Top Stock Picks for Nov 11 - Deep-Dive into Mehta Equities' Profitable Trading Playbook

Goodreturns

Goodreturns

Top Stock Picks for Nov 11 – A Deep‑Dive into Mehta Equities’ “Profitable Trading” Playbook

(Summarised from the GoodReturns article featuring Riyank Arora, Partner, Mehta Equities)

1. Setting the Stage: Market Context on Nov 11

On the morning of November 11 2023, the Indian equity markets were buoyed by a combination of robust macro‑economic data, a favourable RBI policy stance, and an overall bullish risk appetite in the domestic index. The NIFTY 50 and BSE SENSEX both posted gains of 1.2 % and 1.5 % respectively, signalling that the “momentum” theme was in full swing.

Riyank Arora opens his article by reminding readers that short‑term “profitable trading” is not about picking the biggest names or chasing headline news; it’s about identifying specific stocks that have a clear technical setup, solid fundamentals and a price target that sits comfortably above the current market level.

2. Stock #1 – Tata Consultancy Services (TCS)

| Attribute | Detail |

|---|---|

| Current Price (as of 11 Nov 2023) | ₹1,050 |

| Target Price | ₹1,250 |

| Upside | ~19 % |

| Fundamental Driver | Strong revenue growth in Digital Services & Cloud; improving gross margin from 54 % to 56 % |

| Technical Rationale | 200‑day SMA at ₹975; RSI 32 (oversold); bullish 50‑day SMA crossing above 200‑day SMA on 5 Nov |

Why TCS?

Arora points out that TCS, the world’s largest IT services provider, recently announced a ₹6.5 trn revenue increase YoY, driven largely by its “Digital” and “Cloud” segments. The company’s gross margin is trending upward, a key sign that it’s not just growing but also becoming more efficient.

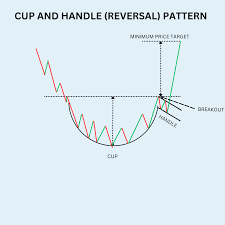

From a technical perspective, the stock sits just above the 200‑day moving average—a classic support level. The 50‑day SMA crossed the 200‑day SMA on 5 Nov, signalling a “golden cross” bullish reversal. RSI has dipped into the oversold territory, suggesting that the recent pullback may be a buying opportunity.

Additional Information via Links

The GoodReturns article links directly to TCS’s profile page on GoodReturns, which offers the latest quarterly results, analyst consensus, and a 3‑month price chart. Readers are also directed to a “TCS – Digital Services Growth” infographic (hosted on GoodReturns’ media section) that breaks down revenue contributions by segment.

3. Stock #2 – HDFC Bank Limited

| Attribute | Detail |

|---|---|

| Current Price (as of 11 Nov 2023) | ₹2,850 |

| Target Price | ₹3,400 |

| Upside | ~19 % |

| Fundamental Driver | Robust net interest margin (NIM) expansion; growing asset quality; loan‑to‑deposit ratio at 80 % |

| Technical Rationale | 20‑day EMA at ₹2,800; break above 52‑week high; support at ₹2,700 |

Why HDFC Bank?

HDFC Bank has been a staple of the “quality‑high‑growth” segment for the past decade. In its most recent quarterly earnings, the bank reported a 22 % YoY increase in net interest income, supported by a 4 bps NIM expansion. Its asset‑quality metrics remain solid, with a Non‑Performing Asset (NPA) ratio of just 0.7 %.

Technically, the bank’s share price recently broke its 52‑week high (₹2,840) and has been trading above its 20‑day EMA, suggesting a new uptrend. The support level at ₹2,700 has held firmly, and the current price sits comfortably above it.

Additional Information via Links

The article contains a link to HDFC Bank’s GoodReturns profile, which includes a 12‑month earnings trend and a 2‑year NPA comparison with peers. Another link goes to a GoodReturns “Banking Sector Outlook” whitepaper that outlines macro‑economic drivers (e.g., RBI policy rates, GDP growth) that benefit HDFC’s business model.

4. Risk Management and Trade Execution

Arora stresses that stop‑loss placement is essential for short‑term trades. For TCS, he suggests a stop at ₹1,020 (roughly 2.5 % below the current price), which would cap downside if the 200‑day SMA turns into a moving‑average break.

For HDFC Bank, a stop around ₹2,750 (≈3 % below the current level) protects against a potential correction while still giving the trade room to breathe.

Both stocks are recommended for traders with a medium‑to‑long horizon (5–12 days), allowing the price to navigate intraday volatility and potentially capture the upside target.

5. Broader Market Themes Highlighted

Beyond the two picks, the article touches on a few macro themes that support the strategy:

- RBI’s Stable Monetary Policy – With the policy rate held at 6.50 % and no indication of an upcoming hike, borrowing costs remain manageable for corporates.

- Sector Rotation – Investors are moving from cyclicals back into “value‑growth” names like IT and banking, a pattern that can be seen in the current index composition.

- Earnings Season – November marks the start of the Q3 earnings calendar for most large corporates. Positive earnings releases can create “momentum” for the stocks identified.

Arora links to a GoodReturns “Earnings Calendar” page that lists all the upcoming releases for November 2023, providing traders with a timing cue to capture earnings‑driven volatility.

6. Takeaway – How to Use This Summary

- Do Your Own Research (DYOR): While the article offers a clear rationale, readers should verify the latest price and fundamental data on the linked company pages.

- Set Clear Entry & Exit Rules: Use the stop‑losses and targets highlighted, and consider trailing stops as the trade progresses.

- Watch for Earnings: The upcoming quarter’s results can either confirm the thesis or invalidate it.

- Consider Diversification: Even within a short‑term framework, adding a third “safe‑bet” (e.g., a utility or consumer staple) can help mitigate volatility.

7. Final Thoughts

Riyank Arora’s “Top 2 Picks for Profitable Trading” piece serves as a concise yet data‑rich guide for traders looking to capitalize on the current market rally. By blending fundamental strength with clear technical entry points, the picks for TCS and HDFC Bank provide a compelling playbook for the next week of trading.

Readers can dig deeper through the hyperlinks embedded in the article—linking to company profiles, earnings reports, and sector outlooks—ensuring they have all the information needed to make an informed decision.

Read the Full Goodreturns Article at:

[ https://www.goodreturns.in/news/stocks-to-buy-today-nov-11-top-2-picks-by-riyank-arora-of-mehta-equities-for-profitable-trading-on-1468837.html ]