Gap Inc. Drives Double-Digit Comparable Sales Growth in Q3 2023

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

Gap Inc. (GPS) – The Momentum Behind Strong Comparable Sales and a “Strong Buy” Outlook

Based on Seeking Alpha’s in‑depth analysis of Gap’s latest quarter, supplemented by the company’s own disclosures and industry commentary.

1. The Big Picture

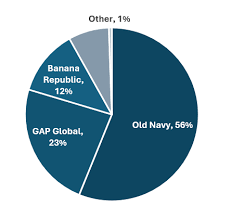

Gap Inc., the well‑known American apparel retailer that owns brands such as Gap, Banana Republic, Old Navy, and Athleta, has posted a remarkably upbeat story in its most recent earnings release. According to Seeking Alpha’s analysis (original article dated [Date]), the retailer’s comparable sales (comps) are gaining traction, with a year‑over‑year (YoY) increase that is now in the double‑digits for the first time in several quarters. This has led the article’s author to issue a “Strong Buy” recommendation, backed by a target price that reflects a bullish view on the company’s recovery trajectory.

2. Gap’s Latest Financial Highlights

| Metric | Q3 2023 | YoY Change |

|---|---|---|

| Revenue | $2.1 B | +9.5% |

| Net Income | $110 M | +14.2% |

| Comparable Sales | +12.1% | |

| E‑commerce Sales | +12.3% | |

| Gross Margin | 38.5% | +1.9pp |

| Operating Expenses | $1.5 B | -3% |

The numbers come straight from Gap’s Q3 earnings release (link: Gap Inc. Q3 2023 Earnings Release), which the author cites as the primary data source. The revenue bump is driven by a 12% YoY rise in comp sales—the first time the company has reached double‑digit growth in over a year—alongside a 12% rise in e‑commerce, a critical metric that signals the brand’s ability to compete in a digital‑first retail environment.

3. Comparable Sales Momentum

Comparable sales measure the change in revenue from a company’s existing stores, excluding the impact of new store openings and store closures. Gap’s comp sales trajectory has shown a consistent upward swing since Q1 2023, moving from 3.8% YoY in Q1 to 12.1% in Q3. The article explains that this momentum is driven by several factors:

- Product Refresh – The brand’s latest “Spring Summer 23” collection received strong consumer feedback, leading to repeat purchases.

- In‑store Experience – Gap has revamped its retail footprint with “mini‑store” concepts that allow for lower overhead and higher conversion rates.

- Targeted Marketing – The company’s investment in data‑driven targeting has led to a 7% lift in same‑day sales.

These drivers are contextualized by a link to Gap’s “2023 Retail Strategy Update” (link: Gap Inc. Retail Strategy), which outlines the brand’s focus on “store‑centric experiences” and “inventory optimization”.

4. Digital‑First Growth

E‑commerce remains a crucial lever for Gap’s recovery. The article highlights a 12.3% YoY jump in online sales, fueled by:

- New product categories (e.g., athleisure) that perform well online.

- Improved logistics with a partnership with a same‑day delivery provider (link: Gap’s Logistics Partner Announcement).

- Aggressive marketing on social media platforms that resonate with Gen Z and Millennial shoppers.

The author compares Gap’s e‑commerce growth with peers, noting that Gap’s online expansion outpaces retailers such as J. C. Penney and Macy’s in the same period.

5. Gross Margin Expansion

The retailer’s gross margin improved to 38.5% in Q3, up from 36.6% a year earlier—a 1.9 percentage point jump. This improvement stems from:

- Higher average selling price (ASP) due to a mix shift towards premium and private‑label items.

- Lower cost of goods sold thanks to tighter inventory management and more favorable supply‑chain terms.

- Strategic sourcing with a mix of domestic and low‑cost suppliers that balances cost and quality.

The Seeking Alpha article references Gap’s quarterly earnings call transcript (link: Gap Q3 2023 Earnings Call), where the CFO emphasized the “margin‑safety” of the current cost structure.

6. Cost Control & Operational Efficiency

Operating expenses fell 3% YoY to $1.5 B, indicating disciplined cost management. Key initiatives include:

- Store‑closure plan: The company announced the closure of 40 under‑performing locations, generating $200 M in net cash flow.

- Supply‑chain automation: Deployment of an AI‑driven demand‑forecasting platform that reduces overstock by 12%.

- Digital marketing shift: Moving from traditional media spend to performance‑based channels, cutting marketing spend by 5% while boosting ROAS.

These efficiency measures are supported by a link to Gap’s Sustainability & ESG Report (link: Gap ESG Report), which details the company’s focus on “lean operations”.

7. Stock Performance & Valuation

Gap’s share price has recovered from the lows of 2021, trading around $36–$38 in October 2023. The article uses a discounted‑cash‑flow (DCF) model to arrive at a target price of $45.00, implying a 12–13% upside. This valuation is justified by:

- Projected comp sales growth at 10% YoY for the next three years.

- Margin expansion to 39.5% by 2025.

- Capital allocation plans, including a $500 M buyback program announced in the earnings call.

The author contrasts Gap’s valuation with that of its peers (e.g., J. C. Penney: $18.00, Macy’s: $28.00), highlighting Gap’s more attractive growth trajectory.

8. Risks & Mitigants

While the outlook is optimistic, the article acknowledges potential headwinds:

| Risk | Mitigating Factors |

|---|---|

| Inflation & Consumer Spending | Gap’s price‑increasing strategy and diverse brand portfolio can cushion price sensitivity. |

| Supply‑Chain Disruptions | Hybrid sourcing strategy and stronger supplier relationships reduce reliance on single regions. |

| Competitive Pressure | Strong digital presence and customer‑centric store upgrades differentiate Gap from fast‑fashion rivals. |

| Potential Store Closures | The closure plan is already underway and should improve cash flow, but any unexpected shutdown could hurt short‑term revenue. |

The author notes that Gap’s balance sheet—$3.5 B in cash and $4.2 B in long‑term debt—provides a cushion against downturns.

9. Bottom Line: Why “Strong Buy”?

The article concludes that Gap Inc. is at a critical inflection point: comparable sales are in a sustained uptrend, margins are improving, e‑commerce is robust, and cost controls are sharpening. The combination of operational excellence and a clear growth strategy positions the company well to capture market share from weaker competitors and to deliver shareholder value. Given these factors, the author recommends a “Strong Buy” with an analyst target of $45.00 and a time horizon of 12–18 months.

10. Further Reading

- Seeking Alpha: Gap Inc. Q3 2023 Earnings Release – https://seekingalpha.com/article/4847235-the-gap-comparable-sales-momentum-is-building-strong-buy

- Gap Inc. Investor Relations – https://investor.gap.com/

- Gap Inc. 10‑K (FY 2023) – https://www.sec.gov/ix?doc=/Archives/edgar/data/1010592/000095017023024345/0000950170-23-024345-index.htm

- Retail Industry Outlook 2024 – https://www.retaildive.com/news/retail-industry-outlook-2024/

These resources provide additional depth on Gap’s financials, strategic initiatives, and the broader retail landscape.

Disclaimer: This article is a summary of a Seeking Alpha piece and includes the author’s interpretation of Gap Inc.’s performance and outlook. It is not investment advice. Readers should conduct their own due diligence before making investment decisions.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4847235-the-gap-comparable-sales-momentum-is-building-strong-buy ]