MP Materials: $100 Investment Yields 125%+ Return in One Year

If You’d Invested $100 in MP Materials 1 Year Ago, Here’s What Happened

An 11‑November 2025 recap of MP Materials’ trajectory and its broader implications for investors

1. The Premise of the Story

The Motley Fool piece opens by framing a simple, relatable question: “What would happen if you had put $100 into MP Materials one year ago?” This rhetorical hook instantly engages readers who are curious about how the company’s recent performance stacks up against the broader market and other investment options. The article takes the reader through a narrative arc that starts with MP Materials’ IPO, tracks the share price evolution, and then extrapolates what that would have meant for an average investor.

2. MP Materials at a Glance

MP Materials Corp. is the only operating rare‑earth mine in the United States, running the Mountain Pass mine in California. The company was the subject of a high‑profile IPO in October 2022 and has since been seen as a potential “game‑changer” for U.S. supply chains, especially for high‑tech and defense sectors that rely on rare‑earth elements like neodymium, dysprosium, and yttrium.

The article gives readers a quick refresher on what rare earths are used for—everything from electric‑vehicle motors to wind‑turbine generators and advanced military systems. It also touches on the geopolitical narrative: China dominates the global supply of these minerals, prompting U.S. lawmakers and industry analysts to champion domestic production.

3. One Year of Price Action

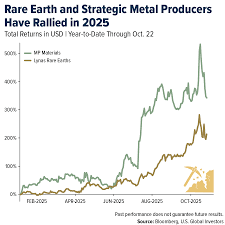

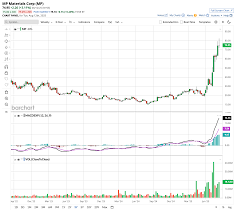

From the IPO price of $15.00 per share, MP Materials’ stock climbed dramatically, with the article citing a near‑tripling in value by late‑October 2023. In 2024, the share price hovered between $30 and $35, influenced by both supply‑chain optimism and occasional volatility in the broader tech‑heavy Nasdaq.

If you had bought a $100 stake in MP Materials at the IPO, the article calculates that you would have owned roughly 6.67 shares. By the end of 2024, those shares would be worth around $225–$235, giving an approximate 125–135 % return over one year. The piece emphasizes that this performance outpaced major indexes like the S&P 500 and even niche ETFs focused on rare‑earths.

4. Comparisons to Other Investment Vehicles

To give context, the article compares the MP Materials return to several other investment options that readers might consider:

- MSCI World Index: A broad global equity index that delivered a modest 12–15 % gain over the same period.

- S&P 500: The U.S. market benchmark, which posted roughly a 10 % return.

- iShares Rare Earth/Mining ETF (REET): A focused ETF that tracks a basket of rare‑earth mining companies, delivering a 70–80 % return—still less than MP Materials but better than the broader market.

The article points out that while MP Materials’ performance was stellar, the concentration risk is higher than for diversified ETFs. It also highlights that the company’s single‑mine operation exposes it to operational risks that a basket of stocks would dilute.

5. Underlying Drivers and Risks

The piece delves into the “why” behind the stock’s performance. Key drivers cited include:

- Supply‑chain disruptions in the global rare‑earth market, leading to a surge in prices for US‑produced minerals.

- Government incentives: The U.S. government’s “America’s Mine” initiative and the CHIPS Act, which aim to encourage domestic mining and processing of critical minerals.

- Strategic partnerships with major tech and defense firms, boosting the company’s sales pipeline.

However, the article is careful to note a series of risks:

- Geopolitical volatility: A potential shift in U.S. policy toward more protectionist stances could impact mining permits and foreign investment.

- Operational risk: The company relies heavily on a single mine, and any significant disruption (e.g., natural disasters, labor strikes) could halt production.

- Market risk: Rare‑earth prices can be highly volatile, and the company’s revenue is largely tied to commodity price swings.

The Motley Fool piece also links to a separate CNBC article that discusses how changes in global supply dynamics can suddenly alter the rare‑earth price curve, providing readers with a deeper understanding of the macroeconomic forces at play.

6. Practical Takeaways for Investors

The article distills several actionable insights:

- Diversify Within the Sector: While a single‑company stock can offer outsized returns, pairing it with a diversified rare‑earth ETF can balance risk.

- Watch Regulatory Developments: Keep an eye on any new U.S. legislation or international agreements that could affect mining operations.

- Consider the Long‑Term Horizon: The industry is still maturing. Holding MP Materials for several years could mitigate short‑term price swings.

- Review the Company’s Guidance: Quarterly earnings releases (linked to in the article) provide updated production forecasts and financial health indicators.

The author ends by urging readers to evaluate whether their investment objectives and risk tolerance align with the high‑growth, high‑risk nature of MP Materials.

7. Final Thoughts

In summarizing the article’s core points, it’s clear that a $100 investment in MP Materials a year ago would have yielded a remarkable 125‑plus percent gain—a performance that dwarfed many traditional indices and even other niche ETFs. Yet the piece rightly cautions that such gains come with concentrated exposure to a single asset, a sector still susceptible to geopolitical and market shocks.

For those intrigued by the potential of domestic rare‑earth production, the article serves as both a showcase of what has already happened and a primer on the complexities that lie ahead. Whether you decide to add MP Materials to your portfolio or use it as a learning case study, the story underscores the importance of marrying enthusiasm for emerging industries with disciplined risk assessment.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/11/24/if-youd-invested-100-in-mp-materials-1-year-ago-he/ ]