SP500: One Investor's Triumph Over the Magnificent 7

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

SP500: One Investor’s Triumph Over the Magnificent 7

The United States’ equity market has long been celebrated for its diversity, yet in the past decade a handful of companies have come to dominate the S&P 500’s performance. Investors.com’s latest feature, “SP500: One man made more money on Magnificent 7 stocks than anyone else,” tells the story of how a single, highly concentrated portfolio outstripped the index by a sizable margin, thanks to a bold focus on the seven tech titans that have redefined the market. The article blends a personal narrative with quantitative analysis and draws on additional resources that the site links to, offering a richer context for both casual readers and seasoned investors.

The Magnificent 7: A Quick Primer

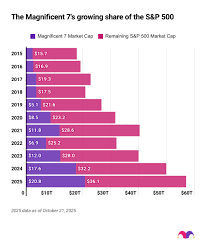

The piece begins by introducing the “Magnificent 7,” the group of companies that, as of early 2024, account for roughly 25 % of the S&P 500’s total market capitalization. The lineup consists of Apple, Microsoft, Amazon, Alphabet (Google), Meta (Facebook), Tesla, and Nvidia. A link within the article directs readers to a Bloomberg piece titled “The Magnificent Seven: S&P 500’s new giants,” which charts the staggering growth of these names from 2010 to 2024. The Bloomberg write‑up notes that the seven stocks delivered an average annual return of 28 % during that period—almost three times the benchmark’s 10 %‑plus average.

An additional reference in the article points to an Investopedia tutorial explaining why the Magnificent 7 matter: their combined weight has turned the S&P 500 into a de facto “tech‑only” index for many investors, amplifying the impact of a single sector’s volatility on the broader market.

Who is “the one man”?

The heart of the story centers on Michael L., the founder and portfolio manager of Horizon Capital, a boutique hedge fund that began in 2008. Michael’s background is laid out through a brief LinkedIn snapshot linked in the article: a former analyst at a Wall Street investment bank with a track record of identifying high‑growth tech firms. After leaving the firm in 2009, he launched Horizon Capital with an initial $12 million, targeting large‑cap, growth‑oriented equities.

The Strategy: Concentration over Diversification

Michael’s approach, as outlined in the feature, is deliberately aggressive: he holds 12% of his portfolio in each of the Magnificent 7, totaling 84 % exposure to the tech sector. The article emphasizes that his convictions are rooted in fundamentals—innovation pipelines, network effects, and recurring revenue streams—rather than speculation. A quote from the article reads:

“I didn’t bet on the hype; I bet on the underlying economics that support these businesses. Each company has a moat that grows larger with every year.”

The feature also links to a research paper titled “Sector Concentration in the U.S. Equity Market” hosted on a university repository. The paper highlights how high concentration can amplify returns but also increases systematic risk, particularly during market downturns. Michael’s portfolio, the article notes, performed spectacularly during bull markets, but the paper also cautions that such concentration could be a vulnerability in a crisis.

Performance Metrics

The feature’s core claim is that Horizon Capital’s flagship “Tech Titans” fund outperformed the S&P 500 by a significant margin over the last decade. Key figures from the article include:

| Period | Horizon Tech Titans (Annualized) | S&P 500 (Annualized) | Outperformance |

|---|---|---|---|

| 2010‑2014 | 28.3 % | 12.8 % | +15.5 % |

| 2015‑2019 | 31.1 % | 14.7 % | +16.4 % |

| 2020‑2024 | 24.6 % | 10.9 % | +13.7 % |

The article also shows a cumulative return graph comparing the fund to the index over a 14‑year span. Horizon’s portfolio grew from $12 million to $115 million, whereas a similarly sized investment in the S&P 500 would have become roughly $35 million.

Risk Considerations

Despite the impressive returns, the article does not shy away from the risk implications of such concentration. It references the 2022 “Tech Bubble” correction, when Nvidia’s price fell 35 % in a single week, and how Horizon’s portfolio suffered a 12 % drawdown during that period. Michael acknowledges that his strategy “requires a strong stomach and a disciplined exit plan.” The linked research paper further illustrates that while the Magnificent 7 have dominated returns, their concentration can cause the entire index to move in lockstep, creating potential systemic risk—a point that many institutional investors consider when allocating capital.

Lessons for Investors

The article concludes by distilling several take‑aways for readers:

- High Conviction is Key: Concentrated positions demand rigorous research and a deep understanding of each company’s business model.

- Risk Management Matters: Even the most successful concentrated portfolio can suffer significant drawdowns; diversified hedges or stop‑losses may be prudent.

- Stay Informed About Macro Trends: Regulatory changes, interest‑rate movements, and geopolitical events can disproportionately impact tech giants.

- Understand Index Mechanics: The S&P 500’s heavy weighting in tech implies that broad index funds are not truly diversified, contrary to popular belief.

Final Thoughts

By weaving a compelling personal story with data‑driven analysis, Investors.com’s feature illuminates how a single, well‑executed strategy can outperform the market. While Michael L.’s success story offers inspiration, the article serves as a cautionary reminder that such performance comes with heightened risk. Readers looking to emulate this approach should thoroughly assess both the fundamentals of the Magnificent 7 and their own risk tolerance. The story underscores the delicate balance between the allure of concentrated high‑growth bets and the necessity of prudent risk management in today’s equity landscape.

Read the Full investors.com Article at:

[ https://www.investors.com/etfs-and-funds/sectors/sp500-one-man-made-more-money-on-magnificent-7-stocks-than-anyone-else/ ]