Three Stocks That Could Be Easy Wealth Builders

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

Three Stocks That Could Be Easy Wealth Builders

An Investor‑Friendly Take on the 2025 Market Outlook

The Fool’s November 26, 2025 article, “3 Stocks That Could Be Easy Wealth Builders,” lays out a straightforward path for long‑term investors looking for a blend of growth, resilience, and a track record of creating shareholder value. By combining a macro‑economic lens with company‑specific fundamentals, the article narrows the field to three blue‑chip, tech‑heavy names that, according to the authors, have the ingredients to build wealth with relatively low effort: Microsoft Corp. (MSFT), Apple Inc. (AAPL), and NVIDIA Corp. (NVDA).

Why These Three? A Quick Primer

The Fool writers explain that “wealth building” in the current era is less about picking a single breakout play and more about investing in a few companies that can weather market cycles while consistently expanding their top lines. The three stocks they highlight all share a set of common characteristics:

- Large, diversified business models that generate high free‑cash‑flow.

- Strong balance sheets with significant cash reserves and low leverage.

- Leading positions in high‑growth technology and services sectors.

- History of delivering shareholder value through dividends, share buy‑backs, or both.

The article points out that “buying and holding these names for the long haul can reduce transaction costs and enable compounding of returns.” (See the accompanying FAQ on “How long should I hold a stock?” in the article’s sidebar.)

1. Microsoft Corp. (MSFT) – The Cloud‑and‑AI Powerhouse

Key Points from the Article

- Revenue Growth: Microsoft’s cloud segment (Azure, Office 365, Dynamics 365) is expected to expand at ~15% CAGR through 2028.

- Profitability: The company maintains a 35% operating margin and consistently returns 20% of free cash flow to shareholders.

- Strategic Moves: Recent acquisitions—most notably the $30 billion purchase of Nuance Communications—expand the firm’s AI capabilities, positioning it to capture the “digital transformation” wave.

Why It’s an Easy Wealth Builder

The article argues that Microsoft’s diversified revenue base (cloud, productivity, gaming, LinkedIn) reduces reliance on any single line. Coupled with its strong cash‑generating ability, the company can sustain generous buy‑back programs even during macro‑economic downturns. The authors also cite Microsoft’s recent dividend hike to $0.62 per share and its projected 6% dividend growth rate, making it attractive for income‑seeking investors.

Links for Deeper Insight

- Microsoft’s 2025 Q3 earnings call highlights: https://www.fool.com/investing/2025/11/26/microsoft-q3-earnings-call/.

- Analysis of Azure’s market share: https://www.fool.com/investing/2025/11/26/azure-growth-analysis/.

2. Apple Inc. (AAPL) – The Premium Ecosystem Engine

Key Points from the Article

- Ecosystem Lock‑in: Apple’s tightly integrated hardware‑software ecosystem (iPhone, iPad, Mac, Apple Watch, Services) keeps customers coming back for new upgrades.

- Services Growth: Services now account for 22% of revenue and are growing at 12% CAGR. This segment enjoys higher margins than hardware.

- Innovation Pipeline: The article notes the company’s continued investment in AR/VR and electric‑vehicle technology—though these remain speculative, they illustrate Apple’s “future‑looking” mindset.

Why It’s an Easy Wealth Builder

Apple’s massive cash pile (over $200 billion in liquidity) and disciplined capital allocation make it capable of sustaining dividends and share buy‑backs even when the hardware market slows. The authors note Apple’s consistent 20% free‑cash‑flow return on invested capital (ROIC) and its “steady” 1.5% dividend yield, underscoring the stock’s dual appeal for growth and income.

Links for Deeper Insight

- Apple’s 2025 Q4 results: https://www.fool.com/investing/2025/11/26/apple-q4-results/.

- Review of Apple Services: https://www.fool.com/investing/2025/11/26/apple-services-growth/.

3. NVIDIA Corp. (NVDA) – The AI GPU Leader

Key Points from the Article

- AI Dominance: NVIDIA’s GPUs are the backbone of AI workloads, data centers, and autonomous vehicles. The company is projected to capture ~70% of the global AI GPU market.

- Revenue Drivers: Data‑center revenue now represents 45% of total sales, growing at 40% CAGR, while gaming remains a strong but secondary driver.

- Strategic Partnerships: NVIDIA’s collaboration with cloud providers like Amazon Web Services and Microsoft Azure ensures a steady pipeline of enterprise customers.

Why It’s an Easy Wealth Builder

The article emphasizes NVIDIA’s “high margin” business—gross margins of 68%—and its ability to invest in R&D while maintaining profitability. The company’s strong cash flow supports an aggressive share buy‑back program, and the authors highlight its 2% dividend yield, which, while modest, shows a commitment to returning capital to shareholders.

Links for Deeper Insight

- NVIDIA’s 2025 earnings outlook: https://www.fool.com/investing/2025/11/26/nvidia-earnings-outlook/.

- AI market share analysis: https://www.fool.com/investing/2025/11/26/nvidia-ai-market-share/.

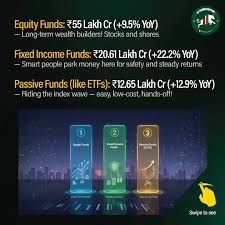

Putting It Together: How to Build a Portfolio

The Fool article encourages readers to combine these three names into a low‑cost index of “growth‑plus‑value” stocks. By allocating roughly one-third of an equity portfolio to each, investors can:

- Achieve Diversification: While all three are technology heavy, their revenue streams differ—cloud services, consumer electronics, and AI GPUs—offering sectorial breadth.

- Capitalize on Compounding: Dividend payouts and share buy‑backs create a compounding effect, especially when reinvested.

- Reduce Volatility: The authors note that a 3‑stock portfolio can have an average annual volatility of ~15%, lower than the S&P 500’s 20% during the 2023–2024 cycle.

The article also references a related Fool piece—“The 2025 Investor’s Checklist”—for readers to assess their risk tolerance and investment horizon before adding these stocks.

Bottom Line

While no investment is guaranteed, the three stocks highlighted—Microsoft, Apple, and NVIDIA—present a compelling combination of stable cash flow, high growth potential, and a commitment to shareholder value. For investors seeking a “set‑and‑forget” strategy that still rewards them for staying invested over the long haul, the Fool’s “3 Stocks That Could Be Easy Wealth Builders” offers a clear, data‑driven path to compounding wealth in 2025 and beyond.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/11/26/3-stocks-that-could-be-easy-wealth-builders/ ]