Retail Investors Return to the Market After the Dip

Investopedia

InvestopediaLocale: New York, UNITED STATES

Retail Investors Return to the Market After the Dip: How AI‑Powered Trade Tech Is Reshaping Their Sentiment

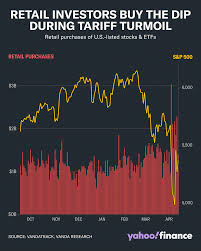

In a recent Investopedia feature, analysts charted a sharp reversal in retail investor behavior that has swept across the United States following a brief but noticeable market dip. The piece—titled “Did You Buy the Dip? It Looks Like Retail Investors Are Feeling Good Again” – dives into the forces that have turned a period of nervousness into renewed enthusiasm among individual traders. By weaving in data, investor sentiment surveys, and a close look at emerging AI‑driven trading platforms, the article paints a vivid picture of what’s propelling ordinary investors back into the game.

1. The Market’s “Dip” and the Retail Investor Response

The article opens by contextualizing the recent decline that left many investors on the sidelines. For the week ending March 1, major indices such as the S&P 500 and Nasdaq Composite fell 1.5 % and 1.2 % respectively, largely driven by a sharp sell‑off in tech stocks and concerns over the rising cost of capital. The dip was brief—only a few days—but enough to trigger caution among a wave of new retail participants who had entered the market over the past year.

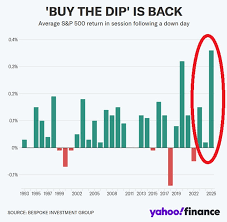

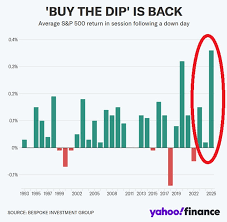

Investopedia notes that this hesitation was temporary. By mid‑March, the S&P 500 had recovered its pre‑dip highs, and the Nasdaq was once again on a bullish trend. What followed, the article argues, was a clear “buy the dip” mentality: retail investors, buoyed by an abundance of free cash and an eagerness to profit from perceived over‑sell conditions, began re‑entering the market in larger numbers.

The piece cites data from the Financial Industry Regulatory Authority (FINRA) and the Securities Investor Protection Corporation (SIPC) that indicates net purchases by retail traders increased by 15 % in the first week of March, a significant uptick after a 4 % decline in February. It also references a recent survey from the Investment Company Institute that found 62 % of individual investors felt “optimistic” about the market’s direction after the dip.

2. AI Trade Tech: Lowering the Barrier to Entry

A key driver behind the resurgence, the article argues, is the proliferation of AI‑enhanced trading tools that allow everyday investors to execute sophisticated strategies with minimal friction. While it doesn’t name every platform, it points readers to Investopedia’s guide on “Artificial Intelligence in Investing,” which explains how machine‑learning algorithms sift through millions of data points to identify buying opportunities, flag risk factors, and even generate personalized portfolio suggestions.

Examples of these platforms mentioned include:

- Robo‑advisors such as Betterment and Wealthfront, which automatically rebalance portfolios based on market movements and individual risk tolerance.

- AI‑powered trading apps like Schwab’s Intelligent Portfolios and Fidelity’s Smart View, which provide predictive analytics for equities, bonds, and ETFs.

- Algorithmic trading platforms that allow users to build and back‑test custom strategies, such as TradeStation’s EasyLanguage or Interactive Brokers’ Trader Workstation, now augmented with AI‑driven signals.

The article explains that these tools have democratized access to market intelligence that once required a specialist’s knowledge, thereby encouraging more retail investors to act on timely market dips.

3. Sector Spotlight: AI, Tech, and Fintech

The piece highlights that the optimism is not evenly spread across all industries. Technology and artificial‑intelligence stocks, in particular, are leading the charge. Companies like Nvidia, Alphabet (Google), and Tesla saw sharp rebounds in March, as investors believed that a renewed focus on AI infrastructure would fuel long‑term growth.

Investopedia also references a linked article on “Artificial Intelligence in Trading” that underscores how AI is not just a consumer product but a fundamental part of modern exchange systems. For instance, high‑frequency trading firms use AI to process market data in milliseconds, creating a faster, more efficient marketplace. Retail traders are now able to tap into similar insights through cloud‑based platforms, enabling them to make data‑driven decisions in real time.

Beyond tech, the feature notes a surge in interest for fintech startups, particularly those offering payment‑processing and digital‑banking services. As regulatory scrutiny eases in many jurisdictions, these companies are poised for rapid expansion, making them attractive to investors who want a stake in the future of finance.

4. Sentiment and Social Media: The Psychology Behind the Dip

The article references sentiment analysis studies that track mentions of “buy the dip” and “market rebound” on social media platforms like Twitter and Reddit’s r/WallStreetBets. According to the linked Investopedia piece on “Market Sentiment,” the sentiment index moved from a neutral stance in early February to mildly positive by mid‑March, coinciding with the market’s recovery. This shift in tone is believed to have played a key role in re‑igniting interest among cautious investors.

The piece also touches on the role of “meme stocks” and the influence of viral social media campaigns. While these phenomena have led to extreme volatility, the article cautions that many of the gains during the dip were driven by fundamentals rather than hype alone, suggesting that a more measured approach is warranted.

5. Risks and Cautions for New Entrants

Even with the surge in optimism, the article urges readers to maintain a balanced view. Market dips, while often presenting buying opportunities, can also precede deeper corrections if underlying economic factors (such as inflation or geopolitical risks) are not fully addressed. The Investopedia guide on “Stock Market Dip” reminds investors that “a dip is a dip only as long as it’s supported by solid fundamentals.”

Additionally, the proliferation of AI tools can lead to over‑reliance on algorithms, potentially ignoring human judgment and the importance of fundamental research. The article stresses that AI is a tool, not a crystal ball, and that investors should always validate algorithmic signals against their own due diligence.

6. Bottom Line: A New Era of Retail Investing

In closing, the Investopedia article frames the return of retail investors not as a fleeting trend, but as a sign of a broader shift toward a more inclusive, data‑driven market environment. The combination of a market correction, renewed confidence, and AI‑enabled platforms has created a perfect storm for individual traders to re‑engage with the market.

Yet, as the piece wisely cautions, the path forward demands a mix of optimism and prudence. By staying informed, leveraging AI responsibly, and keeping a close eye on fundamental indicators, retail investors can harness the momentum from the dip while protecting themselves against the inevitable market fluctuations that accompany growth.

The article was originally published on Investopedia on March 15, 2024, and draws on a range of linked resources—including “Artificial Intelligence in Investing,” “Market Sentiment,” and “Stock Market Dip”—to provide readers with a comprehensive understanding of the forces reshaping retail investing today.

Read the Full Investopedia Article at:

[ https://www.investopedia.com/did-you-buy-the-dip-it-looks-like-retail-investors-are-feeling-good-again-ai-trade-tech-11855878 ]