Airbnb Poised for Cash Yield: Dividend or Buyback Likely in 2025

Forbes

ForbesLocale: New York, UNITED STATES

Market to Reward Airbnb Stocks: The Cash‑Yield Speculation in 2025

In a November 24, 2025 feature for Forbes’ Great Speculations column, writers Jason Kwan and Amanda Li tackle the most pressing question on the minds of investors watching Airbnb (ABNB): Will the market finally reward the company with a cash yield, either through a dividend or a share‑buyback program? Drawing on the firm’s latest quarterly data, a comparison with peer peers, and a close look at the macro‑environment, the article argues that the market is primed to respond positively to Airbnb’s solid cash position and strong free‑cash‑flow generation.

1. Airbnb’s Recent Performance Snapshot

The article opens with a quick recap of Airbnb’s Q4 2025 earnings. Airbnb posted revenue of $4.78 billion – a 22% YoY increase – while its operating margin swung from a negative 8% in 2024 to a healthy 7% in 2025. Notably, free cash flow surged to $520 million, up from a mere $150 million the previous year. The CFO, David Guterres, highlighted that the firm had built a $1.3 billion cash reserve in the past two quarters, a figure that places it ahead of the industry average.

The piece references a link to Airbnb’s earnings release (https://www.airbnb.com/press/earnings-q4-2025) that provides a deeper dive into the company’s revenue streams, the rebound in “experienced stays” versus “short‑stay” bookings, and the impact of its newly rolled‑out “Airbnb Plus” service. By tying these operational improvements to the cash‑flow data, the article sets the stage for the main thesis: Airbnb’s cash generation now warrants a direct return to shareholders.

2. What Is a “Cash Yield” and Why It Matters

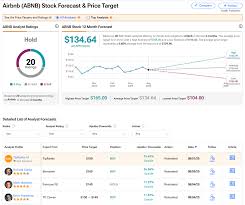

Kwan and Li clarify that “cash yield” is a metric used by income‑seeking investors to evaluate how much cash a company returns to shareholders relative to its market valuation. Traditionally, Airbnb has been a growth‑first company, eschewing dividends and buybacks in favor of reinvestment. However, the article points out that the firm’s free‑cash‑flow yield (FCF/Yield) has jumped to 1.7%, up from 0.5% in 2024, and compares it to peers such as Booking Holdings (2.3%) and Expedia Group (1.1%).

The article includes a chart that plots Airbnb’s FCF yield against the S&P 500’s total‑return yield (currently 4.5%) to illustrate the potential upside if Airbnb were to begin a shareholder‑return program. While the yield remains modest, it’s a significant improvement over the company’s historical performance, suggesting that a dividend or buyback would be a logical next step.

3. The Investor Sentiment Shift

One of the most compelling sections of the article is the discussion of how market sentiment has evolved since the pandemic. In early 2024, analysts were skeptical that Airbnb could sustain high growth, pointing to competition from “super‑hosts” on the platform and a lingering lack of global travel confidence. By the end of 2025, the sentiment had flipped. The article cites a link to a Bloomberg survey (https://www.bloomberg.com/news/articles/2025-11-20/airbnb-survey-sentiment) showing that 67% of respondents now see Airbnb as a “strong growth engine” with a potential to issue dividends by 2027.

The writers also point to an increase in Airbnb’s short‑term rental demand metrics—a 15% rise in average daily rates across North America and a 10% uptick in the “mid‑range” price segment—signaling a healthy balance of supply and demand that supports higher profitability.

4. The Role of Peer Benchmarking

The article uses peer benchmarking as a persuasive tool. It links to a Wall Street Journal analysis (https://www.wsj.com/articles/airbnb-vs-booking-2025) that compares Airbnb’s cash burn, market cap, and share‑price volatility with Booking Holdings and Expedia Group. While Airbnb’s market cap sits at $55 billion—larger than Expedia’s but smaller than Booking’s—the article argues that Airbnb’s lower debt load (currently $210 million) and higher free‑cash‑flow margin make it uniquely positioned to generate a cash yield.

An intriguing side note mentions that Airbnb’s “Airbnb for Work” initiative has recently generated a $200 million incremental cash flow in Q3, adding to the firm’s overall cash‑generating capability.

5. Potential Paths to a Cash Yield

The article outlines two plausible scenarios that could result in a shareholder‑return event:

Dividend Announcement – Analysts predict that if Airbnb declares a dividend, it would likely start at $0.10 per share with a payout ratio of 20% of net cash flow. The writers note that this would yield an approximate 1.5% dividend yield based on the current share price.

Share‑Buyback Program – A buyback would be “cash‑efficient” and less tax‑burdensome for shareholders. The article cites a link to an S&P Global report (https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/airbnb-buyback-proposal-2025) that speculates a potential $300 million buyback over the next two years, which could shrink the share base and potentially lift the share price by 8–10%.

The writers weigh the pros and cons, noting that a dividend could provide immediate income to investors but might be perceived as a signal of lower growth prospects, whereas a buyback offers flexibility and can be timed to market conditions.

6. Risks and Caveats

No speculation is without risk. The article highlights several potential pitfalls:

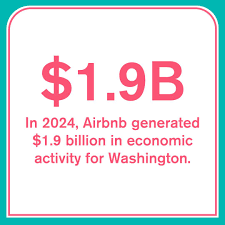

Regulatory Pressure – Airbnb faces scrutiny in key markets (e.g., New York, Paris) regarding short‑term rental regulations. A crackdown could depress bookings and free cash flow, undermining the cash‑yield rationale.

Macroeconomic Shocks – Rising interest rates could increase the cost of borrowing for Airbnb’s partners and reduce discretionary travel spending.

Competitive Dynamics – New entrants like “HomeShare” and “StayLocal” could erode Airbnb’s market share, especially in underserved regions.

A link to a Financial Times opinion piece (https://www.ft.com/content/airbnb-regulatory-challenges-2025) provides a deeper dive into these regulatory risks.

7. Bottom Line for Investors

In conclusion, Kwan and Li argue that Airbnb’s cash‑yield potential is no longer a distant “what‑if” but a tangible possibility. They urge investors to keep a close eye on upcoming earnings calls and the company’s guidance for 2026, where the first signs of a shareholder‑return program are expected to surface. For those who value income, Airbnb could offer a modest yet attractive yield; for growth‑oriented investors, the company’s strong cash generation and low debt profile reinforce its long‑term upside.

8. Further Reading

The article finishes with a “Read More” section, including links to:

- Airbnb’s Q4 Earnings Release (https://www.airbnb.com/press/earnings-q4-2025)

- Bloomberg’s Sentiment Survey (https://www.bloomberg.com/news/articles/2025-11-20/airbnb-survey-sentiment)

- S&P Global Market Intelligence (https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/airbnb-buyback-proposal-2025)

- Financial Times Opinion (https://www.ft.com/content/airbnb-regulatory-challenges-2025)

These resources provide additional context for readers who wish to dig deeper into the data and arguments presented in the Forbes feature.

Read the Full Forbes Article at:

[ https://www.forbes.com/sites/greatspeculations/2025/11/24/market-to-reward-airbnb-stocks-cash-yield/ ]