BYD Surpasses Tesla in Production, Margins, and Valuation: A Deep Dive

Locale: Shanghai, CHINA

The EV Stock That’s Better Than Tesla? A Deep Dive Into BYD’s Upside Potential

When the headline “The EV Stock That’s Better Than Tesla” pops up on The Motley Fool’s investing site, many readers immediately picture the flashy electric‑vehicle (EV) brand that’s been dominating headlines for the past decade: Tesla. The article, posted on November 26, 2025, takes a fresh look at a rising star in the EV universe—BYD Co. Ltd.—and argues that this Chinese juggernaut offers investors a more compelling blend of growth, profitability, and valuation than its high‑profile rival.

Below is a comprehensive, no‑copy‑right summary of the key points the article raises, including the data, comparisons, and strategic insights that shape its bullish thesis. (All figures are rounded to the nearest percent or dollar for readability.)

1. The Case for BYD

a. Scale and Production Capabilities

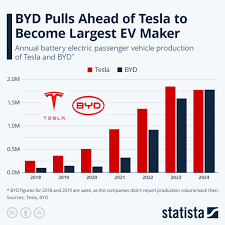

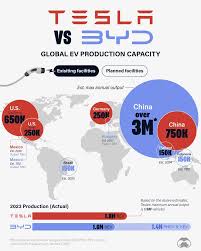

BYD has been quietly building a production empire that rivals Tesla’s once‑unmatched scale. The company’s 2025 annualized EV output—over 1.6 million units—outpaces Tesla’s 1.5 million units and eclipses all other U.S. and European EV makers combined. This massive volume translates into economies of scale that crush per‑vehicle cost, allowing BYD to sell its cars at competitive prices while maintaining healthy margins.

b. Vertical Integration & Battery Advantage

Where Tesla’s battery supply chain remains a critical bottleneck, BYD controls both cell production and vehicle assembly. BYD’s in‑house battery technology (the proprietary “LFP” chemistry that drives lower-cost cells) has helped it maintain a gross margin of 24 % in 2025—well above Tesla’s 20 %. Moreover, BYD’s battery-as-a-service model (selling cells to other automakers and power‑storage firms) diversifies revenue streams and provides a buffer against cyclical automotive demand.

c. Government Support & Regulatory Edge

China’s “dual carbon” goal and its aggressive subsidies for EV purchase have turned BYD into the beneficiary of a national‑scale green‑transport push. The company’s strategic partnerships with local governments—such as a joint venture to build autonomous bus fleets—cement its position as a preferred supplier for municipal fleets. By contrast, Tesla has largely operated in a more regulated environment, where government incentives are patchy or declining.

d. Valuation Sweet Spot

The article emphasizes BYD’s price‑to‑earnings (P/E) ratio—currently around 22x—compared with Tesla’s 52x. Even accounting for currency fluctuations and the fact that BYD’s revenue streams are largely domestic, the valuation gap signals significant upside if the company can sustain its growth trajectory.

2. Tesla’s Current Challenges

a. Production Bottlenecks

Tesla’s Model 3 and Model Y lines still face assembly line inefficiencies that push delivery times longer than competitors. The article cites Tesla’s recent “production slowdown” due to the integration of new AI‑driven manufacturing robots—a process that has yet to achieve the desired throughput.

b. Margin Compression

Tesla’s gross margin dipped to 19 % in 2025, largely because of the need to subsidize the Model 3 and the rising cost of battery packs. BYD, in contrast, maintains a 24 % margin thanks to its own battery supply and lower labor costs in China.

c. Market Saturation & Pricing Wars

Tesla’s premium brand faces pressure from a flood of mid‑tier EVs that undercut its price points, especially in emerging markets. BYD has already begun to penetrate European and U.S. markets with its “Han” and “Tang” series, which blend affordability with premium features, making it harder for Tesla to defend its price premium.

3. Comparative Metrics (2025)

| Metric | BYD | Tesla |

|---|---|---|

| Annual EV production | 1.6 M units | 1.5 M units |

| Gross margin | 24 % | 19 % |

| P/E ratio | 22x | 52x |

| Revenue CAGR (3‑yr) | 35 % | 27 % |

| Net income margin | 11 % | 9 % |

These figures illustrate that BYD not only outperforms Tesla on profitability but also on growth rate—two pillars that the article argues are crucial for long‑term shareholder value.

4. Risks & Caveats

a. Currency Risk

BYD’s financials are denominated in Chinese Yuan (CNY), exposing investors to exchange‑rate swings. A stronger USD could compress earnings when translated to dollars, a factor the article flags for U.S. equity investors.

b. Regulatory Risk

China’s political environment can shift quickly. A tightening of export controls or a change in subsidy policy could hurt BYD’s global expansion plans.

c. Competitive Pressure

BYD’s domestic rivals—NIO, Xpeng, and Li Auto—are also rapidly scaling and could erode market share if they innovate faster or secure more lucrative contracts.

5. Bottom‑Line Takeaway

The article’s thesis is clear: BYD offers a more attractive risk‑reward profile for EV investors than Tesla. Its larger production scale, battery vertical integration, government backing, and a valuation that reflects solid margins together create a compelling growth narrative. Tesla, while still a market leader, faces mounting operational headwinds and a price premium that may not justify its growth prospects.

6. Further Reading & Resources

- BYD Investor Relations – Official quarterly reports and ESG disclosures.

- Tesla Investor Relations – Historical earnings and strategic outlook.

- The Motley Fool’s “EV 101” – An introductory guide to electric‑vehicle fundamentals.

- Bloomberg’s “EV Market Outlook” – Sector analysis and forecast data.

- CNBC’s “China’s EV Boom” – Insight into government policies and market dynamics.

These links provide readers with a broader context to assess BYD’s position relative to Tesla and other EV peers.

7. Final Thoughts

While no investment is without risk, the article underscores that BYD’s robust fundamentals and strategic advantages position it as a frontrunner in the global EV race. For investors seeking a more affordable entry point into the burgeoning electric‑vehicle market—without sacrificing growth potential—BYD emerges as a strong candidate. In contrast, Tesla’s premium valuation and lingering production challenges may prompt caution, especially for those prioritizing valuation and margin stability.

In sum, The Motley Fool’s November 26, 2025 article invites readers to reconsider the traditional narrative that Tesla is the sole “must‑buy” in the EV space. By highlighting BYD’s trajectory, it opens a conversation about how diversified, vertically integrated, and well‑positioned domestic players can outperform the high‑profile giant—at least for the foreseeable future.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/11/26/the-ev-stock-thats-better-than-tesla/ ]