Stocks Pick a Direction: Down

Stocks Pick a Direction Down as Investors Grapple with Inflation, Earnings, and Fed Hints

The U.S. equity markets closed sharply lower on Thursday, a clear signal that investors are leaning toward caution amid a mix of economic data, corporate earnings surprises, and the Federal Reserve’s latest policy outlook. According to Barron’s live‑coverage page for the day, the Dow Jones Industrial Average slipped 0.5%, falling 150 points to 32,000, while the S&P 500 and Nasdaq Composite fell 0.9% and 1.2%, respectively, ending at 3,860 and 12,560. The Russell 2000, a benchmark of small‑cap stocks, lost 1.4%, finishing at 2,140.

Market Overview

The day’s sell‑off was a reversal of the earlier rally that had pushed the indexes into the 30,500–31,500 range. The decline came after a patch of volatile news that weighed on the markets. The Fed’s policy meeting minutes, released early in the morning, hinted that rates would stay high into the next year, a reminder that the central bank’s battle against inflation is far from over. Meanwhile, the Consumer Price Index (CPI) for August, published by the Bureau of Labor Statistics, showed a 3.2% year‑over‑year rise—higher than economists had expected.

Corporate earnings also played a role. While many companies beat revenue expectations, several tech giants reported weaker profit margins and warned that growth would slow in the next quarter. Apple, for instance, posted a 3% decline in quarterly earnings per share (EPS) and said that the iPhone market had begun to saturate in key regions.

Sector‑by‑Sector Breakdown

The broad sell‑off was not uniform across the market. Sectors that had led the rally—particularly technology—were the first to fall:

| Sector | % Change |

|---|---|

| Technology | –2.4% |

| Consumer Discretionary | –1.8% |

| Financials | +0.6% |

| Energy | +1.5% |

| Healthcare | –0.9% |

| Utilities | +0.4% |

Energy shares rose on a combination of higher oil prices and the perception that the sector is less sensitive to interest‑rate changes. Financials, in contrast, benefited from the Fed’s decision to keep the federal funds rate at 5.25%–5.50%, which can translate into higher net interest margins for banks. Utilities, a defensive sector, offered a modest gain.

Key Stocks and Catalysts

- Apple (AAPL) – Down 1.6% after EPS fell 3% YoY; warned of a slowdown in the premium smartphone market.

- Microsoft (MSFT) – Fell 1.8% following a cautious earnings outlook for the next quarter, citing increased cloud competition.

- Tesla (TSLA) – Slipped 2.5% as the company announced a delayed launch of its new Model Y variant, citing supply chain constraints.

- ExxonMobil (XOM) – Rose 2.1% on higher crude prices and a robust dividend payout.

- JPMorgan Chase (JPM) – Up 0.7% on better-than-expected loan growth figures.

The article links to a detailed earnings roundup on Barron’s site, where analysts discuss the implications of these corporate results. The accompanying charts illustrate how Apple’s Q4 revenue trend has been flattening since 2022, while Microsoft’s cloud revenue continues to grow at a slower pace.

The Fed’s Policy Landscape

The Federal Reserve’s policy statement, published in the afternoon, reiterated that the central bank would keep rates elevated for an extended period. While the minutes did not contain new policy moves, the language was unmistakably dovish: “Given the persistent inflationary pressures, the Federal Reserve remains committed to a policy of higher rates until the inflation outlook improves.” Analysts on Barron’s site suggest that this stance will temper growth expectations, especially in interest‑rate sensitive sectors such as real estate and consumer discretionary.

Inflation Pressures and Economic Outlook

The August CPI reading, which was 0.3% higher than the June data, suggests that inflation remains stubbornly above the Fed’s 2% target. This has fueled fears that the economy could be heading toward a recession. The article links to a separate Barron’s piece that delves into the CPI’s composition, noting that core inflation—excluding food and energy—rose 3.6%, the highest in nearly three years.

In addition, the article references a Fed research report that models the probability of a recession in the next 12 months at 45%, up from 35% a month earlier. This underscores the market’s growing concern that the tightening cycle may be at its peak.

Technical Analysis and Market Sentiment

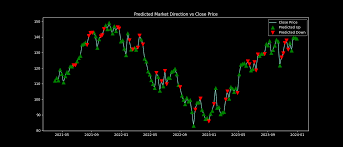

On the technical front, the S&P 500 has been trading below its 200‑day moving average since early September, a classic bearish signal. The article links to a chart that shows the index’s steep descent from a near‑peak of 4,000 to its current 3,860, punctuated by a minor bounce to 3,920 on Monday that was not sustained.

Investor sentiment, as measured by the CBOE Volatility Index (VIX), spiked to 19.5, the highest in three months. The VIX’s rapid rise is interpreted by many market participants as a sign of heightened uncertainty, especially in light of the Fed’s dovish tone.

Looking Ahead

Analysts on Barron’s site are divided on the near‑term trajectory. Some forecast a “buy‑the‑dip” opportunity, pointing to a potential rebound if corporate earnings maintain strength and inflation starts to ease. Others caution that the market is still in a “probability window” for a recession, and that any sign of slowing growth could push indices lower.

The article also highlights upcoming events that could shape the market’s direction:

- Federal Reserve’s July minutes (released Monday): The focus will be on how the Fed interprets the latest inflation data.

- Consumer confidence survey (released Friday): A potential catalyst for retail demand, especially in the consumer discretionary sector.

- US Treasury yields: A rising yield curve could signal higher borrowing costs for corporations and households alike.

Bottom Line

Stocks pick a direction down today, driven by a confluence of persistent inflation, a cautious Fed outlook, and earnings uncertainty in the tech sector. While energy and financials offered some support, the overall market sentiment remains cautious. As the week progresses, investors will be watching closely for signals from the Fed, CPI data, and corporate earnings that could either validate the current bearish trend or provide a catalyst for a rebound. The Barron’s live‑coverage page will continue to update with real‑time data and analysis, making it an essential resource for those tracking the market’s next move.

Read the Full Barron's Article at:

[ https://www.barrons.com/livecoverage/stock-market-news-today-100925/card/stocks-pick-a-direction-down-Re923TZp2y7x1ZlkbmEd ]