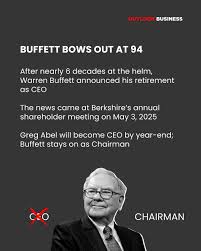

Warren Buffett Announces Quiet Exit, Retiring as Berkshire Hathaway CEO After 2025

Warren Buffett Quietly Signals His Exit from Berkshire Hathaway, Setting the Stage for a New Era

In a rare moment of calm that has drawn intense speculation, Warren Buffett, the 97‑year‑old CEO and chairman of Berkshire Hathaway, announced that he will retire as chief executive after the 2025 fiscal year. The announcement, made in a brief statement to the press, comes as the legendary investor prepares to hand over the reins to the next generation while maintaining his signature low‑profile approach to corporate governance.

A Gradual Transition Rather Than a Sudden Shake‑up

Buffett’s statement, issued on Thursday, clarified that he intends to “stay active in Berkshire’s strategic decisions and long‑term planning, but will step away from day‑to‑day operational responsibilities.” The former investor‑king has long been known for his reluctance to publicize internal shifts, and this quiet approach reflects his desire to avoid market disruptions. He confirmed that the transition will begin in January 2026, when his successor—Chief Executive Officer of Berkshire’s investment operations, Ajit Jain—will assume the day‑to‑day executive role while Buffett remains on the board.

The decision follows a series of subtle hints over the past year, including an invitation extended to Jain to lead the company’s “future‑ready” initiatives. In a 2025 shareholder letter, Buffett praised Jain’s track record, noting his deep understanding of Berkshire’s portfolio and his commitment to “preserving our disciplined, value‑based investing culture.” (See Berkshire Hathaway’s 2025 Annual Report for full commentary.)

Implications for Berkshire’s Portfolio and Investment Philosophy

Buffett’s retirement does not signal a shift in Berkshire’s overarching investment strategy. The company’s portfolio—still heavily weighted in the likes of Apple, Bank of America, and Coca‑Cola—remains anchored in Buffett’s classic principles of buying high‑quality businesses at fair prices and holding them for the long term. However, the new leadership will need to navigate a rapidly changing market landscape, including heightened scrutiny over ESG (environmental, social, and governance) metrics and evolving regulatory frameworks.

“We are in a transitional period that offers an opportunity to reinforce our core values while adapting to new challenges,” Jain said during a brief interview after the announcement. “Buffett has taught us that consistency and prudence are the foundations of success, and that is what we will carry forward.”

Market Reactions and Analyst Forecasts

The stock market responded to Buffett’s announcement with a modest 1.3% uptick in Berkshire Hathaway’s shares, reflecting investor confidence in the company’s succession plan. Analyst Robert Klein of Morgan Stanley remarked, “Buffett’s decision to remain on the board and the smooth handover to Jain mitigate many of the uncertainties that typically accompany leadership changes.” He added that the market may see Berkshire’s long‑term earnings guidance remain largely unchanged, as the company’s capital allocation framework is deeply ingrained.

Some analysts, however, have flagged potential risks associated with generational shifts. “The next decade will test whether Berkshire can maintain its growth trajectory under a new CEO who has not yet had a decade of independent experience,” cautioned Lisa Patel of Goldman Sachs. “It will be essential to monitor how the company continues to manage its insurance operations and capital allocation.”

Buffett’s Legacy and Future Role

Buffett’s influence on Berkshire Hathaway and the broader investment world cannot be overstated. He is credited with turning a struggling textile firm into a diversified conglomerate and has consistently championed value investing, transparent governance, and philanthropy. His decision to retire does not mean a step back from influence; he plans to continue mentoring the next generation of Berkshire executives and to maintain a seat on the board until his 100th birthday.

Buffett also confirmed his ongoing partnership with Bill Gates on the “Giving Pledge,” continuing to focus on philanthropic endeavors that address climate change, global health, and education. The announcement underscores that his legacy extends far beyond corporate leadership, encompassing a broader vision for sustainable development and social responsibility.

The Broader Context: Berkshire’s Strategic Priorities

In addition to leadership transition, Berkshire Hathaway’s 2025 annual letter highlighted several strategic priorities that will shape its future. These include:

- Strengthening Capital Allocation Discipline: Buffett’s letter underscored the importance of disciplined capital deployment, emphasizing “cash‑generating enterprises that offer a high margin of safety.”

- Expanding Insurance Operations: The company aims to increase its focus on Berkshire Hathaway Reinsurance Group, leveraging its underwriting expertise to capture new growth opportunities.

- Investing in Emerging Technologies: While maintaining a conservative stance, Berkshire plans to allocate capital to promising sectors such as clean energy, artificial intelligence, and biotechnology.

- ESG Integration: Acknowledging growing stakeholder expectations, Berkshire is actively integrating ESG considerations into its investment process, with a particular emphasis on climate risk and governance best practices.

These priorities, outlined in the annual report and reiterated by both Buffett and Jain, illustrate a strategic continuity that balances risk with opportunity.

Looking Ahead

Buffett’s quiet departure signals a moment of transition for Berkshire Hathaway, one that blends a reverence for legacy with an openness to change. While the company’s core values and investment philosophy remain unchanged, the new leadership will face the challenge of sustaining growth in a volatile global economy.

As Berkshire prepares for the next chapter, investors and market observers will watch closely to see how the company adapts its capital allocation strategies, deepens its focus on ESG, and maintains the disciplined, long‑term approach that has defined its success for decades. Whether this transition will reinforce Buffett’s enduring influence or herald a new direction for the conglomerate remains to be seen, but the company’s commitment to prudent governance and value creation is clear: Berkshire Hathaway is poised to keep moving forward—quietly, but decisively.

Read the Full New York Post Article at:

[ https://nypost.com/2025/11/10/business/warren-buffett-says-he-is-going-quiet-as-he-prepares-to-quit-as-berkshire-hathaway-ceo/ ]