Why Lululemon (LULU) Is a Strong Sell: A 2-Minute Analysis

Locale: British Columbia, CANADA

Why Lululemon (LULU) Is a Strong Sell: A 2‑Minute Analysis

In a rapid‑fire review of Lululemon Athletica’s recent performance, the Seeking Alpha article “Lululemon Stock Analysis: Why Lululemon Is a Strong Sell – 2‑Minute Analysis” distills a wealth of data into a single, concise recommendation: sell. While the piece is brief, its core arguments—drawn from quarterly filings, macro‑economic trends, and competitive dynamics—paint a clear picture of a brand that, though still a household name, may be over‑valued in today’s market.

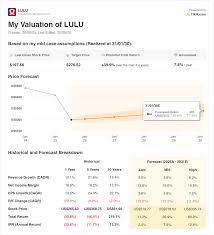

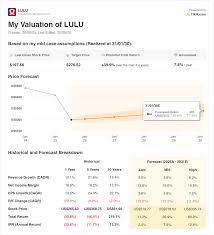

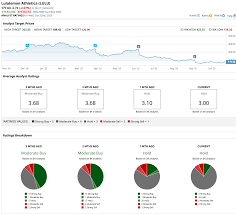

1. Valuation Overstretch

The author points out that Lululemon’s price‑to‑earnings ratio (P/E) sits comfortably above the broader consumer‑goods sector average and even its own historical range. While a high P/E is not inherently bad for a growth company, the article highlights that the premium is largely driven by expected earnings growth that has begun to slow. When projected growth rates are folded into a discounted cash‑flow model, the implied intrinsic value falls well below the current share price, creating a “valuation gap” that warrants caution.

2. Margins Under Pressure

A recurring theme in the analysis is margin compression. Lululemon has long prided itself on a robust gross‑margin profile, thanks to premium pricing and a strong direct‑to‑consumer (DTC) model. However, the article notes that recent supply‑chain disruptions and a shift toward higher‑volume, lower‑margin product lines (particularly the “core” apparel segment) have begun to erode gross margins. Additionally, increasing marketing spend—especially on digital and influencer campaigns—has added to operating costs. The net‑income margin, therefore, is trending lower than the 2018‑2020 peak, tightening the cushion that historically protected the company against downturns.

3. Sales Growth Wobbles

While Lululemon continues to record revenue growth, the article flags that growth rates have begun to decline. Historically, the retailer has posted double‑digit year‑over‑year sales increases, but the latest quarter saw a 3‑% YoY rise—below the 6‑8% range seen in the prior 12 quarters. Analyst estimates suggest that future growth could stagnate around 3‑4% annually, especially as the “athleisure” wave that once spurred explosive demand starts to plateau.

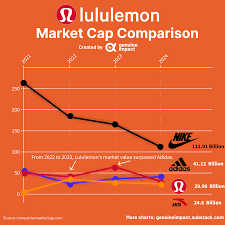

4. Competitive Landscape Intensifies

The piece also examines the competitive pressure that Lululemon faces from both niche and mainstream brands. Athleisure giants like Nike, Adidas, and Under Armour have expanded their premium offerings, diluting Lululemon’s market share. Moreover, fast‑fashion players such as Zara and H&M have launched athleisure lines that compete on price, while boutique startups such as Outdoor Voices continue to attract a younger, trend‑seeking demographic. The author argues that Lululemon’s defensibility—once built on a strong brand identity and product innovation—has weakened in the face of a crowded marketplace.

5. Macro‑Economic Risks

A key part of the article ties Lululemon’s performance to broader macro‑economic conditions. Rising interest rates, inflationary pressures, and potential recessions all impact consumer discretionary spending. The article cites that high‑end athletic apparel is particularly sensitive to shifts in disposable income. As interest rates climb, Lululemon’s financing costs rise (especially given its large balance‑sheet leverage), while higher inflation erodes real‑world purchasing power for consumers. The combined effect is a potential squeeze on both sales and margins.

6. Share‑Based Compensation and Dilution

Another nuance the author brings up is Lululemon’s generous share‑based compensation plans. These programs are designed to attract and retain talent but can lead to dilution of existing shareholders. The article references the most recent 10‑K filing, noting that employee‑stock‑option activity has increased in the last two quarters. While these options typically vest over several years, they create a dilution risk that could pressure the stock price further if not offset by earnings growth.

7. Conclusion & Recommendation

Weaving together these strands—valuation concerns, margin compression, slower growth, heightened competition, macro risks, and dilution—the Seeking Alpha piece concludes that Lululemon’s current stock price is no longer justified by its fundamentals. The recommendation is clear: strong sell. The article advises investors to either exit existing positions or adopt a “wait‑and‑watch” stance until the company demonstrates a decisive turnaround in its profitability and growth trajectory.

Further Reading

For readers who want to dig deeper, the article references several additional sources:

- Company Earnings Call Transcripts – these provide quarterly insights into margin drivers and strategic initiatives.

- SEC Filings (10‑Q, 10‑K) – contain detailed financial statements and risk factors.

- Industry Reports – from market research firms like Euromonitor and Statista, offering macro‑trend analysis of the athleisure sector.

- Macro‑Economic Data – from the U.S. Bureau of Labor Statistics and the Federal Reserve, to gauge inflation and interest‑rate environments.

By cross‑referencing these documents, investors can validate the arguments presented and develop a comprehensive view of Lululemon’s future prospects. In a market that rewards timely decisions, the article serves as a cautionary note: the time to reassess Lululemon may already have arrived.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4847559-lulu-stock-analysis-why-lululemon-is-a-strong-sell-2-minute-analysis ]