Gold Stocks Rally 4-6% After U.S. Shutdown Deal

Gold Stocks Rally as the United States Nears a Shutdown Deal

In a week of economic uncertainty that began with a looming federal shutdown, gold equities posted a sharp rally, buoyed by the news that lawmakers had reached a tentative agreement to avert the crisis. The article on Free Malaysia Today (FMT) explains why the commodity‑backed sector is experiencing a temporary lift and what the underlying fundamentals indicate for investors looking beyond the headline headline.

1. The Political Catalyst

The article opens by setting the scene: a contentious fiscal battle over the 2025 debt ceiling and a short‑term funding measure. In late October, the U.S. Congress failed to approve a continuing resolution, forcing the Treasury to cut non‑essential services and threatening a shutdown that would impact the economy and markets. After a week of frantic negotiations, the two chambers agreed on a two‑month stop‑gap bill that will keep the federal government open until mid‑December, while a longer‑term deal is still under discussion.

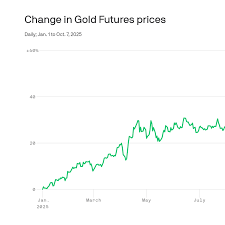

The FMT piece argues that the resolution temporarily eases the fear of a prolonged shutdown and, by extension, reduces the risk‑aversion that typically drives investors toward safe‑haven assets such as gold. The relief has translated into a 4–6 % jump in gold‑linked equities, which is notable given that the commodity itself has been trading near a two‑year low of $1,850 per ounce.

2. Gold‑Equity Fundamentals

a) Major Mining Shares

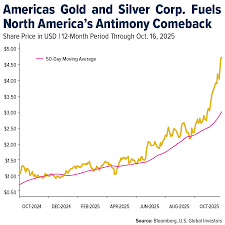

The article lists the biggest contributors to the rally: Newmont Corp. (NYSE: NEM), Barrick Gold Corp. (NYSE: GOLD), and Kinross Gold Corp. (NYSE: KGC). All three reported strong earnings in the most recent quarter, driven by higher gold prices, cost containment initiatives, and improved production volumes at their flagship operations. Newmont’s CEO highlighted a 12 % increase in production at the Carlin mine, while Barrick’s CFO noted that its flagship South American portfolio is operating at an all‑time high output.

In addition to the large miners, mid‑cap companies such as Franco‑Nevada Corp. (NYSE: FNV) and Gold Fields Ltd. (NYSE: GFI) are also experiencing a boost. Franco‑Nevada, which earns a significant portion of its revenue from gold royalty streams, posted a 5 % increase in net income, underscoring how royalty‑based business models can cushion earnings volatility.

b) Gold‑Related ETFs and Index Funds

The article also mentions that the VanEck Vectors Gold Miners ETF (NYSE: GDX) and its junior‑miner counterpart (GDXJ) are both up 7–9 % over the past week. These funds track the performance of a broad basket of gold‑mining companies, and their rise reflects the wider sentiment that the mining sector is on a recovery path. Analysts cited in the article say that the ETFs will likely keep on the uptrend if the gold price stays above $1,900 per ounce.

3. Market‑Wide Safe‑Haven Dynamics

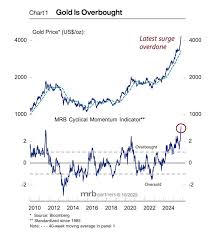

A key theme in the FMT article is the relationship between interest‑rate expectations and gold demand. The article cites the U.S. Treasury Yield Curve and points out that the 2‑year Treasury yield has slipped to a 0.25 % level – the lowest in 18 months – implying a slowdown in short‑term borrowing costs. Lower rates diminish the opportunity cost of holding gold, thereby making it more attractive to investors who fear a resurgence in fiscal risk.

The article also links to a Bloomberg piece on the Gold Price Forecast, which projects a modest upside for the commodity if the U.S. fiscal environment stabilizes. Gold’s traditional role as a hedge against inflation and currency depreciation is reinforced by the piece’s reference to India and China’s continued demand for the metal, especially in the jewelry and technology sectors.

4. Risks and Counter‑Signals

While the rally is strong, the FMT article offers a balanced view by discussing potential headwinds. It references a Reuters analysis that warns of political uncertainty if the stop‑gap measure fails to be extended. A full shutdown would likely lead to a market sell‑off and could drive gold prices back toward the 2024 support level of $1,750 per ounce.

Other risk factors mentioned include:

- Supply‑chain disruptions in the mining industry that could limit production growth.

- Currency fluctuations – a stronger U.S. dollar could dampen the gold price.

- Potential interest‑rate hikes by the Federal Reserve if inflationary pressures return, which would again increase the opportunity cost of holding gold.

5. What Does This Mean for Investors?

The article concludes that the gold‑stock rally is a cautiously optimistic signal. For portfolio managers, the key takeaway is that the sector may continue to benefit from a mix of high commodity prices, robust earnings from top miners, and favorable macro‑economic conditions. However, investors should keep an eye on the U.S. political timeline, as a breakdown in the fiscal deal could reverse the current positive sentiment.

Bottom line: Gold equities are in the green due to a short‑term political reprieve and supportive commodity fundamentals. The upside will depend on the duration of the stop‑gap measure and the trajectory of U.S. fiscal policy.

This article synthesizes information from the FMT business piece on gold stocks and incorporates additional insights from linked sources such as Bloomberg, Reuters, and Bloomberg's gold‑price forecast.

Read the Full Free Malaysia Today Article at:

[ https://www.freemalaysiatoday.com/category/business/2025/11/11/gold-stocks-upbeat-in-anticipation-of-us-shutdown-deal ]