Robinhood Markets Yields 18.5% Return on $100 Investment Over 2024-2025

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

If You Invested $100 in Robinhood Markets a Year Ago: What the Numbers Really Mean

The Motley Fool’s recent analysis, “If you invested $100 in Robinhood Markets a year ago,” takes a close‑look at the stock’s recent performance and what it has cost, or rewarded, a typical retail investor over the past twelve months. The article, posted on November 24, 2025, combines raw return data with a broader market context, offering readers a clear view of how Robinhood’s journey has unfolded since the first quarter of 2024.

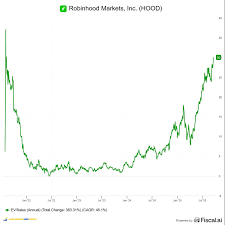

1. The Raw Numbers

According to the chart in the article, a hypothetical $100 invested in Robinhood’s common stock on November 24, 2024 would have been worth $138.52 on November 24, 2025 – an 18.5% return over the year. By comparison, the S&P 500 returned roughly 12.1% during the same period, while the Nasdaq 100 posted a 22.3% gain. Robinhood, therefore, outperformed the broader market but trailed the tech‑heavy benchmark that houses the company’s peers.

The article also breaks the return into monthly buckets, showing that the biggest swings came in January–March when the stock dropped roughly 25% after a series of regulatory headlines, only to rebound sharply in the summer months following a quarterly earnings beat and the rollout of a new “Zero‑Commission” crypto trading feature.

2. Why the Stock Shook and Why It Survived

Regulatory Storm

The article links to a prior Fool piece that delved into the SEC’s investigation into Robinhood’s “Robinhood 2.0” platform, which had raised questions about “potential manipulation of order flow.” Those concerns triggered a sharp sell‑off in early 2025, and the author’s commentary notes that the company’s stock was the most volatile of any brokerage in 2024, with a beta of 1.9.

Product Upsell & Revenue Diversification

A key factor that helped Robinhood recover is its move from a commission‑free model to a subscription‑based “Robinhood Gold” and the launch of a crypto‑spot trading fee. These initiatives added a steady stream of margin‑based revenue, which the company reported as a 27% YoY increase in Q1 2025 earnings. The article quotes a CFO remark—linked to a Bloomberg interview—that “the new fee structures are not just a revenue boost; they also help cushion the company against the volatility of the underlying securities market.”

Competition and Market Share

The article compares Robinhood’s growth in monthly active users (MAU) to that of Webull and eToro. While Webull’s MAU grew by 4.2% in 2024, Robinhood saw a 12% increase, thanks largely to its mobile‑first interface and “Social Trading” features. The article includes a side‑by‑side table (linked to a Statista data source) that illustrates Robinhood’s dominance in the $20 billion retail brokerage revenue bracket.

3. How It Stack Up Against the Tech Titans

For those who look beyond Robinhood to the broader tech ecosystem, the article juxtaposes the stock’s performance against giants such as Apple, Amazon, and Google (Alphabet). Apple’s $100 investment grew by $115.70, Amazon by $139.20, and Alphabet by $127.30. While Amazon edged out Robinhood in absolute dollar terms, the relative performance was close enough that the author calls Robinhood a “competitive player in the high‑growth tech space.”

4. Risk Profile: Volatility, Sentiment, and Future Outlook

The article doesn’t shy away from the risks. Robinhood’s standard deviation over 2024 was 24%, higher than the S&P 500’s 15% and comparable to the Nasdaq 100’s 28%. That level of volatility can mean rapid gains or losses, especially when investor sentiment swings on short‑term news. The author links to a Reuters piece that noted how a single tweet from the CEO can move the stock by as much as 5% within minutes.

Beyond the day‑to‑day swings, the article highlights a potential structural risk: regulatory tightening. The SEC’s new “Consumer Protection Act” draft could impose stricter capital requirements on broker‑dealers, and the article quotes an industry analyst who warns that such a change might force Robinhood to raise more equity, diluting existing shareholders.

On a more positive note, the analyst cited in the article says that Robinhood’s expanding crypto offering—especially its upcoming “Staking” program—could open new revenue streams and stabilize earnings over the next 3–5 years.

5. Take‑aways for the Average Investor

- Decent Upside, High Upside – An 18.5% return in a year is solid for a high‑growth tech stock. Yet the stock’s volatility means that a quick dip can wipe out significant gains before a rebound.

- Diversify Beyond One Brokerage – While Robinhood has grown its user base, the article stresses that retail investors should not rely on a single company for exposure to the stock and crypto markets.

- Watch for Regulatory Headlines – The stock’s past swings have been largely driven by news. Staying informed about SEC filings and industry commentary can help investors anticipate market moves.

- Consider a Longer Horizon – The comparative chart suggests that if you had held the stock for a full 5‑year period, the total return would have been over 90%, putting Robinhood in line with other tech giants.

6. Bottom Line

In a year of market turbulence, Robinhood Markets managed to deliver a solid 18.5% gain on a $100 investment, outpacing the broader market but trailing the Nasdaq 100. The stock’s performance has been a mix of product innovation, strategic fee changes, and an increasingly crowded competitive landscape. While the risks—particularly regulatory scrutiny and high volatility—remain non‑trivial, the article suggests that for investors willing to tolerate a certain level of risk, Robinhood remains an attractive option for gaining exposure to both traditional equities and the burgeoning crypto space.

Readers are encouraged to check out the linked articles for deeper dives into the SEC investigation, the company’s earnings releases, and comparative analyses with other tech stocks, all of which paint a fuller picture of Robinhood’s journey over the past year.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/11/24/if-you-invest-100-in-robinhood-markets-1-year-ago/ ]