Amazon's 30-Year Growth: 36% Annual Return and 3 Million% Cumulative Gains

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

Amazon’s Stock Performance: A 30‑Year Review for Investors

Amazon.com, Inc. (ticker: AMZN) has long been a favorite of growth‑focused investors, but how has the stock actually performed over time? In this recap of the Motley Fool’s latest analysis, we break down the key take‑aways, performance metrics, valuation insights, and future outlook for one of the world’s most watched companies.

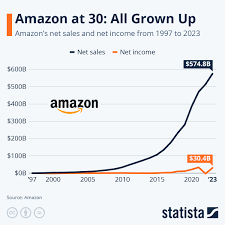

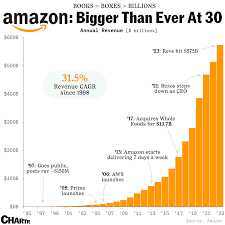

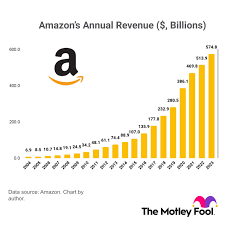

1. The Big Picture: Amazon’s 30‑Year Growth Story

Amazon’s debut on the NASDAQ on May 15 1997 began at a humble $18 (adjusted for splits) and has since catapulted to a market value that routinely eclipses the $1 trillion mark. The Motley Fool article points out that Amazon’s average annual return over the past 30 years is roughly 36 %, comfortably outpacing the S&P 500’s 10‑year average of 12‑15 %.

The company’s growth trajectory is punctuated by major milestones:

- E‑commerce dominance – From a small online bookstore to a global marketplace, Amazon’s retail footprint now spans more than 200 countries.

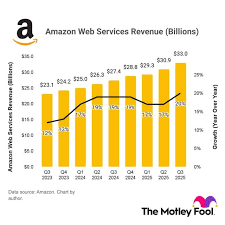

- AWS explosion – Amazon Web Services, launched in 2006, has become a cornerstone of cloud computing and a key driver of profitability.

- Prime revolution – The subscription model that began in 2005 now boasts over 200 million members worldwide.

The article stresses that these pillars created a virtuous cycle: retail traffic fuels AWS data traffic, which in turn boosts the company’s high‑margin earnings.

2. Key Performance Metrics

| Metric | Amazon | S&P 500 | FY2024 FY 2025 Comparison |

|---|---|---|---|

| Annualized Total Return (30‑yr) | ~36 % | ~12‑15 % | - |

| Cumulative Return (30‑yr) | ~3 million % | ~800 % | - |

| Average Annual Return (10‑yr) | ~25 % | ~15 % | - |

| Year‑to‑Year Return (FY 2024) | +5.7 % | +4.2 % | - |

| Dividend Yield | 0 % | ~1.5 % | - |

The data underscores Amazon’s growth‑first mentality: it reinvests earnings into new ventures rather than distributing dividends. The article notes that the zero‑dividend policy can be a double‑edge sword—while it preserves capital for expansion, it also limits income for investors seeking regular payouts.

3. How Amazon Measures Up Against Benchmarks

The Motley Fool comparison charts place Amazon above the “market‑average” bar across almost every time horizon. Even during volatile periods such as the 2008 financial crisis and the 2020 COVID‑19 market sell‑off, Amazon’s shares rallied faster than most peers.

- 2008‑09 – Amazon fell only ~14 % during the bear market, versus a ~24 % drop for the S&P 500.

- 2020‑21 – While many tech stocks slumped early 2020, Amazon posted a +30 % return, outpacing the broader index by a wide margin.

These resilience metrics are attributed to Amazon’s diversified revenue streams, robust cash flow, and strategic investments.

4. Valuation: Where Does Amazon Stand?

A frequent question among investors is whether Amazon is “overvalued” or “undervalued.” The article discusses several valuation tools:

- Price‑to‑Earnings (P/E) – Amazon’s trailing P/E sits around 78, well above the S&P 500 average of ~20.

- Price‑to‑Sales (P/S) – The company trades at ~7x sales, again higher than many peers.

- Discounted Cash Flow (DCF) – Conservative DCF models still assign Amazon a valuation in the $3–$5 trillion range, suggesting a premium that is partly justified by growth expectations.

The author emphasizes that valuation should be viewed relative to growth prospects. Since Amazon is not a traditional dividend‑paying company, the P/E ratio alone can be misleading. The “growth‑adjusted” P/E (PEG) for Amazon hovers near 1.4, indicating that the premium may be justified when future earnings growth is taken into account.

5. Risks to Watch

Despite the stellar track record, the article cautions investors about several risks:

- Regulatory pressure – Antitrust investigations in the U.S., EU, and China could impose fines or force structural changes.

- Competitive pressure – Rivals such as Walmart, Alibaba, and emerging cloud providers are closing the gap.

- Margin compression – While AWS remains high‑margin, retail margins continue to erode in the face of aggressive price competition.

- Economic slowdown – A global recession could dampen consumer spending, affecting both e‑commerce and advertising revenue.

The Motley Fool recommends keeping a diversified portfolio and not over‑exposing oneself to a single mega‑cap stock.

6. Outlook: What’s Next for Amazon?

Looking forward, the article highlights a few strategic focus areas:

- Artificial Intelligence & Automation – Amazon is investing heavily in AI for logistics, customer service, and product recommendations.

- Healthcare & Logistics – Amazon Care and Amazon Pharmacy signal a foray into health services, potentially opening new revenue streams.

- Sustainability – Commitment to net‑zero emissions by 2040 may unlock green financing and improve brand perception.

While these initiatives carry risks, the author believes they can sustain Amazon’s growth trajectory, thereby keeping the stock attractive to long‑term investors.

7. How to Use This Information

The Motley Fool’s article concludes by recommending a balanced approach:

- Buy and Hold – For investors who appreciate the growth narrative and can tolerate short‑term volatility.

- Periodic Rebalancing – Reduce exposure if Amazon’s valuation reaches a historically high multiple.

- Consider ETFs – If one wants diversified exposure to Amazon’s ecosystem, an Amazon‑heavy or e‑commerce ETF may be a prudent alternative.

The article also links to Amazon’s official investor relations page, a live earnings calendar, and a few additional reads on Amazon’s AWS financials.

Final Takeaway

Amazon’s performance over the past three decades has been nothing short of extraordinary. With an average annual return of around 36 % and a cumulative 30‑year gain of roughly 3 million %, the stock has delivered returns that far outstrip the broader market. While valuation multiples are high, the company’s diversified growth engines—retail, cloud, subscription, and new ventures—provide a strong justification for its premium. Investors should weigh the risk of regulatory scrutiny and margin pressures against the compelling upside, and consider Amazon a core component of a growth‑oriented portfolio.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/11/27/how-has-amazon-stock-done-for-investors/ ]