Dow Gains 664 Points on Renewed Rate-Cut Optimism

Kiplinger

KiplingerLocale: New York, UNITED STATES

Dow Climbs 664 Points as Investors Digest Growing Rate‑Cut Hopes

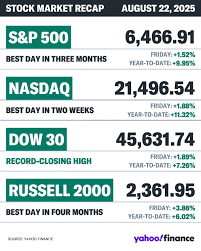

On the most recent trading day, the U.S. equity market closed higher across the board, with the Dow Jones Industrial Average (DJIA) posting a gain of 664.5 points—an almost 3% uptick. The S&P 500 and Nasdaq Composite also finished on an up day, reflecting a broader rally that appears to be fueled by renewed optimism about the Federal Reserve’s willingness to ease policy later in the year. In this piece we break down the key drivers behind the market’s lift, the economic backdrop that is shaping expectations, and what investors can anticipate in the coming weeks.

1. Market Reaction to Fed Outlook

Fed‑Led Sentiment:

The primary catalyst for the rally was the widening belief among market participants that the Federal Reserve could lower interest rates in the near term. Although the Fed has signaled that it is maintaining its stance of “tightening” until inflation moves sustainably below 2%, the recent release of the Committee’s minutes and the steady decline in U.S. Treasury yields have tempered fears of an abrupt shift in policy. Market analysts noted that the yield curve has been flattening, a technical indicator that historically signals expectations of rate cuts.

Yield Curve Dynamics:

The 10‑year Treasury yield has slipped to a 1.75% level, down from a brief high of 2.12% earlier in the month. This slide, coupled with the 2‑year Treasury yield’s slight decline, has narrowed the spread between short‑term and long‑term rates. Historically, a narrowing spread is often associated with the market’s anticipation of accommodative policy to support growth. The Fed’s most recent meeting minutes, released by the Fed’s website, highlighted concerns about the resilience of the labor market and the potential for a “mild” recession, further emboldening the narrative that the central bank may lower rates in the fall.

2. Sectoral Breakdown and Notable Performers

Industrial and Energy Stocks:

The Dow’s performance was led by a solid surge in industrial shares such as General Electric and Caterpillar, both of which reported strong earnings. Energy giants also contributed, with ExxonMobil and Chevron posting gains amid a modest rise in oil prices to $70 per barrel, driven by supply‑side concerns in the Middle East.

Technology and Consumer Discretionary:

The technology sector, represented by the Nasdaq Composite, was up more than 1.8%. Apple and Microsoft were the biggest contributors, reporting robust quarterly results and reaffirming growth outlooks. Consumer discretionary stocks such as Tesla and Home Depot benefited from investor sentiment that supports continued spending in the domestic economy.

Financials and Real Estate:

Financial stocks, often sensitive to changes in interest rates, gained despite the Fed’s tight policy stance. The market’s reaction suggests a belief that any forthcoming rate cuts would eventually improve the profitability of banks. Real‑estate investment trusts (REITs) also saw gains, reflecting optimism about lower mortgage rates boosting housing demand.

3. Economic Data and Inflation Narrative

Inflation and CPI:

Recent inflation data revealed that the Consumer Price Index (CPI) rose by 0.4% month‑over‑month in August, below the 0.5% expectation of many market analysts. This slower‑than‑expected rise in inflation helped alleviate some concerns that the Fed might need to maintain high rates for longer. Moreover, core inflation—the CPI excluding food and energy—remained at 3.9%, a level that many economists consider still above the Fed’s long‑term goal but indicative of a possible cooling trend.

Employment Figures:

The Bureau of Labor Statistics reported that non‑farm payrolls grew by 150,000 jobs in July, slightly below the 180,000 projected. The unemployment rate held steady at 3.8%, the lowest level in 50 years. While the job market remains robust, a slowing growth rate in employment may be interpreted as a sign that the labor market could be approaching a plateau, feeding into expectations of future rate cuts.

Industrial Production and PMI:

The Institute for Supply Management’s Purchasing Managers Index (PMI) slipped to 57.9 in August, a slight drop from 59.2 in July. Despite the decline, the reading remains well above the 50 threshold that separates expansion from contraction, suggesting that the manufacturing sector continues to grow. The mild contraction in PMI is often viewed by investors as a sign that the economy may not be overheating, thus easing pressure on the Fed.

4. Market Commentary and Analyst Perspectives

Bullish Outlook from Analysts:

Several prominent analysts from major brokerage houses commented that the current rally is a “signal of improved risk appetite.” For instance, one analyst noted that the combination of a lower yield curve, softer inflation, and steady employment data had created a perfect environment for equities to climb. Others cautioned that the rally might be “over‑valuing” certain sectors, particularly technology, where price‑to‑earnings ratios have been on the higher side.

Risks and Potential Headwinds:

Not all voices are optimistic. Some analysts warned of potential downside if the Federal Reserve continues to delay rate cuts. A rising spread between the 10‑year and 2‑year Treasury yields could indicate tightening sentiment again, especially if inflation data reverts to higher levels. Moreover, geopolitical tensions—particularly in the Middle East—could pose a risk to energy markets and thus the industrial sector.

5. What Investors Should Watch

Upcoming Data Releases:

Investors should pay close attention to the next CPI release, scheduled for the middle of next week, as well as the upcoming payrolls report. These will give further clarity on whether inflation remains on a downward path and if employment growth has slowed enough to justify policy easing.

Fed Minutes and Statements:

The Fed’s next policy meeting is slated for mid‑October. While the Fed has signaled that it remains cautious, the minutes from the last meeting are expected to provide insight into how the committee’s hawk‑dovish balance might shift in the coming months.

Corporate Earnings Season:

With the third quarter earnings season underway, many large-cap stocks are scheduled to report their quarterly results. Strong corporate earnings could validate the bullish stance, while weaker-than‑expected results could dampen sentiment.

6. Bottom Line

The Dow’s 664‑point gain reflects a confluence of factors that are reshaping investor expectations: a narrowing yield curve, softer inflation data, and a robust yet cooling labor market. While the rally is a welcome respite for a market that has been on the sidelines since the March 2024 sell‑off, it also underscores the delicate balance the Federal Reserve must maintain between curbing inflation and supporting growth. As data continues to flow, market participants will remain vigilant, ready to pivot on any sign that the Fed’s policy narrative changes.

For a deeper dive into the technical aspects of the yield curve and its historical significance, readers may refer to the Federal Reserve’s comprehensive report on “Yield Curve Dynamics and Monetary Policy.”

Read the Full Kiplinger Article at:

[ https://www.msn.com/en-us/money/other/dow-gains-664-points-as-rate-cut-hopes-rise-stock-market-today/ar-AA1R9LGa ]