Bullish sentiment declines slightly; shows latest AAII survey (SPY:NYSEARCA)

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

Bullish Sentiment Declines Slightly in Latest AAII Survey – Market Outlook

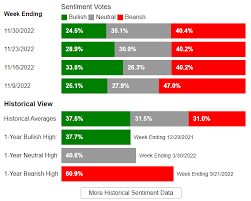

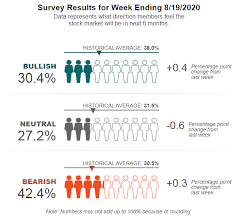

A recent update from the American Association of Individual Investors (AAII) reveals a modest dip in retail investor optimism. The weekly AAII investor sentiment survey, a long‑standing barometer of individual stock‑market attitudes, shows that bullish sentiment has slipped just below the 50‑percent threshold, while neutral and bearish views have steadied or risen slightly. The shift, while small, offers insight into how everyday investors are reacting to the past week’s market developments and broader macroeconomic signals.

Key Numbers

| Sentiment | % of Respondents | Change vs. Previous Week |

|---|---|---|

| Bullish | 49.3% | ↓ 0.7% |

| Neutral | 20.4% | +0.5% |

| Bearish | 23.0% | +0.3% |

The AAII’s most recent survey, covering 4,872 respondents (up 8% from the prior week’s 4,500+ participants), paints a picture of a market that is neither firmly bullish nor bearish. Bullish sentiment has fallen from 50.0% to 49.3%, while neutral sentiment has risen from 20.0% to 20.4%. Bearish sentiment has modestly climbed to 23.0%, from 22.7% the week before.

These numbers are significant because, historically, AAII bullish sentiment tends to peak just before market rallies and troughs a month or two before market declines. While the current dip is small, it signals that some investors are taking a more cautious stance amid a mix of recent market news.

Context: What Drives the Numbers?

Several factors may have nudged sentiment downward:

Earnings Season Dynamics – Over the past two weeks, a handful of high‑profile companies released mixed earnings results. While the tech sector largely beat expectations, some industrial and consumer staples firms missed forecasts, prompting a reassessment of growth prospects.

Inflation and Interest‑Rate Outlook – Inflation data last week showed a slight uptick in the core consumer price index (CPI), feeding expectations that the Federal Reserve could keep policy rates elevated longer than some investors had anticipated. The possibility of a tighter monetary stance often tempers bullish sentiment.

Geopolitical Tensions – Renewed diplomatic friction in certain regions has led to heightened market volatility, especially in the energy sector. Such uncertainty can push investors toward a neutral or cautious outlook.

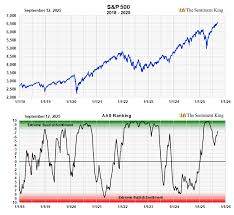

Market Volatility – The S&P 500 has been trading in a relatively tight range, oscillating between 4,200 and 4,300 points. The lack of a clear trend may make investors hesitant to commit to a bullish narrative.

How the Survey Works

The AAII survey solicits weekly responses from U.S. residents, asking them whether they expect the stock market to rise, fall, or stay the same over the next twelve months. The results are then compiled into three primary sentiment categories: bullish, neutral, and bearish. Because the survey captures the views of individual investors, it can serve as a contrarian indicator—bullish sentiment often precedes market peaks, while bearish sentiment can foreshadow downturns.

Links and Further Reading

The Seeking Alpha article referencing the AAII survey contains several hyperlinks that provide additional context:

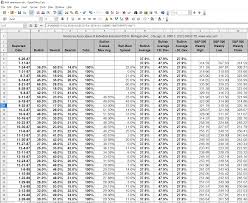

AAII Investor Sentiment Page (https://aaii.org/investor-sentiment/): This page offers real‑time access to the latest survey results, historical charts, and explanatory articles. The AAII’s data portal includes downloadable PDFs and interactive visualizations that illustrate how sentiment trends have correlated with market movements in the past.

Historical Sentiment Data (https://aaii.org/assets/Investor_Sentiment.pdf): A comprehensive PDF detailing the monthly and weekly breakdowns of bullish, neutral, and bearish sentiment since the survey’s inception. Analysts often reference this file to back up long‑term trend claims.

AAII Editorial (https://aaii.org/investor-sentiment-blog/): The AAII’s blog provides deeper dives into the methodology behind the survey, discussions of its predictive power, and commentary on how sentiment aligns with macro‑economic indicators.

Seeking Alpha Discussion Thread (https://seekingalpha.com/article/4517348-bullish-sentiment-declines-slightly-shows-latest-aaii-survey/comments): The comments section of the original article is a lively forum where traders and investors share their interpretations of the sentiment data, reference other technical indicators, and speculate on short‑term market moves.

These resources together help paint a fuller picture of how individual investor sentiment fits into the broader tapestry of market analysis.

What Does This Mean for Investors?

While a 0.7% dip in bullish sentiment is not a dramatic shift, it does suggest that a portion of retail investors is revisiting their expectations of the market’s trajectory. For traders and portfolio managers, such data can be useful in gauging potential sentiment‑driven volatility. If bullish sentiment were to drop below 45% for an extended period, some analysts would view that as a warning that the market might be overvalued or that a correction could be on the horizon.

Conversely, the modest increase in neutral sentiment indicates a growing “wait‑and‑see” stance among investors. This could dampen short‑term momentum, as fewer participants are inclined to chase the market. Meanwhile, the slight rise in bearish sentiment may not be enough to trigger a panic, but it signals that risk‑averse investors are tightening their positions, possibly adding to downward pressure if market catalysts emerge.

Bottom Line

The latest AAII investor sentiment survey reports a small but noteworthy decline in bullish sentiment, bringing it just below the 50‑percent line. This change is framed by a mix of earnings volatility, inflation concerns, and geopolitical uncertainties. While the dip is not a harbinger of a severe market downturn, it does underscore the importance of monitoring retail investor mood as a complementary gauge to traditional market indicators. For those tracking the AAII’s data, the trend remains a useful pulse on how the everyday investor is feeling about the market’s next 12 months.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/news/4517348-bullish-sentiment-declines-slightly-shows-latest-aaii-survey ]