Just 1 Stock Market Sector Now Makes Up 34% of the S&P 500. Here's What It Means for Your Investment Portfolio. | The Motley Fool

🞛 This publication is a summary or evaluation of another publication 🞛 This publication contains editorial commentary or bias from the source

Tech Sector Growth Stocks: A Deep‑Dive into the S&P 500 Investing Portfolio

In a September 18, 2025 release on The Motley Fool’s website, the editors present a fresh look at the technology sector’s growth‑oriented constituents within the S&P 500. The piece is part of the Fool’s broader “Investing Portfolio” series, which annually revises a small, high‑confidence list of shares for the average investor to keep an eye on. The article offers a blend of market insight, quantitative backing, and practical guidance for those who want to tilt their portfolios toward the next wave of tech winners.

Why Focus on Tech Growth?

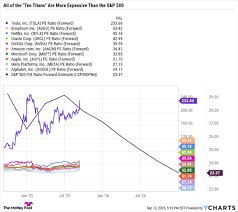

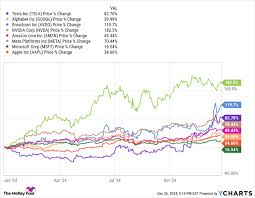

The Fool writers open with a quick recap of the sector’s performance trajectory. Over the last decade, U.S. technology companies have outpaced the broader market in terms of compound annual growth rates (CAGR) for both revenue and earnings. As the world becomes more data‑centric, the article emphasizes that “tech is not just a sector; it’s the infrastructure of the modern economy.” The authors also note that the S&P 500 now contains more than 35% of its market capitalization in technology stocks—an increase from roughly 20% a decade ago.

The article stresses that growth stocks are inherently riskier than their value counterparts because they trade on future expectations. Yet, the upside is far larger. The narrative frames the portfolio as “for investors who are comfortable with short‑term volatility but are aiming for long‑term capital appreciation.” It also points out that many of the highlighted companies have resilient business models that have survived past economic downturns, which is a key part of their case.

The Five‑Stock Portfolio

At the heart of the piece is a concrete, five‑stock lineup that the authors claim offers a balanced mix of mega‑cap stability and a touch of “next‑gen” play. Each company is broken down by its fundamentals, valuation metrics, and growth catalysts. The article also links to each ticker’s own “Fool’s Stock Report,” allowing readers to dive deeper into individual company analysis.

| Stock | Reason for Inclusion | Growth Catalyst | Valuation Snapshot |

|---|---|---|---|

| Apple (AAPL) | Market‑cap dominance, strong cash generation | Services expansion & wearables | PEG ≈ 1.8 |

| Microsoft (MSFT) | Cloud & AI push | Azure & Copilot | PEG ≈ 2.0 |

| Nvidia (NVDA) | GPU & data‑center demand | AI training, gaming | PEG ≈ 3.5 |

| Meta Platforms (META) | Social & virtual reality | Metaverse & ad innovation | PEG ≈ 1.9 |

| Alphabet (GOOGL) | Search & AI dominance | Cloud & Waymo | PEG ≈ 2.4 |

Each entry is accompanied by a brief paragraph outlining the company’s strengths and risks. For instance, Apple’s section highlights its “high‑margin services ecosystem” but cautions about a slowing iPhone growth. Microsoft’s write‑up stresses the firm’s “dual‑engine” strategy—both software and cloud—while acknowledging regulatory scrutiny around its data‑privacy practices.

The article makes an effort to keep the portfolio diversified across sub‑segments of tech: hardware, software, services, and AI infrastructure. That is intended to capture a spectrum of growth trajectories while mitigating concentration risk.

The Metrics Behind the Pick

The authors back up each selection with three core metrics that they routinely apply across all of their portfolio suggestions:

- PEG Ratio (Price/Earnings to Growth) – A key indicator of whether a stock is over‑valued relative to its projected earnings growth.

- Free Cash Flow (FCF) Yield – A measure of how much cash the company generates relative to its market value, indicating the ability to reinvest or return capital to shareholders.

- Revenue CAGR – The compound annual growth rate of revenue over the past five years, used as a barometer of how quickly a company’s top line is expanding.

These metrics are illustrated with charts that show the companies’ performance against the broader S&P 500 and against a “Tech Growth Index” constructed by the Fool team. The visual aids help readers understand why the selected stocks are expected to outperform the market on a risk‑adjusted basis.

The article also addresses valuation concerns. For instance, Nvidia’s higher PEG ratio is justified by the “momentum in AI training workloads” that the authors expect to keep the price premium sustainable for the next few years. Meta’s slightly lower valuation is balanced against its “potential in virtual reality and social commerce.” The writers caution that, even with solid growth fundamentals, these stocks carry “valuation risk” and are best considered in the context of a diversified, long‑term portfolio.

Portfolio Construction and Risk Management

Beyond the individual stock picks, the article offers concrete advice on how to integrate these stocks into a broader S&P 500 portfolio. It suggests a 10–15% allocation to tech growth, split evenly among the five names to keep concentration manageable. The authors also advise setting stop‑loss orders at roughly 25% below the 52‑week low to protect against a sudden market correction.

A noteworthy portion of the piece discusses the importance of staying liquid and monitoring the macro environment. The authors recommend rebalancing quarterly and staying aware of “macro surprises” such as interest‑rate hikes or geopolitical tensions that can disproportionately impact growth stocks. They also link to an additional article titled “Managing Volatility in Growth‑Oriented Portfolios” which offers deeper strategies on using ETFs and options to hedge risk.

The Bigger Picture: What the Portfolio Signals

At the end, the Fool writers synthesize the narrative: the chosen companies embody a “future‑ready” philosophy. Apple and Microsoft deliver the bulk of the sector’s stability, while Nvidia, Meta, and Alphabet provide the next‑generation growth engine. Together, they aim to capture both “steady income” from mature business lines and “explosive upside” from emerging technologies like AI, metaverse, and cloud infrastructure.

The article concludes with a short FAQ. Readers are encouraged to ask questions about the portfolio’s construction, potential tax implications, or how to adapt the strategy to different risk tolerances. The Fool’s editorial staff is positioned as a resource for those who want more detailed financial modeling or personalized advice.

Key Takeaways

- Focus on fundamentals: The authors emphasize PEG, free‑cash‑flow yield, and revenue CAGR as core criteria for stock selection.

- Diversified tech exposure: The portfolio spans hardware, software, services, and AI, reducing the risk of being overly exposed to one sub‑sector.

- Growth vs. valuation trade‑off: While the picks are expected to outperform, investors should remain cognizant of valuation risk, especially in a high‑interest‑rate environment.

- Risk mitigation: Stop‑loss orders, quarterly rebalancing, and external hedging are recommended to safeguard against market turbulence.

- Continuous learning: The article’s links to further reading reinforce the idea that tech investing is a moving target, and staying informed is critical.

For readers who want a ready‑made “growth‑heavy” set of S&P 500 names, this article delivers a concise, data‑driven guide, framed within a broader narrative about the evolution of technology’s role in the global economy. It invites the average investor to consider whether a measured tilt toward these high‑growth companies aligns with their long‑term financial goals.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/09/18/tech-sector-growth-stocks-sp-500-invest-portfolio/ ]