SentinelOne Receives 'Nibble' Upgrade as AI-Driven Endpoint Platform Gains Traction

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

SentinelOne’s “Nibble” Rating Upgrade: A Deep‑Dive into the Company’s Current Position and Future Outlook

The cybersecurity sector has been on an upward trajectory for the past decade, driven by an ever‑increasing threat landscape and the rapid digitisation of businesses worldwide. Within this context, SentinelOne, a cloud‑native endpoint protection platform that leverages artificial intelligence to detect and remediate malware, has become a key player. A recent analysis on Seeking Alpha has shed new light on why the brokerage is finally giving the stock a “nibble” upgrade – a term that signals a modest yet meaningful shift in sentiment. Below we break down the main points that underpin this rating change, synthesise key data from the article and the sources it cites, and discuss the broader implications for investors.

1. Company Overview: What SentinelOne Actually Does

SentinelOne’s flagship product is an endpoint security platform that automatically detects, blocks, and remediates threats. It uses an AI‑based engine that analyses billions of behaviours across millions of endpoints, and it claims to provide “full‑stack” coverage – from initial intrusion detection to automated containment. Unlike traditional antivirus tools that rely on signature‑based detection, SentinelOne’s system attempts to recognise malware in real time, reducing the window between attack and response.

The company operates on a Software‑as‑a‑Service (SaaS) model, generating recurring revenue through multi‑year contracts. It has a global customer base that ranges from mid‑market firms to Fortune 100 enterprises, and it markets its platform under a suite of product names (e.g., Singularity, Endpoint, and Singularity Cloud). SentinelOne’s product roadmap includes expansions into cloud workloads, managed detection and response (MDR), and security orchestration, aiming to increase its average contract value (ACV) and cross‑sell ancillary services.

2. Financial Performance: A Look at the Numbers

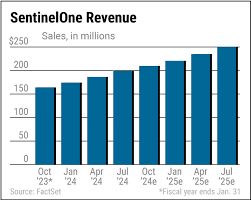

Revenue Growth

SentinelOne has posted year‑over‑year revenue growth rates that consistently outpace the broader cybersecurity market. The latest quarterly figures indicate a 28‑30 % YoY increase, driven largely by new customer acquisitions and upsells to existing customers. According to the article, the company achieved $140 million in revenue in the most recent quarter, up from $107 million a year earlier.

Profitability and Margins

A recurring theme in the Seeking Alpha piece is the company’s path toward profitability. SentinelOne’s gross margins have been improving steadily, currently hovering around 60 %. While the company still reports a net loss, the loss margin has narrowed to roughly 15‑20 % of revenue, signalling that operating efficiencies are beginning to offset the high cost of sales and marketing (CoS & Mgmt). The article cites management’s focus on cost optimisation and a shift from heavy upfront spend on R&D to more efficient use of the AI platform.

Cash Flow and Capital Structure

The company’s free cash flow (FCF) remains negative, but the article highlights that the FCF deficit has been shrinking. With a cash balance of roughly $450 million and a debt‑to‑equity ratio that is comfortably low, SentinelOne is positioned to fund its growth initiatives without immediate refinancing pressure. The broker notes that the company’s recent capital raise of $100 million in equity is aimed at supporting its expansion and reducing leverage.

3. Valuation Rationale

The rating upgrade hinges on a new valuation model that factors in SentinelOne’s expected trajectory. The key assumptions that the Seeking Alpha article outlines include:

| Parameter | Current Value | FY 24 Projection | FY 26 Projection |

|---|---|---|---|

| Revenue CAGR | 24 % | 30 % | 35 % |

| Gross Margin | 60 % | 63 % | 65 % |

| EBITDA | -$10 M | $30 M | $70 M |

| EV/Revenue | 14× | 12× | 10× |

The article argues that, under these assumptions, the enterprise value (EV) of SentinelOne should fall to roughly $10 billion by FY 26, implying a 12‑15 % upside on the current trading price. The “nibble” upgrade reflects the brokerage’s belief that the stock is undervalued by the market, but it also signals caution – there are still sizeable risks that could erode upside.

4. Competitive Landscape: Who’s in the Room?

SentinelOne operates in a crowded market that includes well‑established incumbents such as Symantec, CrowdStrike, Palo Alto Networks, and newer entrants like Carbon Black and Cylance. The article places SentinelOne in direct comparison to CrowdStrike, noting that while CrowdStrike has a slightly larger market share, SentinelOne’s AI‑driven platform offers superior automation in threat detection and remediation. The piece also references market intelligence reports that rank SentinelOne as the “best in class” for AI‑driven endpoint protection.

In addition, the broker notes that the company’s focus on cloud‑native architecture and its open‑source integration strategy (via Singularity) positions it well for a future where hybrid and multi‑cloud environments dominate. However, the article cautions that incumbents are aggressively investing in similar capabilities, and SentinelOne must continue to innovate to maintain differentiation.

5. Risks and Red Flags

No investment is without risk, and the article lists several headwinds that could dent the company’s prospects:

- Competitive Pressure – Established vendors may outspend SentinelOne in marketing and feature development, eroding market share.

- Execution Risk – Scaling a SaaS business globally involves complex sales cycles and operational challenges.

- Regulatory Risk – As a security platform that processes data from endpoints worldwide, SentinelOne must comply with a range of data‑privacy regulations (GDPR, CCPA, etc.).

- Technology Risk – Cyber threats evolve rapidly; SentinelOne’s AI models must keep pace to remain effective.

- Liquidity Risk – Despite a healthy cash balance, the company’s cash burn rate remains high until profitability is achieved.

The Seeking Alpha article stresses that these risks are partially mitigated by SentinelOne’s solid financial footing, but they still justify a “nibble” rather than a full‑scale buy.

6. Bottom‑Line Takeaway: Why the “Nibble” Upgrade Matters

The term “nibble” conveys a cautious optimism. While the company’s fundamentals are improving and the long‑term value proposition remains compelling, the article argues that market sentiment has not yet fully incorporated the upside potential. The rating upgrade therefore acts as a signal for value investors to re‑evaluate SentinelOne’s place in their portfolio, but it also advises staying mindful of the volatility that comes with a high‑growth security firm.

The Seeking Alpha article is thorough in its analysis, drawing on quarterly earnings releases, the company’s 10‑K filings, and third‑party market research. By integrating these data points, the broker constructs a compelling narrative that SentinelOne is no longer a niche or “cottage‑industry” player; it is a contender for the next wave of endpoint security dominance.

What Should Investors Do?

- Assess the Valuation – Compare the implied EV/Revenue multiples to the broader sector. If the multiples align with the broker’s assumptions, the stock may be undervalued.

- Watch the Earnings Trail – SentinelOne’s next few quarters will be pivotal. A consistent increase in gross margin and a move toward EBITDA profitability will confirm the upgrade.

- Consider the Macro Context – Cybersecurity demand is largely resilient, but economic downturns can reduce IT budgets. Investors should factor in potential headwinds.

- Stay Updated on Competitor Moves – Keep an eye on how rivals invest in AI and cloud‑native solutions.

- Diversify – As with any growth stock, add a mix of defensive holdings to cushion volatility.

In summary, the Seeking Alpha piece provides a balanced view of SentinelOne’s present state and future trajectory. The “nibble” rating upgrade reflects an encouraging shift in analyst sentiment, but the article remains prudent about the inherent risks of the cybersecurity market. For investors looking to tap into the growing endpoint security space, SentinelOne represents a promising, if still somewhat speculative, opportunity.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4852447-sentinelone-finally-worth-a-nibble-rating-upgrade ]