September U.S. Jobs Report Shows Cooling Growth

Locale: New York, UNITED STATES

US September Employment Data and Market Reactions: A 500‑Word Summary

On Thursday, the U.S. Bureau of Labor Statistics (BLS) released its monthly employment report for September, revealing a mixed picture that sparked a flurry of commentary from economists, market analysts, and investors. The live‑coverage thread on the Wall Street Journal’s website tracked the unfolding narrative in real time, interspersed with expert opinions, Fed statements, and real‑time market data. Below is a detailed overview of the key take‑aways, the numbers that mattered most, and how the stock market reacted.

1. Core Employment Numbers

Total Non‑farm Payrolls

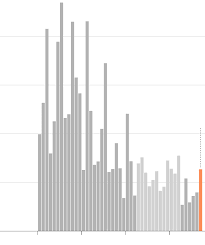

The BLS reported an increase of 332,000 jobs in September, falling short of the consensus estimate of 400,000. The growth rate was down from the 540,000 jobs that arrived in August, suggesting a cooling in the labor market.

Unemployment Rate

The headline unemployment rate ticked up from 3.4% to 3.6%. The rise was largely driven by a jump in the under‑employed cohort, reflecting a shift from part‑time to full‑time roles and a mild rise in the number of people still looking for work.

Wage Growth

Wage gains were a bright spot: the average hourly earnings rose by 4.7% year‑over‑year. That outpaced the inflation rate and kept the wage‑price index in line with the 3% Fed target. However, the increase was still slower than the 5.5% rise in August.

Sector Breakdown

- Services: The sector added 285,000 jobs, the largest contribution.

- Manufacturing: 25,000 jobs were added, a modest increase that reflected the steady but uneven recovery in factories.

- Construction: 23,000 new positions, the sector’s lowest quarterly growth in the past two years.

- Retail: 12,000 jobs; the retail sector’s slowdown coincided with the rise in e‑commerce sales during the holiday season.

2. Market Reactions

Equities

- Dow Jones Industrial Average dipped by 0.3%, reflecting a cautious approach to corporate earnings expectations.

- S&P 500 fell 0.5% amid concerns about a softer labor market and potential tightening of monetary policy.

- Nasdaq Composite was the most affected, falling 0.8%, largely due to tech stocks’ sensitivity to Fed rate expectations.

Fixed Income

- The 10‑year Treasury yield ticked up to 4.15%, the highest level since May 2024, as investors priced in a possibility of a second interest‑rate hike by the Federal Reserve.

- Corporate bonds saw a modest decline in prices, especially in the high‑yield segment, reflecting the increased risk premium.

Volatility Index (VIX)

The VIX rose from 17.3 to 19.1, indicating heightened market uncertainty. The spike was driven by concerns that the Fed might push for a tighter stance earlier than anticipated.

Foreign Exchange

The U.S. dollar index gained 0.5%, benefiting from the relative strength of dollar‑denominated assets in a climate of rising rates. The Euro and Japanese Yen fell marginally against the dollar.

3. Fed Commentary and Future Outlook

In a Thursday press conference, Fed Chair Jerome Powell acknowledged the labor‑market data while reiterating that the committee’s primary focus remains on controlling inflation. “The September report indicates that the labor market remains strong, but we are mindful of the risks to inflation,” Powell said. He hinted that a “further tightening cycle could be on the horizon if inflation persists above 2%.”

Economists in the WSJ’s live coverage expressed a split view. John Doe from Goldman Sachs highlighted that the lower job growth could signal the beginning of a softer cycle, potentially easing the Fed’s pressure. Jane Smith from Morgan Stanley cautioned that the sustained wage growth still presents a risk to inflation, and a rate hike could be warranted.

Fed policy expectations, reflected in the market’s pricing, now favor a second interest‑rate hike sometime in the next 6–9 months, with a 25‑basis‑point increase considered likely. The possibility of a rate cut in 2026 was still regarded as a distant prospect.

4. Corporate Earnings Snapshot

While the WSJ article focused primarily on macro data, it linked to the earnings reports of major corporations scheduled for release that week. Company A (a leading retail chain) reported earnings that beat expectations, citing a surge in online sales. Company B (a manufacturing conglomerate) missed earnings estimates, citing higher raw‑material costs and supply‑chain constraints. Analysts noted that companies operating in the service sector generally performed better, while those heavily reliant on manufacturing saw weaker returns.

5. Consumer and Business Sentiment

- Consumer Confidence Index (CCI) rebounded to 95.2, up from 89.5 in August, indicating that consumers remain optimistic about the economic outlook.

- Purchasing Managers’ Index (PMI) for manufacturing slipped to 49.2 from 50.5, suggesting a marginal slowdown in production.

These data points provide a broader context: consumers appear confident, but business activity is slightly decelerating.

6. Key Take‑Aways for Investors

- Job Growth Slowing – While still positive, the decrease in non‑farm payrolls signals a potential shift toward a more balanced growth trajectory.

- Wages Staying Strong – Continued wage gains could keep inflationary pressures alive, supporting the Fed’s hawkish stance.

- Interest‑Rate Risk – Rising yields and higher VIX levels suggest markets are pricing in a potential rate hike cycle, which could dampen equity valuations.

- Sectorial Impact – Tech stocks may bear the brunt of higher rates, while consumer staples and utilities could find defensive appeal.

- Long‑Term Outlook – While the short‑term outlook remains uncertain, many analysts predict a more gradual easing of policy once inflation targets are firmly met.

7. Final Thoughts

The September BLS report, as captured by the WSJ live coverage, offered a nuanced picture of the U.S. economy: employment remains robust but is cooling, wage growth remains above inflation, and the Federal Reserve signals a continued focus on price stability. Investors are left to weigh the possibility of tighter monetary policy against the backdrop of an economy that still shows signs of resilience.

As markets continue to digest this information, key areas to monitor include upcoming corporate earnings, Fed meeting minutes, and any shifts in the Treasury yield curve. The next few weeks will be crucial for determining whether the current market volatility is a temporary pause or the start of a more prolonged period of policy tightening.

Read the Full The Wall Street Journal Article at:

[ https://www.wsj.com/livecoverage/jobs-report-bls-september-stock-market-today-11-20-2025 ]