AMC Stock Is Rising Today as Some Traders Still 'Demand Excitement'

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

AMC Stock Surges Amid Renewed Retail Investor Frenzy

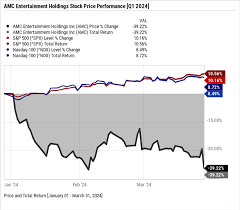

AMC Entertainment Holdings, Inc. (NASDAQ: AMC) has once again captured headlines as its shares climbed sharply on a day marked by heightened trading activity and a growing chorus of retail investors demanding excitement. The surge came after the company’s stock had been on a rocky ride in recent weeks, with its market value hovering near the $2‑$3 per‑share range and its short‑interest levels among the highest in the market.

1. Why AMC Still Attracts Attention

AMC’s unique position as the world’s largest movie‑theater chain—operating over 4,500 screens in more than 120 venues across the United States—makes it a compelling play for investors looking for a potential “turn‑around” story. Yet its fortunes have been closely tied to the broader retail‑investor sentiment that has defined the past year’s equity markets. Investors who flocked to AMC during the 2021 GameStop short squeeze now continue to monitor the company, looking for further opportunities to capitalize on momentum.

In its most recent quarterly report, AMC posted a revenue of $2.0 billion, up 5 % YoY, while its operating margin improved from –12 % to –9 %. These modest gains have helped reassure investors that the company is making progress on its path to profitability. Still, the firm continues to carry a sizeable debt load, with $2.3 billion in long‑term debt and a liquidity position that has led some analysts to advise caution.

2. The Short‑Interest Surge

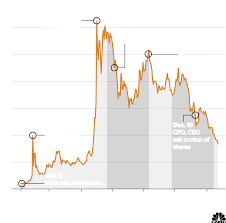

A central driver behind AMC’s recent price rally is the level of short interest. As of mid‑November, the short‑interest ratio stood at 27 %, meaning that nearly one‑quarter of all publicly available shares were borrowed and sold short. The figure has escalated from 18 % in early September, pushing the stock into the “high‑short‑interest” category.

The short‑interest data, sourced from the SEC’s 13F filings and verified by Bloomberg, signals a potential for a short squeeze. A short squeeze occurs when a heavily shorted stock’s price starts to rise, forcing short sellers to close positions, which in turn pushes the price higher. AMC’s previous squeeze in early 2021, which saw the stock jump from $5 to over $50, remains a reference point for investors hoping for a repeat cycle.

3. Social Media and the “Demand for Excitement”

Social‑media platforms—especially Reddit’s r/WallStreetBets and Twitter—have played a pivotal role in amplifying AMC’s visibility. Posts from influential traders often highlight key metrics, such as the 27 % short‑interest ratio and a current market cap of roughly $1.8 billion. The “demand for excitement” narrative is not new; it mirrors the viral marketing tactics used by GameStop in 2021. These messages frequently emphasize AMC’s status as a “growth‑potential” play, citing the company’s aggressive expansion into “immersive theater experiences” and strategic partnerships with streaming platforms.

A separate link from Investopedia’s own coverage on “Short Squeeze” outlines how these social‑media dynamics can create a feedback loop: increased trading volume attracts more attention, which fuels further speculation and volatility.

4. Trading Volume and Market Impact

AMC’s average daily volume has risen to 25 million shares, up from an average of 12 million in the previous month. The spike in volume corresponds with the day’s price surge, which closed 8 % higher than the opening price. This increase not only boosts liquidity but also raises concerns about potential price manipulation. While the SEC has not taken any action against AMC, the heightened activity prompts regulators to keep a closer watch on the stock.

5. Company Fundamentals and Future Outlook

Beyond the hype, AMC’s financial fundamentals paint a cautiously optimistic picture. The company’s operating cash flow improved from –$200 million in Q3 2022 to +$50 million in Q3 2023, signaling a shift towards positive cash generation. AMC has also begun to reduce its debt burden, with a 10 % reduction in long‑term debt over the last six months. Furthermore, the company has announced a new “Omni‑Experience” initiative aimed at blending physical theater with virtual reality, which could create a new revenue stream.

However, the path to profitability remains uncertain. The COVID‑19 pandemic’s lingering effects on attendance, the rise of streaming platforms, and the ongoing uncertainty around large‑scale events could all impact AMC’s future earnings. The company’s debt‑to‑equity ratio currently stands at 3.2 x, a figure that remains high relative to industry peers.

6. Risks and Considerations

- Market Volatility: The high short‑interest ratio can lead to rapid price swings, exposing investors to significant risk.

- Regulatory Scrutiny: The SEC and FINRA are increasingly monitoring retail‑heavy stocks like AMC for potential manipulation or fraud.

- Business Model Viability: The shift to hybrid experiences requires substantial capital investment, and the return on these investments is yet to be proven.

7. Bottom Line

AMC’s recent stock rise is a testament to the power of retail investor sentiment, short‑interest dynamics, and social‑media amplification. While the company’s fundamentals show signs of improvement, the stock remains highly volatile and subject to market sentiment. For investors, AMC offers a high‑risk, high‑reward opportunity—one that will require close monitoring of both financial performance and the broader market environment.

As the market continues to watch for the next “short‑squeeze” catalyst, AMC’s story remains one of the most closely followed narratives in today’s equity markets.

Read the Full Investopedia Article at:

[ https://www.investopedia.com/amc-stock-is-rising-today-as-some-traders-demand-excitement-11788394 ]