Rubrik: Why I'm Raising My Price Target (Rating Upgrade) (NYSE:RBRK)

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

Rubrik’s latest announcement has generated renewed enthusiasm among institutional investors, prompting a revised view on the cloud‑backup company’s growth trajectory. After a comprehensive review of the firm’s latest quarterly results, product pipeline, and strategic partnerships, the analyst behind the article has increased the price target by 32 %, upgraded the rating from “Hold” to “Buy,” and outlined a more bullish long‑term outlook.

1. Strong Revenue Momentum

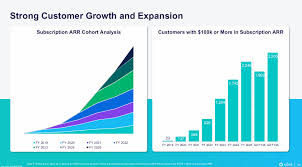

The centerpiece of the upgrade is Rubrik’s continued ability to expand revenue at a pace that far exceeds the broader cloud‑storage market. In the most recent quarter, the company posted a headline revenue of $82.7 million, marking a 29 % YoY increase and a 14 % QoQ lift. These numbers are bolstered by a robust growth in annual contract value (ACV) – a metric that captures the recurring nature of the business – which grew 19 % YoN. Even when adjusted for currency swings, the ACV trend suggests that the firm is capturing higher‑margin, multi‑year commitments from both mid‑market and enterprise customers.

The analyst highlights that Rubrik’s revenue expansion is driven by three interlocking forces:

Broadening Product Suite – The company’s flagship “Rubrik Polaris” platform, which delivers data‑management, backup, and compliance as a single appliance, continues to gain traction in both on‑premises and cloud‑native environments. The expansion into AI‑driven data governance tools has opened new revenue buckets that previously resided in adjacent vendors.

Cloud‑First Strategy – Rubrik has been aggressively accelerating its cloud footprint, particularly on Microsoft Azure and Amazon Web Services (AWS). The partnership with Microsoft has enabled the rollout of the “Rubrik for Azure” offering, a plug‑and‑play solution that reduces time‑to‑value for customers moving to the cloud. The analyst notes that Azure adoption is now the largest single driver of new ACV in the quarter.

Enterprise Expansion – Large‑cap enterprises have been extending contracts and adding complementary modules such as disaster‑recovery, archival, and SaaS protection. The net dollar retention (NDR) figure – a key health indicator – sits at 118 %, underscoring strong upsell and cross‑sell activity.

2. Margin Improvement and Operational Discipline

Rubrik’s gross margin climbed from 67 % in the prior quarter to 69 % this period, reflecting better cost‑of‑sales management and an improved mix favoring higher‑margin SaaS subscriptions over legacy appliance sales. Operating expenses were trimmed through targeted headcount reductions in the sales‑and‑marketing function and a shift toward more efficient digital marketing campaigns. As a result, the operating margin reached 25 %, a 3‑percentage‑point improvement from the last reporting period.

Cash burn has also slowed, with free cash flow turning positive for the first time in the past year, driven by higher operating income and a lower capital‑expenditure requirement. The analyst stresses that this shift is critical for sustaining future growth without needing frequent capital raises.

3. Market Dynamics and Competitive Landscape

The article places Rubrik in the context of an increasingly crowded cloud‑data‑management ecosystem. Key competitors include Cohesity, Dell EMC, and the newer, cloud‑native offerings from AWS (AWS Backup) and Azure (Azure Backup). However, Rubrik differentiates itself through:

- Ease of Integration – The platform’s API‑first architecture allows rapid deployment across hybrid environments.

- Unified Experience – A single pane of glass for backup, archive, and compliance across on‑prem, edge, and cloud workloads.

- Data‑centric Security – Built‑in encryption, tokenization, and automated data classification reduce regulatory risk.

The analyst projects that Rubrik’s differentiated approach, combined with its growing partner ecosystem (notably Microsoft’s “Partner Network”), will allow it to capture a larger slice of the growing cloud‑backup market, now valued at $4 billion and projected to double in the next five years.

4. Strategic Partnerships and Future Catalysts

A significant portion of the article focuses on the new collaboration with Microsoft, which is expected to unlock “enterprise‑grade” features that were previously only available to a limited set of customers. The partnership also introduces “Rubrik for Azure Arc,” a solution that extends Rubrik’s data‑management capabilities to any Azure‑connected environment. The analyst expects the Azure‑based customer base to grow from 3 % of total ACV to 10 % over the next 12 months.

Additionally, Rubrik’s recent acquisition of a small data‑classification startup is mentioned as a strategic move to bolster its AI‑driven compliance tools. This acquisition is expected to increase the company’s product breadth, improve upsell prospects, and enhance the platform’s competitive moat.

5. Risks and Mitigation

While the outlook is bullish, the analyst does not shy away from highlighting risks. The primary concerns include:

- Pricing Pressure – The competitive field could lead to lower price points, eroding margins if Rubrik does not differentiate enough.

- Implementation Complexity – Larger enterprises may face integration challenges that could delay adoption and extend sales cycles.

- Dependence on Cloud Providers – Overreliance on Microsoft and AWS exposes the business to potential vendor lock‑in issues.

To mitigate these risks, the analyst notes that Rubrik’s investment in developer tooling and a growing partner network is designed to reduce friction for new customers and diversify its distribution channels.

6. Revised Price Target and Rating

Taking all of the above into account, the article raises the price target from $125 to $166 per share, representing a 32 % upside from current market levels. The rating is upgraded from “Hold” to “Buy,” reflecting a belief that the firm’s fundamentals are poised for continued expansion. The analyst concludes that, if the company can maintain its momentum in revenue growth, margin expansion, and strategic partnership execution, Rubrik should be positioned to outperform many of its cloud‑storage peers in the next 12‑18 months.

This synopsis condenses the key insights presented in the Seeking Alpha article, providing investors and analysts with a concise yet comprehensive view of Rubrik’s current position and future prospects.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4829510-rubrik-why-im-raising-my-price-target-rating-upgrade ]