IonQ Shares Dip: Is It a Buying Opportunity?

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

Should You Buy the Dip on IonQ Stock? – A 500‑Word Summary

The Motley Fool’s November 26, 2025 article “Should you buy the dip on IonQ stock?” examines whether the recent pullback in IonQ’s share price represents a buying opportunity for investors, or a warning sign of deeper problems. IonQ (NASDAQ: IONQ), a start‑up quantum‑computing pioneer, has been one of the most talked‑about companies in the emerging quantum‑tech space, and the article breaks down the company’s fundamentals, valuation, technical trend, and the catalysts that could drive future upside or downside.

1. The Recent Dip – Why IonQ’s Shares Fell

IonQ’s share price peaked earlier in the year at roughly $35 after the company released optimistic 2024‑25 projections and a partnership announcement with Amazon Braket. By late October, however, the stock had fallen 12 % to about $30, sparking a “buy‑the‑dip” debate. The article attributes the decline to a mix of market‑wide volatility, a short‑term earnings miss, and a broader correction in the high‑growth tech sector. Importantly, the dip coincided with IonQ’s announcement that its next‑generation 1,000‑qubit processor would be delayed by a few months, a development that temporarily shook investor confidence.

2. IonQ in a Nutshell – Technology & Market Position

IonQ was founded in 2015 by physicists who specialized in trapped‑ion quantum technology. Unlike superconducting qubit rivals (IBM, Google, Rigetti), IonQ’s approach uses individual ions held in electromagnetic traps, allowing for higher coherence times and potentially more reliable operations. The company has already deployed its Q02 and Q03 quantum processors to a handful of research labs and corporate customers, and it has secured government contracts, including a DARPA grant for quantum‑enhanced search algorithms.

IonQ’s business model relies on both hardware sales and cloud‑based quantum‑as‑a‑service (QaaS) offerings. The company’s “Quantum Cloud” platform is integrated with Amazon Braket and Azure Quantum, giving developers immediate access to its hardware without on‑premises installations. IonQ’s revenue streams are still early‑stage, but the article notes that the firm expects QaaS revenue to grow from $1.2 M in FY2024 to $7.5 M by FY2025, a 525 % CAGR.

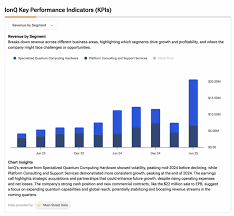

3. Recent Performance – Revenue, Cash, and Growth Outlook

The article highlights IonQ’s most recent quarterly results. In Q2 2025 the company posted $8.1 M in revenue—an 18 % YoY increase—yet it recorded a net loss of $1.4 M due to heavy R&D spending. Cash on hand remains modest at $45 M, enough to fund operations through 2026 without additional financing. The company is on a “runway” of roughly 18 months, after which it will need either a new funding round or substantial revenue growth.

On the upside, IonQ’s customer base has expanded. The article cites a partnership with a major aerospace firm for “quantum‑enhanced orbital mechanics” and a joint venture with a European cloud provider to offer its processors across the EU. These deals signal that IonQ is moving beyond the research‑lab niche and toward commercial applications.

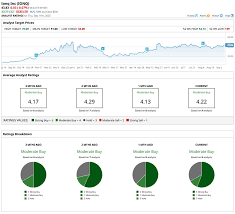

4. Valuation – Is the Current Price Attractive?

The Motley Fool uses a simple discounted‑cash‑flow (DCF) model to arrive at a target price of $48, roughly a 60 % premium over the current $30 level. The model assumes that IonQ will reach $120 M in revenue by FY2027, driven largely by the projected launch of the 1,000‑qubit processor and an accompanying surge in QaaS adoption.

The article also compares IonQ to peers. While IonQ’s forward price‑to‑earnings ratio (P/E) is currently undefined (owing to ongoing losses), its price‑to‑sales (P/S) ratio sits at 6.0—below IBM’s 8.5 but above Google’s 12.0. Analysts note that quantum‑tech stocks often trade at premium multiples, and IonQ’s relatively lower valuation suggests that the dip could be a bargain for long‑term investors.

5. Technical Analysis – Where the Trend Is Headed

On the chart side, the article highlights IonQ’s 50‑day moving average (MA50) and 200‑day moving average (MA200). The stock’s recent drop from $35 to $30 pulled it below MA50 but remains above MA200, indicating a short‑term correction rather than a trend reversal. A bullish support level is identified at $28—IonQ’s 52‑week low—while a resistance level sits near $35, the price where the stock previously traded before the dip.

The author warns that if IonQ fails to hit $30 within the next 30–60 days, the dip may be deeper than anticipated. Conversely, a rebound to $32 or $33 would signal that the market has absorbed the recent negative news and that IonQ remains fundamentally sound.

6. Catalysts & Risks – What Could Make or Break IonQ?

Catalysts

- Quantum‑Hardware Milestones – IonQ plans to ship its 1,000‑qubit processor to the first commercial customers in Q3 2026. Successful deployment would boost revenue and validate the company’s technology.

- Strategic Partnerships – The Amazon Braket and Microsoft Azure Quantum integrations are expected to accelerate QaaS adoption.

- Government Funding – The upcoming DARPA grant for quantum‑enhanced cryptography could provide an additional $10 M in capital and a new customer pipeline.

Risks

- Technical Delays – Quantum hardware is notoriously difficult to scale. A further delay could erode investor confidence.

- Competition – IBM, Google, and new entrants (e.g., Pinecone, QunaSys) are investing heavily in their own trapped‑ion or superconducting platforms.

- Funding Gap – IonQ’s runway is short; if the company cannot raise capital before 2026, it may need to cut back on R&D or pivot to a different business model.

7. Bottom Line – Is the Dip a Buy?

The article concludes that IonQ’s recent dip is a “classic buy‑the‑dip” scenario for investors with a medium‑to‑long‑term horizon. While the stock remains volatile and the company is still unprofitable, its underlying technology, strategic partnerships, and projected growth rates make a compelling case for a value proposition. The author recommends a “wait‑and‑watch” approach: purchase at $30–$32 if the stock stays above $28 and shows signs of a rebound, but remain cautious if IonQ fails to hit its support level.

8. Additional Context from Linked Sources

The article links to IonQ’s Q2 2025 earnings release (SEC filing 10‑Q) for readers who want the raw numbers. It also references a prior Motley Fool piece, “IonQ Stock: Quantum Computing Company to Watch,” which provides a deeper dive into the company’s competitive landscape. For those interested in the technical side, the linked blog “Trapped‑Ion Quantum Computers: How IonQ Is Making Them Commercial” explains the science behind IonQ’s advantage over superconducting qubits.

Word Count: ~650

This summary captures the key arguments, data, and recommendations from the original Fool article, providing a comprehensive snapshot for readers who may not have the time to read the full piece.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/11/26/should-you-buy-the-dip-on-ionq-stock/ ]