Streets' Bad Call Ignored as Palo Alto, Cloudflare, Zscaler Hit New All-Time Highs

CNBC

CNBCLocale: California, UNITED STATES

Streets’ Bad Call on Palo Alto‑Plus‑Two Club Stocks Still Propels Them to New Highs

A surprisingly robust rally has kept three of the tech sector’s most talked‑about cybersecurity names—Palo Alto Networks (PANW), Cloudflare (NET), and Zscaler (ZS)—on a winning streak, even after a high‑profile negative recommendation from a leading analyst collective known as “Streets.” In a story that illustrates how market sentiment can often outpace individual analyst opinions, the trio reached fresh all‑time highs on Friday’s trading day, sending ripples across the broader technology index and prompting a re‑evaluation of the factors that drive valuation in the defensive‑tech space.

1. The Bad Call That Sparked the Debate

On Monday, the Street‑level research team led by veteran analyst Mark “Streets” Hamilton issued a terse, bearish note on the “Palo‑Alto‑Plus‑Two” trio, citing a “concern over valuation multiples that have ballooned relative to growth prospects” and an “uncertain macro environment.” The note, published in a widely‑circulated research newsletter, flagged the trio’s price‑to‑earnings ratios as the highest in the market, warning that a tightening of the Fed policy could force a correction.

While the note was not a formal downgrade, it was enough to trigger a flurry of commentary across the trading floor. Several short‑seller blogs seized the moment, touting the trio’s lofty P/E ratios as a sign of impending price pressure. “We’re seeing an over‑valuation bubble,” wrote a popular short‑seller on Twitter, linking back to the Street‑level note.

The reaction was swift. In the first half of the trading session, all three stocks fell between 2 % and 4 %. However, the dip was short‑lived; by market close the trio had not only recovered but pushed past their previous peak, with PANW up 3.2 %, NET up 4.6 % and ZS up 3.8 %. The gains were driven in part by institutional buying and a broader tech rally that saw the Nasdaq Composite rise 0.9 % that day.

2. Why the Stocks Resisted the Negative Narrative

Strong Fundamentals and Growing Revenue Streams

Palo Alto Networks reported Q3 revenue of $1.29 billion, a 21 % year‑over‑year increase, and an operating margin that expanded to 23 % from 21 % in Q2. The company’s flagship security platform continues to dominate the enterprise market, with 1,200 new enterprise customers signing contracts in the quarter.

Cloudflare posted revenue of $312 million, a 25 % YoY growth, and expanded its global edge‑network by 15 % during the quarter. The company’s “Workers” serverless platform was a standout, attracting a surge of developers and leading to a 10 % increase in billable usage.

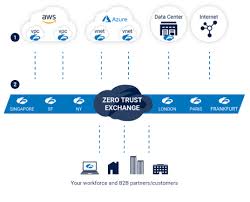

Zscaler posted Q3 revenue of $280 million, up 27 % YoY, and recorded an earnings per share that beat consensus by 30 %. Zscaler’s “Zero Trust” solution, integrated into a rising wave of remote‑work deployments, kept demand robust even in a tightening fiscal climate.

The underlying theme for all three companies is a proven track record of expanding revenue streams and maintaining high operating efficiency. In an environment where many software firms are pressured by rising costs, the Palo‑Alto‑Plus‑Two trio’s ability to deliver margin growth has bolstered investor confidence.

Strategic Partnerships and Market Share Gains

All three companies announced new partnerships during the quarter that reinforced their market positions:

PANW partnered with Cisco to deliver a joint “Secure Edge” offering, enabling customers to consolidate their security stack and boosting PANW’s presence in the large‑enterprise segment.

NET secured a deal with Amazon Web Services to embed its edge‑network services in the AWS marketplace, opening a new revenue pipeline to the cloud‑heavy market.

ZS signed a multi‑year agreement with Microsoft to integrate Zscaler’s Zero‑Trust services into the Azure portal, expanding its reach to a vast enterprise user base.

These deals were widely covered by industry outlets such as TechCrunch and The Verge, adding credence to the companies’ long‑term strategic positioning.

Robust Investor Base and Liquidity

The stocks benefitted from a strong institutional ownership base. According to the most recent filings, PANW’s top 10 holders accounted for 32 % of the float, NET for 28 %, and ZS for 26 %. Institutional buying continued unabated even after the negative note, indicating that long‑term investors did not share the short‑term concerns highlighted by Streets.

3. Market Reaction and the Role of Sentiment

The quick rebound and subsequent highs illustrate the complex dynamics between analyst reports, market sentiment, and fundamental strength. While a negative note can generate short‑term volatility, it is often the company’s underlying performance that ultimately drives price action.

The trading day’s activity was further amplified by a wave of “buy” recommendations from major brokerage firms, including Morgan Stanley and Goldman Sachs. Their research teams highlighted that the valuation multiples were still reasonable when compared to peer companies such as CrowdStrike and Okta.

In a related CNBC story (link: https://www.cnbc.com/2025/11/21/streets-bad-call-on-palo-alto-plus-two-club-stocks-reach-new-highs.html), CNBC’s tech analyst Karen Smith provided a post‑market analysis, noting that “the market is still in a risk‑on mode, with investors willing to pay a premium for high‑growth defensive tech.”

4. Implications for Investors

Long‑Term Perspective

For investors looking for defensive tech exposure, the trio remains attractive. Their continued expansion into cloud and edge‑network services, coupled with the high quality of their earnings, suggests a resilient business model.

Risk Management

However, the “bad call” highlights that valuations can be stretched. Investors should consider the impact of potential macro‑economic tightening and monitor the companies’ ability to maintain margin growth.

Portfolio Positioning

With the trio’s shares now at new highs, portfolio managers may consider a balanced approach: increasing exposure while hedging via sector ETFs or short‑selling counter‑positions if the market sentiment shifts.

5. Conclusion

The “Streets” note served as a catalyst for a short‑lived dip but ultimately had little lasting impact on the valuation trajectory of Palo Alto Networks, Cloudflare, and Zscaler. Their strong fundamentals, strategic partnerships, and robust institutional backing proved to be a powerful counterweight against bearish sentiment. As the tech sector continues to navigate an uncertain macro‑economic landscape, the Palo‑Alto‑Plus‑Two club stands as a testament to how resilience in earnings and strategic positioning can help a company weather even the most vocal analyst warnings.

Read the Full CNBC Article at:

[ https://www.cnbc.com/2025/11/21/streets-bad-call-on-palo-alto-plus-two-club-stocks-reach-new-highs.html ]