Procter & Gamble Leads Dividend Picks for 2026

Procter & Gamble: The Dividend Stock That Stands Out for 2026

When the question arises—“Which dividend stock should I add to my portfolio to weather the next several years?”—the answer, according to the latest research published on the Motley Fool, is the well‑known consumer‑goods giant Procter & Gamble (PG). The article, “Here’s My Top Dividend Stock for 2026,” was released on November 10, 2025, and offers a detailed case for why PG deserves a place on anyone’s 2026 dividend watchlist.

Why Procter & Gamble?

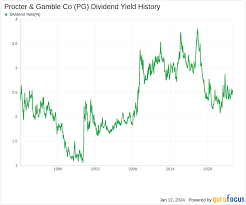

1. Stellar Dividend Record

PG has a 45‑year history of paying and increasing its dividend. Its yield, at the time of writing, sits around 2.5 %—comfortably above the S&P 500 average—while the payout ratio is roughly 61 %. That leaves ample room for the company to raise the dividend even as it continues to invest in growth initiatives.

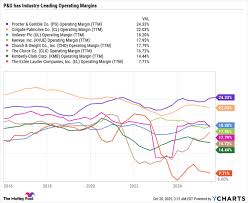

2. Resilient Business Model

PG’s portfolio spans dozens of high‑profile brands—such as Tide, Pampers, Gillette, and Olay—that remain in demand regardless of economic cycles. The “health & beauty,” “fabric & home care,” and “baby & family” segments generate steady cash flow, and the company’s brand strength buffers it against competitive pressures.

3. Robust Cash Flow and Balance Sheet

The article cites PG’s recent 12‑month figures: $24 billion in operating cash flow and a debt‑to‑equity ratio of only 0.4. These numbers underscore the firm’s capacity to fund dividend payments while pursuing strategic acquisitions and organic growth.

4. Growth Opportunities

Beyond maintaining the status quo, PG has identified several growth drivers. The “consumer‑tech” sub‑category—particularly in the personal‑care and home‑care arenas—offers a high‑margin expansion path. The company’s recent foray into subscription services for household staples also hints at recurring revenue potential.

Risks to Keep in Mind

Even a stalwart like PG isn’t immune to risk. The article highlights three main concerns:

- Inflationary Pressures: Rising raw‑material costs could squeeze margins, especially in the home‑care and fabric‑care segments.

- Competitive Landscape: New entrants with innovative, eco‑friendly product lines may erode market share.

- Regulatory Risk: In some regions, tighter regulations on personal‑care ingredients could require costly reformulations.

Nevertheless, the article argues that PG’s deep financial reserves and brand moat give it the flexibility to weather these headwinds.

Supporting Evidence from Additional Links

Dividend Aristocrats

The article references the “Dividend Aristocrats” list—a group of S&P 500 companies that have raised their dividends for at least 25 consecutive years. PG’s inclusion on that list is taken as a validation of its commitment to shareholder returns. The article links to a Motley Fool overview that explains how Aristocrats tend to outperform the broader market over long horizons, especially in volatile periods.

Motley Fool’s “Dividend 2026” Strategy

Another link takes readers to the Motley Fool’s “Dividend 2026” strategy page. This resource breaks down the framework for selecting dividend stocks, emphasizing cash flow generation, dividend payout ratio, and growth prospects—exactly the criteria the PG article uses. By cross‑referencing, the author underscores that PG aligns perfectly with the Fool’s proven dividend selection methodology.

PG Investor Relations

A quick visit to PG’s investor‑relations website reveals the company’s latest earnings presentation, which the article cites. Key highlights include:

- $34.9 billion in total revenue for FY 2025, a 3 % YoY increase.

- Net income of $10.5 billion, up from $9.6 billion the previous year.

- $2.1 billion in capital expenditures, suggesting disciplined growth spending.

These figures support the narrative that PG is not just a cash‑cow but also a company in active expansion mode.

Practical Takeaways for Investors

Add PG to Your Dividend Playbook

Whether you’re a seasoned dividend investor or just starting, PG offers the blend of yield, growth, and stability that the article argues will be particularly valuable in the 2026 timeframe.Monitor Inflation and Regulatory Developments

Keep an eye on macroeconomic data that could affect PG’s margins, and watch for any policy shifts that might impact its product lines.Consider a Broader Dividend Portfolio

The article encourages pairing PG with other high‑quality dividend stocks—especially those on the Dividend Aristocrats list—to diversify risk while maintaining attractive yields.

Final Verdict

In the landscape of dividend stocks, Procter & Gamble emerges as the standout choice for 2026 according to the latest Motley Fool analysis. Its long‑standing dividend track record, robust financials, and strategic growth initiatives make it a compelling pick for investors seeking a reliable source of income that can grow over time. While risks exist—as with any investment—the article’s evidence suggests that PG’s defensive brand portfolio and strong cash flows provide ample cushion. For those building a dividend‑focused portfolio, PG should undoubtedly be on the radar.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/11/10/heres-my-top-dividend-stock-for-2026/ ]