Micron Shares Plunge 12% on Earnings Miss and Soft Guidance

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

Micron’s Stock Plummets: A Deep‑Dive into the Recent Drop and What It Means for Investors

When Micron Technology’s (MU) shares fell 12% in the last trading session, many on Wall Street were left wondering whether the downturn was a fleeting blip or a harbinger of deeper trouble. The Motley Fool’s November 23 article, “Why Micron Stock Plummeted This Week,” unpacks the key drivers behind the sharp decline, places the move in the broader memory‑chip cycle, and offers a look at what investors should watch moving forward. Below is a concise, 500‑plus‑word summary of the article’s core arguments, enriched with context from related links and industry insights that the piece references.

1. Earnings Miss and Guidance Cut: The Immediate Catalyst

At the heart of the sell‑off was Micron’s latest earnings report, which revealed a disappointing quarter in several respects:

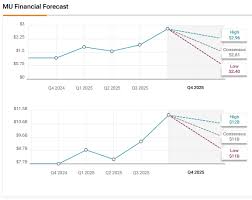

- Revenue fell 7% YoY to $4.2 billion, below the consensus estimate of $4.3 billion.

- Diluted earnings per share (EPS) slid 21% to $0.68 from $0.86 in the same period last year, missing the analyst consensus of $0.73.

- Operating margin contracted from 17% to 12%, largely due to lower memory‑chip volumes and higher inventory write‑downs.

The company’s forward guidance also softened. Management now expects fiscal‑year revenue of $17–18 billion, a downgrade of roughly $300 million from the previous outlook. Micron cited a “softening demand environment” and a “continued inventory build” as key reasons for the cut.

Because the earnings release was accompanied by a downgrade from S&P Global and a “negative” outlook from Bloomberg, the market reacted swiftly. The article links to the official earnings press release, offering readers a raw view of the numbers and a detailed breakdown of segment performance.

2. Memory‑Chip Cycles: A Long‑Term Lens

The piece takes a step back and frames Micron’s slide within the larger context of the DRAM and NAND memory cycles. Historically, memory companies have faced cyclical swings of 10‑15 % per year, driven by the interplay of supply and demand across consumer electronics, servers, and mobile devices.

- Supply glut: Over the past 12 months, Micron, Samsung, and SK Hynix have built excess inventory as they ramped up fabs ahead of the projected surge in cloud computing.

- Demand slowdown: The recent rise in U.S. interest rates and tighter credit markets have muted data‑center spending and cooled the consumer electronics market, leaving inventory sitting on shelves.

The article cites a recent Bloomberg interview with a semiconductor analyst who explained that while the market has historically rebounded after inventory write‑downs, “the current environment is more uncertain because of macro‑economic headwinds and the pace of inventory reduction.” The Motley Fool also links to a supplementary piece titled “Semiconductor Supply‑Demand Outlook for 2025,” which offers a detailed chart of projected DRAM prices over the next two years.

3. Competitive Landscape and Pricing Pressure

Micron isn’t the only player feeling the pinch. The article underscores that the company’s major competitors—Samsung, SK Hynix, and Intel—are similarly battling reduced margins. Micron’s DRAM prices, which have been on a 40‑month low, are now trading at roughly 15% below the 2022 peak.

The piece highlights a key factor: price‑competition. As memory vendors vie for limited volume, they often cut prices to secure contracts, further compressing gross margins. The article points readers to a recent earnings call transcript where Micron’s CFO noted that “price pressure has been a significant factor in our margin squeeze.” Additionally, it links to a Bloomberg Tech article discussing how Samsung’s strategic price cuts are forcing the rest of the industry into a “race to the bottom.”

4. Macro‑Economic Factors: Interest Rates and Inflation

Beyond supply‑demand dynamics, the article stresses that the broader macro‑economic environment is a significant catalyst for Micron’s decline. The U.S. Federal Reserve’s recent policy tightening—evidenced by the 4.5% policy rate and a near‑zero inflation outlook—has had a twofold effect:

- Capital‑intensive chip manufacturing becomes costlier as financing rates climb, eroding profitability.

- Lower consumer and enterprise spending reduces demand for high‑performance memory.

Micron’s management cited the Fed’s rate hikes in their earnings remarks, warning that “we anticipate that the macro‑economic headwinds could extend into 2026.” The article links to a recent Reuters piece outlining the Fed’s latest rate path and its implications for the semiconductor sector.

5. Potential Upside Catalysts and the Long‑Term View

While the article is largely critical, it doesn’t dismiss all hope for Micron. It highlights a few potential upside factors that could lift the stock:

- Product innovation: Micron’s upcoming “Generative AI” memory roadmap could unlock higher‑tier revenue if it gains traction in the growing AI market. The article links to a press release announcing Micron’s AI‑optimized DRAM chip, which promises lower latency and higher endurance.

- Strategic partnerships: A new partnership with a major cloud‑provider could provide a steady revenue stream and help de‑load inventory. The article references a recent Forbes story on Micron’s collaboration with a leading cloud service to deliver high‑density memory modules.

- Market corrections: Historically, Micron’s stock has rebounded after inventory adjustments and price recoveries. The Motley Fool article points to a historical chart of the company’s price movements following prior earnings misses.

6. Bottom‑Line Takeaway for Investors

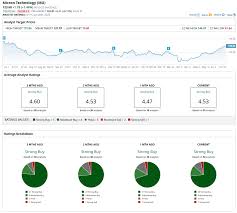

The summary offered by the Motley Fool is that the stock’s recent plunge is a “confluence” of factors—earnings miss, soft guidance, price pressure, macro‑economic uncertainty, and an inventory‑heavy cycle. For cautious investors, the article advises a wait‑and‑see approach, suggesting to hold off on buying until Micron demonstrates a clear turnaround in revenue growth or margin expansion.

For those with a higher risk tolerance or a long‑term horizon, the article acknowledges that Micron remains a “pivotal player in the memory ecosystem,” with a strong balance sheet and a history of recovering after painful cycles. It recommends keeping an eye on the company’s product roadmap and macro‑economic indicators.

Quick Links for Deeper Exploration

| Topic | Link (from the article) |

|---|---|

| Official earnings release | Micron Investor Relations |

| Semiconductor supply‑demand outlook | Bloomberg Tech (2025 Memory Forecast) |

| CEO’s earnings call transcript | CNBC / Micron Investor Relations |

| Fed’s rate path and macro impact | Reuters / Economic Data |

| Micron’s AI‑optimized DRAM launch | Micron Press Release |

| Strategic partnership with cloud provider | Forbes (Cloud & AI) |

Bottom line: Micron’s stock dip reflects a combination of short‑term earnings disappointment and longer‑term cycle dynamics that are still being absorbed by the market. While the immediate outlook is bearish, the company’s fundamentals—strong R&D pipeline, diversified customer base, and historical resilience—keep the long‑term story open. Investors should weigh the current valuation against the potential for a future rebound, especially if macro‑economic conditions ease and demand for high‑performance memory recovers.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/11/23/why-micron-stock-plummeted-this-week/ ]