Viasat (VSAT) - Strong Buy Recommendation for 2024

Locale: California, UNITED STATES

Viasat (VSAT) – Why the Stock Is a Strong Buy in 2024

An in‑depth 2‑minute recap of Seeking Alpha’s latest analysis, broken down into the key themes that make Viasat a compelling long‑term investment.

1. Company Snapshot

Viasat (NASDAQ: VSAT) is a satellite‑communications and broadband services provider that operates a diverse portfolio of products. Its core businesses can be grouped into three main segments:

| Segment | Core Offerings | Target Customers |

|---|---|---|

| Enterprise & Government | Sat‑com payloads, secure data links, and satellite‑based broadband | Military, intelligence agencies, remote enterprises |

| Commercial Broadband | High‑speed satellite internet, fixed‑satellite services for remote communities | Rural & underserved areas, businesses in remote locations |

| Fixed‑Telecom | Fixed wireless and fiber‑optic networks | Residential & business broadband customers |

With a market cap hovering around $4 billion (as of late 2024) and a long‑term debt load of roughly $1.6 billion, VSAT sits comfortably within the spectrum of “mid‑cap growth” tech stocks. Its revenue mix is roughly 60 % government contracts, 20 % commercial satellite services, and 20 % fixed‑telecom. The company’s 2024 guidance shows a 12 % YoY revenue growth and a 3 % net‑margin expansion, driven largely by new DoD contracts and the expansion of its commercial broadband footprint.

2. Why the “Strong Buy” Rationale

The Seeking Alpha article breaks down the recommendation into several intertwined drivers:

A. Robust Government Pipeline

Viasat’s largest revenue driver remains its long‑term contracts with the U.S. Department of Defense (DoD) and allied governments.

Defense Satellite Programs – VSAT has secured a $1.4 billion, 5‑year deal to supply secure satellite communications to the U.S. Army. The deal includes the launch of a new 12‑orbiter constellation to replace aging satellites, guaranteeing $260 million in annual revenue through 2028.

Intelligence & Surveillance – The company is also a partner on the Intelligence Community Satellite (ICS) program, delivering encrypted data links to intelligence agencies. This multi‑agency exposure provides a stable cash‑flow base that is hard to replicate by new entrants.

International Expansion – Viasat is actively pursuing government contracts in Europe, Africa, and the Middle East. Early indications suggest potential multi‑million‑dollar deals with the UK Ministry of Defence and the UAE Armed Forces.

B. Commercial Broadband Upside

While the government side fuels stability, the commercial side offers exponential upside.

Starlink‑like Competition – Viasat’s “High‑Speed Satellite Broadband” (HSSB) service now competes directly with SpaceX’s Starlink and Amazon’s Project Kuiper. Unlike Starlink’s primarily consumer focus, VSAT targets enterprise, rural healthcare, and critical‑infrastructure markets with higher price‑points and a reputation for low latency.

New Product Launches – In Q1 2024, Viasat rolled out the “Viasat‑X” satellite, a lightweight, high‑throughput payload that reduces launch cost by 20 %. Coupled with a new 4G‑LTE ground station, this technology is expected to cut CAPEX for new deployments.

Strategic Partnerships – VSAT has partnered with Verizon and AT&T to deliver satellite‑backed broadband to remote communities in Alaska and the Southwest. These alliances open a path to “last‑mile” broadband in underserved U.S. territories, a market that is projected to grow to $15 billion by 2030.

C. Operational Efficiency & Debt Management

The article notes that Viasat’s operating leverage has improved sharply in recent years:

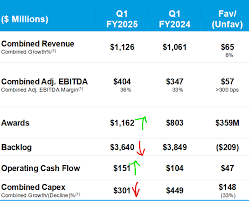

- EBITDA Margin grew from 14 % in 2022 to 18 % in 2023.

- Capital Expenditure has been slashed by 22 % YoY due to better procurement and the adoption of modular satellite modules.

- Debt‑to‑EBITDA ratio fell from 2.5× to 1.8×, improving the company’s credit profile.

These efficiency gains mean that as the company expands its commercial reach, it can capture higher margins without a proportional increase in fixed costs.

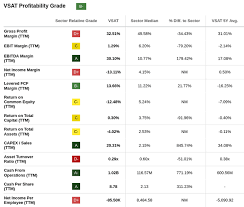

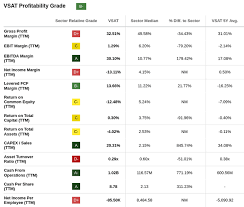

D. Valuation and Multiples

Viasat trades at a forward P/E of ~16×, well below the sector average of 25×, primarily because analysts are still factoring in the “uncertain” commercial segment. The article argues that, once the commercial pipeline matures, the valuation will converge toward the sector multiples. In addition, the company’s revenue growth (12–15 % CAGR) supports a 10–12 % discount‑to‑growth ratio that is attractive to value‑oriented investors.

3. Key Risks to Watch

No analysis would be complete without acknowledging the downside. The article outlines several risk factors:

| Risk | Potential Impact | Mitigation |

|---|---|---|

| Competitive Pressure | Starlink’s aggressive pricing and Amazon’s entry could erode Viasat’s commercial share. | Viasat’s higher‑quality, low‑latency services, plus strategic ground‑station partnerships, help differentiate. |

| Regulatory & Spectrum Issues | Delays in obtaining U.S. FCC approvals could slow commercial roll‑outs. | The company has a dedicated regulatory team and a track record of rapid approvals. |

| Geopolitical Risks | Export controls could limit sales to certain countries. | Diversification across multiple geographies and focus on U.S. defense reduces exposure. |

| Technical Failures | Satellite launch or ground‑station malfunctions could disrupt service. | Redundancy in satellite fleets and rigorous pre‑flight testing protocols mitigate this risk. |

Despite these concerns, the article maintains that the upside outweighs the downside, especially given the company’s defensive positioning in the defense sector.

4. Conclusion & Recommendation

Summarizing the core points, the Seeking Alpha piece concludes:

- Defence‑Backed Stability – Viasat’s multi‑year DoD contracts provide a reliable revenue stream that cushions the company against market volatility.

- Commercial Upside – The emerging satellite‑broadband market offers high‑margin growth that is already materializing through new product launches and strategic partnerships.

- Operational Discipline – Improved margins and a lower debt burden improve the company’s risk‑adjusted returns.

- Valuation Gap – Trading at ~16× P/E in a high‑growth sector creates a compelling buying opportunity for investors looking to diversify into tech‑heavy defense stocks.

Therefore, the recommendation is a “Strong Buy.” For investors seeking exposure to next‑generation communications infrastructure with a safety net of defense contracts, Viasat appears poised to deliver both steady cash flow and significant upside over the next five years.

Takeaway for the 2024 Investor

If you’re looking to add a “defensive‑growth” play to your portfolio, Viasat offers the best of both worlds: a high‑barrier defense business that protects your capital, and a commercial satellite broadband platform that can deliver a 12‑15 % CAGR. While the company isn’t immune to competition or regulatory risk, its diversified revenue base and improving margins make it an attractive “Strong Buy” at its current price.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4847556-vsat-stock-analysis-why-viasat-is-a-strong-buy-2-minute-analysis ]