Morning Bid: Selloff abates as economy hums, layoffs rise

US Markets Navigate a Patchwork of Economic Signals and Political Uncertainty

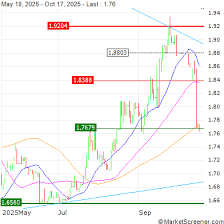

On November 6, 2025, U.S. equity and fixed‑income markets were shaped by a confluence of domestic policy expectations, shifting inflation dynamics, and a looming debt‑ceiling impasse. The Dow Jones Industrial Average slipped 0.5 % amid concerns that a tightening yield curve could dampen corporate profitability. The S&P 500 and Nasdaq Composite posted modest gains of 0.3 % and 0.6 % respectively, buoyed by a few high‑flying technology and consumer‑discretionary names that outperformed the broader market.

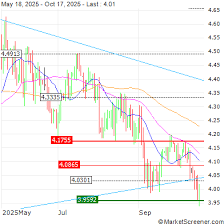

Treasury Yields Reflect a Growing Rate‑Risk Premium

The 10‑year Treasury yield stood at 4.81 %, up from 4.74 % earlier in the week. The 2‑year yield, meanwhile, hovered at 4.12 %, indicating a steepening short‑term rate environment. Analysts suggest that the widening spread between 10‑year and 2‑year yields is a sign of market anxiety over potential future tightening by the Federal Reserve. The yield curve, still slightly inverted in 2022 but now steepening, has raised questions about whether the U.S. will confront a recession or a prolonged period of high borrowing costs.

Federal Reserve Keeps Policy Rate Unchanged

The Fed’s policy stance, as outlined in a recent statement, kept the federal funds target range at 5.75 %–5.95 %. Officials emphasized that they are “continuing to monitor inflation and economic activity” while maintaining the view that higher rates will be needed to keep inflation close to the 2 % goal. The policy decision is consistent with the Fed’s dual mandate of promoting maximum employment and price stability. However, the bank’s cautious tone on potential rate cuts in 2026 has injected uncertainty into the markets, especially for sectors sensitive to borrowing costs.

Inflation Dynamics and the Fed’s Toolkit

U.S. inflation data released this week show a modest rise in the Consumer Price Index (CPI) at a 3.1 % annualized rate, slightly above the 3 % level of the previous month. Core CPI, excluding food and energy, ticked up 3.2 %. The latest numbers confirm that the Fed’s hawkish stance is warranted, given that the inflation trend has shown resilience despite policy tightening. Economists noted that while headline CPI is still above the target, the core figure suggests a slowing pace of underlying price pressures.

Economic Growth Outlook Moderates

Gross Domestic Product (GDP) growth for Q3 2025 was revised upward to 1.2 % annualized, signaling that the U.S. economy is still on a moderate expansion path. Yet, the revised figure reflects a slowdown from the 1.6 % growth observed in Q2. The service sector remains the main driver, while manufacturing output has been sluggish, partly due to supply chain bottlenecks. The labor market remains robust, with unemployment standing at 3.8 %. Wage growth, however, has moderated to a 4.2 % year‑over‑year rise, which may keep inflation in check over the medium term.

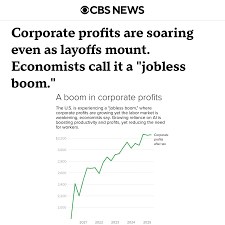

Corporate Earnings Provide a Mixed Signal

Quarterly earnings from major U.S. companies reflected a divided landscape. While technology firms like Apple and Microsoft posted strong margins, energy giants such as Exxon Mobil reported a 12 % decline in net income, citing higher fuel costs and lower demand for oil. Consumer‑discretionary companies had mixed results; retailers like Walmart and Target outperformed expectations, whereas luxury brands like LVMH and Tiffany struggled to maintain sales volumes.

Debt‑Ceiling Crisis Looms

A key political risk that continued to shadow markets is the debt‑ceiling impasse in Congress. With the U.S. borrowing limit set to hit 31 trillion dollars by the end of next month, bipartisan negotiations have stalled. If the ceiling is not raised, the Treasury could be forced to curtail payments, which would trigger a default risk spike. Market participants have priced in a 15 % probability of default by the Treasury’s debt‑ceiling deadline, pushing Treasury yields higher as a compensatory measure.

Global Context: China, Europe, and Emerging Markets

Beyond domestic concerns, U.S. investors were keeping a close eye on global developments. China’s latest GDP data indicated a 4.8 % year‑over‑year growth, a modest increase that supports the global economic outlook but also raises questions about potential tightening of monetary policy in the world's second‑largest economy. In Europe, the Eurozone inflation rate remained stubbornly high at 4.0 %, prompting the European Central Bank to signal potential further rate hikes. Emerging markets faced a mixed environment; some, like India and Brazil, benefited from higher commodity prices, while others experienced capital outflows amid rising U.S. yields.

Market Outlook: Navigating a Complex Terrain

In summary, U.S. markets on November 6, 2025, were navigating a labyrinth of economic signals and political uncertainties. The Fed’s continued high‑rate stance, coupled with a steepening Treasury curve, has pressured equities, especially growth‑oriented tech stocks. Inflation remains a concern, but core measures indicate a modest slowdown. The debt‑ceiling stalemate introduces a potential flashpoint that could cause volatility in fixed‑income markets. Meanwhile, robust GDP growth and low unemployment paint a cautiously optimistic picture for the labor market.

For investors, the key lies in balancing the attractiveness of yield‑driven assets against the backdrop of an inflationary economy and potential fiscal friction. Those with a longer investment horizon may find value in U.S. Treasury bonds and dividend‑rich sectors, while growth investors might focus on companies with resilient earnings and a strong price‑to‑earnings trajectory. As political developments unfold, market participants will need to remain vigilant and adapt to the dynamic landscape shaped by both domestic policy and global macroeconomic forces.

Read the Full reuters.com Article at:

[ https://www.reuters.com/business/finance/global-markets-view-usa-2025-11-06/ ]