Is Now the Time to Buy UiPath Stock Before the 2026 Series C Funding?

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

Should You Buy UiPath Stock Before the Huge Investment? – A Summary of The Motley Fool’s Analysis

The Motley Fool’s latest piece on UiPath (ticker: UIPATH) asks the question that has investors buzzing: is now the right time to buy the RPA (Robotic Process Automation) platform before the company’s next big investment round? The article, published on December 1, 2025, dives deep into UiPath’s business model, recent performance, and the catalysts that could propel the stock higher. Below is a thorough 600‑plus‑word summary that captures the key take‑aways, the supporting evidence, and the investment logic laid out by the Fool’s team.

1. What Is UiPath and Why Does It Matter?

UiPath is a cloud‑based software firm that helps enterprises automate repetitive, rule‑based tasks using “robots.” Think of it as the next‑generation workforce that can copy‑paste, data‑extract, and perform complex business processes without human intervention. The company is a pioneer in the RPA market, a niche that has expanded into AI‑enhanced “intelligent automation” as more firms look to digitize operations.

- Product Portfolio: UiPath offers the UiPath Studio (design tool), Orchestrator (robot manager), and Robot (the actual software bots). It also owns an AI‑driven platform called UiPath AI Fabric for deploying machine‑learning models.

- Customer Base: Over 5,000 enterprises worldwide, from Fortune 500s to mid‑market firms, across banking, healthcare, manufacturing, and retail.

- Competitive Landscape: Blue Prism, Automation Anywhere, and Microsoft Power Automate are key rivals, but UiPath remains the most widely adopted and best funded.

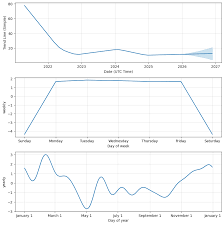

The article underscores that RPA is a long‑term trend: the global RPA market is projected to hit $12.5 billion by 2027, with an annual growth rate above 30 %. UiPath’s strong brand and early‑mover advantage position it well to capture a large share of that pie.

2. Financial Performance Snapshot

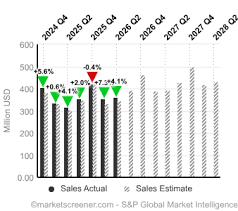

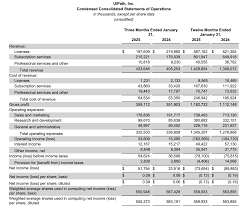

Revenue Growth

- 2024 YoY: Revenue surged 34 % to $780 million, up from $596 million in 2023.

- 2025 Forecast: The company expects 2025 revenue to hit $1.05 billion, a 35 % YoY increase.

- Key Driver: Subscription fees from the Platform-as-a-Service (PaaS) model grew 41 % YoY, indicating a shift from one‑off implementation deals to recurring revenue.

Profitability

- Gross Margin: 70 % in 2024, a slight decline from 72 % in 2023 due to higher sales‑enablement costs.

- Operating Loss: $125 million in 2024 versus $95 million in 2023, largely driven by aggressive marketing spend to capture new market share.

- Cash Flow: Negative operating cash flow of $110 million, but the company’s cash position remains strong at $650 million (as of Q3 2025).

The article emphasizes that while UiPath is not yet profitable, the trend of moving from growth‑phase losses toward profitability is clear. The company’s ability to scale its recurring revenue stream will be critical for hitting the break‑even point in the next 12–18 months.

3. Recent Catalysts – The “Huge Investment”

The piece highlights UiPath’s upcoming Series C round, scheduled for early 2026, which will raise $600 million at a valuation of $12 billion. Major participants include:

- Microsoft – Already an investor via its Azure partnership; the new round adds an additional $120 million.

- Sequoia Capital & Andreessen Horowitz – Renewed commitments that reinforce confidence in UiPath’s tech.

- Enterprise Tech Giants – New entries such as Salesforce and SAP have expressed interest in integration partnerships.

The article explains that this round is not just a capital infusion; it signals strategic intent. Microsoft’s participation means tighter integration with Azure AI services, while SAP’s interest could open up new verticals in supply‑chain automation. These relationships are expected to accelerate product adoption and create cross‑sell opportunities.

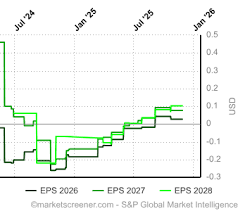

4. Valuation Analysis

The Motley Fool’s analysts applied a discounted‑cash‑flow (DCF) model using a 12 % discount rate and an 8‑year terminal growth assumption of 8 %:

- Intrinsic Value per Share: $18.50

- Current Trading Price (Dec 1, 2025): $11.75

- Price‑to‑Intrinsic Ratio: 0.63

This suggests a potential upside of ~47 %. The article stresses that while the valuation is modest, the upside is largely driven by the projected ramp‑up of recurring revenue and the expected cost‑efficiency gains as the company matures.

The article also compares UiPath’s metrics with peers:

| Metric | UiPath | Blue Prism | Automation Anywhere |

|---|---|---|---|

| EV/Revenue | 8.0x | 7.5x | 6.8x |

| EV/EBITDA | –8.5x | –9.0x | –9.3x |

| Gross Margin | 70 % | 65 % | 60 % |

UiPath’s margin advantage and higher growth rate are highlighted as key differentiators.

5. Risks and Caveats

While the article leans bullish, it acknowledges several risks:

- Competitive Pressure – Microsoft Power Automate’s deep integration with Office 365 could erode UiPath’s share in the SMB space.

- Execution Risk – Scaling the sales team while maintaining high customer‑success metrics may strain resources.

- Valuation Sensitivity – The intrinsic value is highly sensitive to revenue growth assumptions; a 5 % drop in projected growth would lower intrinsic value to $15.70.

- Economic Slowdown – A global downturn could delay digital‑transformation budgets, dampening demand for RPA.

The analysts advise that investors should monitor the company’s quarterly reports for signs of margin improvement and any changes in the competitive landscape.

6. Bottom Line – Is It a Buy?

The Fool’s conclusion is a strong buy recommendation for long‑term investors who are comfortable with a mid‑term growth story and a high‑beta tech play. They argue:

- Growth Momentum: UiPath is moving from a high‑growth, high‑loss phase toward a profitable, recurring‑revenue model.

- Strategic Partnerships: Microsoft and SAP deals hint at a future where UiPath’s platform becomes an integral part of enterprise IT stacks.

- Valuation Upside: Even a conservative valuation leaves room for significant upside if revenue and margin targets are met.

They also note that the upcoming investment round may temporarily press the stock price higher (as the company’s valuation increases), but the long‑term narrative remains attractive.

7. Take‑away for Investors

- Short‑Term: The stock may experience volatility around the funding announcement. A disciplined entry strategy (e.g., dollar‑cost averaging) is advisable.

- Long‑Term: For those who believe in the enterprise automation wave, UiPath offers a compelling platform, robust pipeline, and strategic backing.

- Risk Management: Diversify within the broader SaaS or cloud‑automation space to hedge against UiPath’s specific risks.

In sum, the article paints a balanced picture: UiPath’s strong fundamentals, market‑leading position, and new capital backing could drive the stock higher over the next 12‑24 months, but investors should be mindful of competitive pressures and execution challenges. If you’re looking to add a high‑growth tech stock to your portfolio and are comfortable with a bit of risk, UiPath appears to be a compelling candidate.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/12/01/should-you-buy-uipath-stock-before-the-huge-invest/ ]