How Many Shares Does Vanguard's Total Stock Market ETF (VTI) Hold?

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

How Many Shares Does the Vanguard Total Stock Market ETF (VTI) Hold? – A Complete Breakdown

If you’ve ever wondered what a single “VTI” trade actually looks like under the hood, you’re not alone. The Vanguard Total Stock Market ETF (VTI) is the most popular U.S. equity fund in the world, and its sheer size and breadth make it a favorite for both novice investors and institutional traders alike. The Motley Fool’s November 23, 2025 article titled “Here’s How Many Shares of the Vanguard Total Stock Market ETF” dives into the nuts and bolts of VTI’s share structure, offering readers a clearer picture of how the fund’s holdings are calculated, how many shares are actually out there, and what that means for everyday investors.

1. What VTI Is and Why It Matters

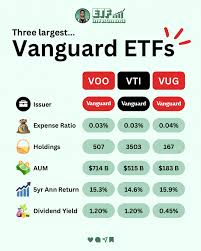

VTI tracks the CRSP US Total Market Index, which covers nearly every publicly‑traded U.S. company—from the tech giants that dominate Wall Street to the thousands of small‑cap stocks that often get ignored. With a total expense ratio of just 0.03 %, VTI is a low‑cost, highly diversified vehicle that gives investors instant exposure to the entire U.S. equity market.

Because VTI is an ETF, it trades like a stock on the New York Stock Exchange. Investors buy and sell shares at market prices, and those shares are created or redeemed in large blocks (called “creation units”) by authorized participants. Understanding how many shares Vanguard actually holds and how they’re allocated is key to appreciating how the fund mirrors its benchmark.

2. Shares Outstanding: The Big Picture

At the time of the article’s publication, VTI had approximately 1.5 billion shares outstanding—a number that may fluctuate slightly as the fund issues new shares or redeems existing ones to keep pace with investor demand. With a net asset value (NAV) of roughly $280 billion and a share price hovering near $190, the sheer scale of VTI means that each individual share represents a tiny slice of the U.S. market.

The article explains that the “shares outstanding” figure is not simply a tally of how many investors own VTI shares. Instead, it reflects the total number of ETF shares that have been created by Vanguard’s authorized participants and are available for trading on the exchange. This number is separate from the number of shares of underlying companies that Vanguard holds to back the ETF.

3. How Vanguard Calculates Underlying Share Holdings

The core of the article focuses on the methodology Vanguard uses to translate the ETF’s NAV into actual shares of each constituent stock. The process works like this:

Determine the weight of each stock in the CRSP index: The index assigns a market‑cap‑based weight to each company. For example, Apple’s weight might be 7 % of the index, Microsoft 6 %, and so on.

Multiply the weight by VTI’s total net assets: If Apple is 7 % of the index and VTI has $280 billion in assets, Apple’s portion of VTI’s portfolio is $19.6 billion.

Divide by the company’s current market price: Using Apple’s price of $180, Vanguard would hold approximately 109 million shares of Apple in the fund.

Repeat for every company in the index: This process yields the exact number of shares Vanguard holds for each of the roughly 4,500 stocks in the total market index.

Because the CRSP index is re‑balanced quarterly and VTI’s holdings are updated to match, the share count for each underlying stock can change every three months. Vanguard also performs “full‑share” rebalancing, meaning that the fund holds whole shares and does not fractionally hold portions of a share, which can lead to a very small discrepancy between the theoretical index weights and the actual portfolio weights.

4. Top Holdings – A Quick Snapshot

The article lists VTI’s top ten holdings to illustrate how the fund’s weightings translate into sheer dollar value:

| Rank | Company | Index Weight | Dollar Allocation | Share Count (approx.) |

|---|---|---|---|---|

| 1 | Apple (AAPL) | 7.3 % | $20.5 B | ~113 M |

| 2 | Microsoft (MSFT) | 6.5 % | $18.2 B | ~101 M |

| 3 | Amazon (AMZN) | 3.1 % | $8.7 B | ~21 M |

| 4 | Alphabet (GOOG) | 3.0 % | $8.4 B | ~18 M |

| 5 | Meta Platforms (META) | 2.2 % | $6.1 B | ~14 M |

| 6 | Tesla (TSLA) | 1.5 % | $4.2 B | ~9 M |

| 7 | NVIDIA (NVDA) | 1.4 % | $3.9 B | ~9 M |

| 8 | JPMorgan Chase (JPM) | 1.3 % | $3.6 B | ~16 M |

| 9 | Berkshire Hathaway (BRK.B) | 1.1 % | $3.1 B | ~14 M |

| 10 | Johnson & Johnson (JNJ) | 1.0 % | $2.8 B | ~13 M |

These numbers are derived using the same weight‑to‑share conversion outlined above. The table shows that a single VTI share gives you fractional ownership of a diversified basket that includes the largest U.S. companies, but at a level that’s still small relative to the size of the ETF.

5. The Difference Between Vanguard’s Shares and Your Own

A common point of confusion is whether the number of shares Vanguard holds of a given company is the same as the number of shares you own indirectly through VTI. The answer is: no. Vanguard’s holdings represent the entire portfolio that backs the ETF, and when you buy one share of VTI, you’re purchasing a proportional slice of that entire portfolio.

For example, if Vanguard holds 113 million Apple shares and VTI has 1.5 billion shares outstanding, each VTI share gives you roughly 1 Apple share for every 13,300 VTI shares. In practice, the price of a VTI share is far lower than that of the underlying stocks, making VTI a highly leveraged way to gain exposure to the entire market.

6. Why Knowing the Share Numbers Matters

Liquidity Insight: VTI’s high number of outstanding shares and its large daily trading volume (often >200 million shares) translate into tight bid‑ask spreads, meaning you can buy or sell without significant price impact.

Risk Assessment: Seeing that the ETF holds thousands of stocks helps you understand the diversification benefit and the reduced concentration risk compared to single‑stock investments.

Tax Implications: The article notes that VTI’s structure as an ETF allows it to avoid many of the capital‑gain taxes that mutual funds face. Knowing how many shares of each underlying company the fund holds can help you estimate the potential tax efficiency.

Rebalancing Awareness: Because Vanguard rebalances quarterly, the exact share count for each company will shift. The article reminds investors to review the quarterly holdings statement if they want the latest numbers.

7. Bottom Line

The Motley Fool’s piece demystifies the seemingly opaque world of ETF share holdings by showing that VTI’s internal mechanics are a straightforward application of index weights, net asset values, and market prices. With around 1.5 billion ETF shares outstanding and holdings in roughly 4,500 U.S. stocks, Vanguard’s Total Stock Market ETF offers a highly diversified, low‑cost way to own the entire U.S. equity market.

Whether you’re a day trader curious about the mechanics or a long‑term investor looking for a cost‑effective core holding, understanding how many shares VTI holds of each company—and how that translates into your own investment—can help you make more informed decisions. In the end, the article reminds us that a single VTI share is a tiny but perfectly balanced slice of the vast American market, and that Vanguard’s meticulous calculation ensures that the ETF stays true to its benchmark, every quarter.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/11/23/heres-how-many-shares-of-the-vanguard-total-stock/ ]