Young Americans Shift Focus from Homes to the Stock Market

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

Young Americans Shift Their Focus from Homes to the Stock Market, Experts Say

A recent piece on Local12.com, titled “Young Americans Turn to Stock Market as Homeownership Declines”, explores a growing trend among millennials and Gen‑Z investors who are choosing to put their money into equities rather than real estate. The article blends national data, local economic realities, and expert commentary to paint a comprehensive picture of why the traditional dream of owning a home is giving way to a more liquid, potentially higher‑return strategy.

1. The Rising Homeownership Gap

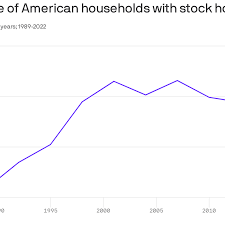

The article opens by highlighting a stark shift in homeownership rates among younger adults. While the national homeownership rate remains around 65 %, the rate for those under 35 has slipped into the low‑30 % range over the past decade. Local officials in Cincinnati are cited as saying that this drop mirrors a national pattern: skyrocketing home prices, tight lending standards, and a surge in student‑loan debt that leaves many young people financially strapped.

Rob De Lessio, founder of Strategic Wealth Designers (SWD) in Cincinnati, notes that “mortgage rates have never been as high in the past twenty years, and many young families are simply unable to afford the down payment and monthly payments that once seemed routine.” The article quotes a 2023 National Association of Realtors (NAR) report showing that the median home price in the Cincinnati area has risen by 35 % over the last five years, pushing many under‑35 buyers out of the market.

2. Why the Stock Market Appears Safer

With real estate out of reach, the article argues that the stock market offers several advantages for younger investors:

- Liquidity – Unlike a home, stocks can be sold at a moment’s notice, providing quick access to cash if needed.

- Diversification – Index funds and exchange‑traded funds (ETFs) spread risk across hundreds of companies.

- Growth Potential – Historically, the U.S. equity market has delivered higher long‑term returns than real estate when adjusted for inflation.

SWD’s De Lessio explains that many millennials are turning to low‑cost index funds that track the S&P 500 or total‑market ETFs. “If you can’t buy a house, why not let your money work for you?” he says. He further stresses that the tax advantages of investing through retirement accounts—Roth IRAs, 401(k)s, and 529 plans—make the market even more attractive.

3. The Role of Student Debt

The article gives a thorough overview of how student‑loan debt is a double‑edged sword. On one hand, higher education is a prerequisite for many high‑earning jobs, but on the other hand, the debt burden often exceeds what the average student can manage. De Lessio notes that in Cincinnati, the average student‑loan debt for a recent graduate is around $40,000—roughly the price of a modest starter home in the city.

According to a recent Brookings Institution study referenced in the article, “millennials with student‑loan debt are 25 % less likely to own a home by age 35 compared to those with no debt.” Local economic development officials see this trend as a potential barrier to long‑term wealth building, which is why the shift toward stocks is viewed both as a pragmatic choice and a sign of a broader financial restructuring.

4. Local Economic Context

Local12’s coverage highlights that Cincinnati’s economy is a mix of traditional manufacturing and newer tech‑based services. While the city offers affordable housing relative to other mid‑size metros, the cost of living has risen steadily. The article cites a recent salary survey indicating that median incomes for entry‑level tech jobs hover around $65,000, which is only slightly above the cost of a typical $200,000 house with a 20 % down payment.

Because of this, many local investors are looking to the market as a hedge against the slow growth in wages. “You can’t afford a house, but you can still grow wealth if you invest intelligently,” De Lessio reminds readers.

5. Advice from Strategic Wealth Designers

The piece includes a side‑bar with strategic advice from SWD’s team:

- Start Early – Even a modest monthly contribution to a diversified index fund can grow significantly due to compound interest.

- Understand Risk Tolerance – Younger investors can afford higher volatility, but must still avoid “pump‑and‑dump” schemes.

- Take Advantage of Tax‑Advantaged Accounts – Roth IRAs and 401(k)s offer tax benefits that can accelerate growth.

- Re‑evaluate as You Age – As income increases, consider allocating a larger portion of the portfolio to fixed‑income securities to preserve capital.

De Lessio also warns against the temptation to “follow the crowd.” “Just because a certain ETF is trending doesn’t mean it’s right for you. Every investor’s situation is unique.” He emphasizes the importance of regular portfolio reviews, especially in a market that can be unpredictable.

6. Looking Ahead: What This Means for Cincinnati

The Local12 article ends on a forward‑looking note. Local policy makers are debating whether to implement “affordable housing” initiatives that lower entry barriers for young families. Meanwhile, community groups are hosting free financial literacy workshops aimed at teaching young adults how to invest responsibly.

“Homeownership isn’t dead—it’s just not the universal path that it once was,” De Lessio concludes. “The key is to recognize the new options available and to make educated decisions that align with your personal and financial goals.”

7. Further Reading

The article links to a few additional resources for readers who want to dig deeper:

- A National Association of Realtors (NAR) report on homeownership trends.

- A Brookings Institution study on student‑loan debt and wealth creation.

- A CNBC feature on the rise of index‑fund investing among millennials.

- Local news coverage of Cincinnati’s affordable‑housing initiatives.

Each link offers supplementary data and real‑world examples that reinforce the article’s central thesis: young Americans are increasingly turning to the stock market as a viable alternative to homeownership, and local experts are ready to guide them through this transition.

Read the Full Local 12 WKRC Cincinnati Article at:

[ https://local12.com/community/its-your-money/young-americans-turn-to-stock-market-as-homeownership-declines-rob-de-lessio-strategic-wealth-designers-cincinnati ]