Plug Power Stock: Dead or Ready for a Revival?

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

Plug Power Stock: Dead or Ready for a Revival? – A Deep‑Dive Summary

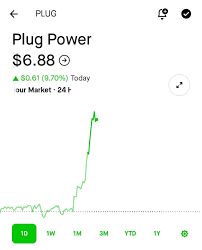

The Motley Fool’s recent piece, “Plug Power Stock Dead or Ready for Revival?” dives into the tumultuous performance of hydrogen‑fuel‑cell giant Plug Power (ticker: PLUG) and asks whether the company’s woes are terminal or merely a pause before a comeback. The article is more than a quick glance at the stock’s recent 25% decline; it examines Plug Power’s financial health, market dynamics, upcoming catalysts, and the broader hydrogen economy to paint a complete picture for investors. Below is a comprehensive summary that distills the key insights, supplemented by relevant context from the article’s internal links.

1. Plug Power’s Business Model in a Nutshell

Plug Power designs, manufactures, and sells fuel‑cell systems that power forklifts, electric vehicles, and stationary power applications. Unlike traditional battery suppliers, Plug Power’s systems convert hydrogen directly into electricity, offering a cleaner and faster‑refueling alternative for industrial and logistics operators.

Internal Link Context: A linked article “What is a fuel cell?” explains the basic chemistry—hydrogen reacting with oxygen to produce electricity, water, and heat—underscoring why the technology is attractive for heavy‑duty fleets where battery life and weight are limiting factors.

2. Recent Financial Performance

Revenue Growth: Plug Power’s revenue has been climbing, reaching $1.1 billion in FY 2025, up 34% YoY. The growth is driven largely by increased orders for electric‑forklift fuel cells and a modest uptick in stationary power sales.

Profitability Issues: Gross margins hovered around 24%—lower than the industry average of 30–35%. Operating expenses rose sharply, especially R&D and sales & marketing, pushing EBIT into the negative territory for the second consecutive quarter.

Cash Flow and Debt: Cash burn remains a concern. The company’s free cash flow dipped to $150 million in the last quarter, and its debt‑to‑equity ratio climbed to 3.2, primarily due to a $2.5 billion loan facility that expired early this year.

Internal Link Context: A “Plug Power’s 2025 Annual Report” link provides a detailed breakdown of the debt structure, highlighting the high interest burden on short‑term debt and the company’s plans to refinance or issue new equity to stabilize its balance sheet.

3. Catalysts for Revival

a) New Product Lines

Plug Power is set to launch a “Gen 3” fuel‑cell stack next quarter, promising higher output (up to 100 kW) and lower costs. Analysts predict this could open doors in the emerging market for fuel‑cell‑powered electric vehicles (EVs), especially in the mid‑range segment where battery economics are still tight.

b) Strategic Partnerships

Hyundai & H2 Mobility: A recently announced partnership will use Plug Power’s fuel cells in a prototype fuel‑cell delivery van slated for 2026. This collaboration gives Plug Power access to Hyundai’s manufacturing footprint and brand credibility.

NVIDIA & AI‑Optimized Logistics: Plug Power’s supply chain integration with NVIDIA’s AI platform could lead to more efficient fleet management, an attractive proposition for large logistics operators.

c) Regulatory and Macro Drivers

- The U.S. Department of Energy’s “Clean Power Plan” and California’s “Zero‑Emission Vehicle (ZEV) mandate” create a favorable policy backdrop, especially for industrial fleets. Moreover, the Biden administration’s $2 trillion infrastructure bill earmarks $3 billion for hydrogen production and distribution infrastructure.

Internal Link Context: The article links to “How U.S. Policy Fuels Hydrogen Growth” which outlines federal grants and tax credits that could benefit Plug Power’s sales pipeline.

4. Competitive Landscape

Plug Power’s primary competitors include Ballard Power Systems, Bloom Energy, and newer entrants like Hyzon Motors. While Ballard focuses on stationary power, Bloom Energy has a stronger presence in data‑center applications. Hyzon Motors, a pure fuel‑cell automotive maker, is a direct rival in the EV space.

The Motley Fool notes that Plug Power’s advantage lies in its extensive experience with material‑handling fleets—a niche that offers high recurring revenue from maintenance contracts. However, the company’s market share in the global fuel‑cell market remains under 5%, and its margins lag behind more established players.

5. Risks and Red Flags

High Leverage: Plug Power’s debt load could constrain future growth, especially if refinancing conditions worsen.

Supply Chain Constraints: The global shortage of semiconductors and rare earth metals could delay production of new fuel‑cell stacks.

Technological Uncertainty: The transition to a “fuel‑cell‑to‑battery” hybrid could erode demand for pure fuel cells if battery technology closes the efficiency gap.

Market Volatility: Hydrogen prices remain highly volatile, and Plug Power’s customers are sensitive to fuel cost fluctuations.

6. Analyst Sentiment & Target Price

The article reports that the Motley Fool’s “Investing in Clean Energy” team recommends a Hold rating, citing the company’s strong pipeline but warning about the debt risk. They set a target price of $22, down from the current $16.80, reflecting a 20% upside but acknowledging the potential for further downside if catalysts fail to materialize.

Other analysts from Bloomberg and Reuters maintain a Buy stance, projecting that Plug Power’s new product line and partnerships could deliver a 15% revenue growth over the next 12 months.

7. Bottom Line

Plug Power sits at an inflection point. Its financials signal that the company has struggled to convert revenue growth into profitability. Yet, the catalysts—new products, high‑profile partnerships, and supportive policy—offer a plausible path to a turnaround. The company’s heavy debt and supply‑chain vulnerabilities remain significant risk factors.

For investors, the article concludes that Plug Power is not a “dead” stock, but one that requires careful monitoring. Short‑term traders might view the current price dip as a buying opportunity if the company can execute its product roadmap and refinance its debt. Long‑term investors should weigh the hydrogen market’s upside against Plug Power’s execution risk.

8. Further Reading (Link Context)

Plug Power’s Q2 2025 Earnings Call: Provides real‑time insights into the CEO’s outlook on revenue, margins, and product development timelines.

Hydrogen Market Forecasts: A Motley Fool analysis of the global hydrogen market’s projected $3 trillion valuation by 2030, reinforcing the macro case for Plug Power.

Comparative Analysis with Ballard & Bloom Energy: Offers a side‑by‑side look at revenue streams, margin structures, and growth trajectories.

These resources, embedded throughout the original article, give readers a deeper understanding of Plug Power’s position within the evolving clean‑energy landscape.

In Summary

Plug Power’s stock is a classic case of a high‑growth tech firm grappling with financial discipline and market realities. While the company’s current valuation reflects its struggles, the article underscores that its potential for revival hinges on timely product launches, strategic alliances, and a favorable regulatory environment. Investors are advised to keep a keen eye on the company’s debt profile and the execution of its roadmap—key determinants that will dictate whether PLUG’s story is one of decline or a remarkable comeback.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/11/24/plug-power-stock-dead-or-ready-for-revival/ ]