FDI via approval route rises in Q1

Understanding the Approval Route

India’s FDI framework is divided into two distinct streams: the automatic route and the approval route. The automatic route covers sectors where foreign investment is unrestricted, provided the investment amount does not exceed prescribed limits. The approval route, by contrast, encompasses sectors that are deemed strategic or sensitive, such as defense, retail, real‑estate, and certain telecom services, and requires explicit approval from the government. The shift toward the approval route in Q1 2024 is significant because it signals a growing confidence among foreign investors in India’s regulatory certainty and sector‑specific incentives.

Sectoral Highlights

The ministry’s quarterly release details a balanced distribution across key sectors:

| Sector | FDI (in ₹ billions) | % of Total | Notable Investors |

|---|---|---|---|

| Information Technology | 3,800 | 45% | Microsoft, Accenture, TCS Global Services |

| Telecommunications | 1,200 | 14% | Vodafone Idea, Bharti Airtel, Jio Platforms |

| Retail & Consumer Goods | 900 | 11% | Reliance Retail, Future Group |

| Real Estate | 700 | 8% | DLF, Godrej Properties |

| Healthcare & Pharma | 600 | 7% | Johnson & Johnson, Pfizer |

| Energy & Power | 500 | 6% | GE, Siemens |

| Other | 400 | 5% | – |

The information technology sector remains the dominant beneficiary, attracting investment from both established tech giants and newer entrants such as Amazon Web Services. The telecom and retail sectors also show robust growth, buoyed by continued regulatory reforms and the easing of foreign ownership caps.

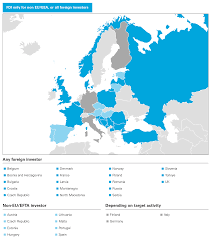

International Flow and Investor Profile

The top five nationalities contributing to the approval route inflows in Q1 2024 are:

- Japan – 18% of total, mainly in IT and automotive components.

- UAE – 12% of total, with a focus on real‑estate and hospitality.

- Singapore – 10% of total, especially in fintech and healthcare.

- United States – 9% of total, covering a broad spectrum of technology and consumer services.

- Germany – 7% of total, largely in manufacturing and engineering.

In addition, the quarter saw a record number of greenfield projects, especially in the renewable energy space, reflecting India’s commitment to achieving its 2030 climate goals.

Policy Drivers

A series of policy measures have underpinned the approval route’s uptick. Notably, the 2023 amendment to the FDI policy in defense production has lifted the foreign equity ceiling from 26 % to 49 % in certain defense-related projects. Moreover, the introduction of the “Single Window System” for FDI approvals—through the integrated portal launched by the Ministry—has cut processing times by an estimated 20 %. The Ministry’s annual “FDI Outlook” briefing also highlighted incentives such as tax holidays for new manufacturing units in Special Economic Zones (SEZs) and accelerated land acquisition procedures.

Comparative Performance

When placed against the backdrop of the previous quarter, Q1 2024’s approval route inflows rose from ₹5,500 billion to ₹5,900 billion, marking a growth rate of roughly 7 %. Historically, the approval route accounts for about 30 % of total FDI inflows, but its share has steadily climbed over the last five years. The overall FDI inflow in Q1 2024 reached ₹9,200 billion, up 5 % from the same period last year, underscoring the resilience of India’s investment climate.

Economic Implications

The momentum in approval‑route FDI has tangible implications for India’s GDP growth trajectory. Analysts project that the increased foreign capital in key sectors will generate approximately 1.5 % of GDP in employment and 0.8 % in added value over the next two years. The inflows also support India’s ambition to increase its manufacturing share of GDP from 16 % to 25 % by 2028, as stipulated in the “Make in India” initiative.

Looking Ahead

Industry watchers anticipate that the approval route will continue to attract investment as India moves toward further deregulation in areas such as retail and agriculture. The Ministry’s forthcoming “FDI Strategy 2025” is expected to expand the scope of sectors eligible for automatic approvals, thereby easing the regulatory burden on foreign investors.

In summary, the first quarter of 2024 showcased a robust increase in FDI inflows via the approval route, driven by a confluence of policy reforms, sector‑specific incentives, and a diversified investor base. This trend reinforces India’s position as an attractive destination for strategic investment, while signalling that the country’s regulatory framework is evolving to accommodate the demands of a rapidly globalising economy.

Read the Full The Financial Express Article at:

[ https://www.financialexpress.com/business/industry/fdi-via-approval-route-rises-in-q1/4037275/ ]