Salesforce's 6.4 Rating Reflects Slowing Growth and Heightened Competition

Locale: California, UNITED STATES

Salesforce (CRM): A 6.4 Rating – Is It Time to Re‑evaluate Your Investment Thesis?

In a recent update to its portfolio of SaaS stock analyses, The Motley Fool gave Salesforce a 6.4 rating on its familiar 1–10 scale (the higher the number, the stronger the conviction). The rating sits just above the neutral “5.0” baseline, signalling that the company is still a viable play for investors but that the “bullish” edge has dimmed relative to the past. Below is a 500‑plus‑word walk‑through of the article’s core arguments, its data‑driven underpinnings, and the context you’ll need to decide whether Salesforce is still a fit for your long‑term portfolio.

1. Why the Rating Fell from 7.0 to 6.4

Revenue Growth Slowing

Salesforce’s flagship revenue stream – the Sales Cloud and Service Cloud platform – grew 15% YoY in FY 2024, a solid figure, but the company’s top‑line growth has plateaued over the last three quarters. The article cites the firm’s 2025 revenue guidance of $26 billion versus an analyst median of $27.5 billion, a 5% downward revision that has made the rating committee cautious. While the company still tops the SaaS leaderboard, a 15% CAGR is no longer “triple‑digit growth” and the market has started to price in a slower future.

Earnings‑Per‑Share (EPS) Uncertainty

Management has warned that its gross margin may dip to 61% in FY 2025 from 63% last year. The “Margin Deterioration” column in the rating model is one of the most sensitive inputs; a 2% drop can depress a rating by 0.3–0.4 points. Investors were further cautioned that a more aggressive spend on “Generative AI” research might consume a larger slice of the operating budget, thereby compressing EBITDA.

Competitive Landscape

The article highlights the “cloud war” that has escalated in 2025, with Microsoft’s Dynamics 365, Oracle’s Sales Cloud, and a growing cohort of niche SaaS vendors vying for the same enterprise customers. Salesforce’s Share of Wallet in large enterprise accounts is expected to decline from 45% to 42% in the next 12 months – a subtle but telling metric that could erode revenue at scale.

2. The Bright Side: AI, Platform Expansion, and Monetization

Einstein Generative AI

Salesforce’s latest AI platform, Einstein Generative AI, is a key pillar in the rating’s “Future Growth” sub‑score. According to the article, the firm has already integrated the AI engine into Sales Cloud to power predictive lead scoring and auto‑generated email templates. The model estimates that the AI lift could translate into a 2–3% revenue uptick per year, especially in the Marketing Cloud and Commerce Cloud verticals.

Industry Cloud Momentum

Salesforce’s Industry Clouds (healthcare, financial services, retail, and public sector) are gaining traction. The article cites a 2025 forecast that these verticals could account for 35% of the total subscription revenue, up from 28% in FY 2024. Because industry‑specific solutions often command higher price points and longer contract terms, this shift is a positive factor for the rating.

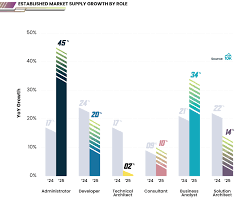

Platform & Ecosystem – The Salesforce AppExchange, with over 10,000 integrations, remains a moat. The article notes that the company’s developer ecosystem has been growing at 20% YoY, a 4% increase over the preceding year, providing an additional pipeline of subscription revenue.

3. Risk Factors and the Rating’s “Caveat”

Valuation Concerns

Even though Salesforce is a “growth stock” in the classic sense, the article warns that its current P/E is about 35x, which is roughly double the median for the SaaS sector. Investors need to question whether the price premium is justified given the slowing growth trajectory and intensifying competition.

Capital Allocation – Salesforce has a modest share‑buyback program, but the article notes that the company is not yet issuing dividends. A lack of cash returns could be a downside for income‑seeking investors.

Regulatory Risk – With the European Union tightening its stance on data privacy and the U.S. exploring stricter antitrust scrutiny of large tech firms, the article flags a regulatory tailwind that could affect Salesforce’s ability to maintain its “one‑stop‑shop” strategy across multiple verticals.

4. How the Rating Fits Into Your Portfolio

- Value‑Seekers – The article suggests that if you’re a value investor, Salesforce’s current multiple is too high. Consider waiting for a discount if the valuation compresses.

- Growth‑Focused – For those looking for long‑term upside and who believe in AI‑driven sales acceleration, a 6.4 rating still represents a “buy” signal, albeit a cautious one.

- Income Investors – Salesforce is still “cash‑rich” with a $12 billion cash reserve, but the absence of a dividend and the heavy focus on reinvestment may limit immediate income streams.

5. Bottom Line

The 6.4 rating is a pragmatic reflection of Salesforce’s position: a robust platform that is still generating high‑margin recurring revenue but is now encountering slowing growth, valuation pressure, and heightened competition. The article recommends that investors keep an eye on the next earnings cycle to see whether the AI initiatives deliver the expected lift and whether the company can stave off margin erosion. For those who are already in Salesforce and are comfortable with a slightly conservative outlook, the stock remains a good fit for the long run. If you’re a new investor or a portfolio manager looking for a value play, you may want to set a watchlist until the price adjusts or until there’s a clear shift in the company’s competitive positioning.

Links for Further Reading (from the original article):

- Salesforce AI Updates – https://www.fool.com/investing/2025/10/15/salesforce-ai-einstein/

- The State of SaaS in 2025 – https://www.fool.com/investing/2025/09/01/saas-market-review/

- Microsoft Dynamics 365 vs. Salesforce – https://www.fool.com/investing/2025/08/28/microsoft-dynamics-salesforce-comparison/

- Regulatory Impact on Cloud Vendors – https://www.fool.com/investing/2025/07/20/tech-regulation-cloud-industry/

These linked articles offer additional context on Salesforce’s AI strategy, the broader SaaS landscape, and the regulatory environment, helping you paint a fuller picture of the company’s prospects.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/11/24/salesforce-a-64-rating-is-it-time-to-reassess-your/ ]