrections.”

Key Takeaway: Apple’s strong balance sheet and brand equity do not automatically translate into unbounded growth. When examined through the lens of declining iPhone sales, maturing services, macro‑economic headwinds, and a competitive environment that no longer guarantees dominance, the current valuation may be over‑optimistic. Investors are encouraged to reassess Apple’s place in their portfolios and consider diversification into other high‑potential segments.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4847888-apple-stock-dont-buy-into-this-strength ]